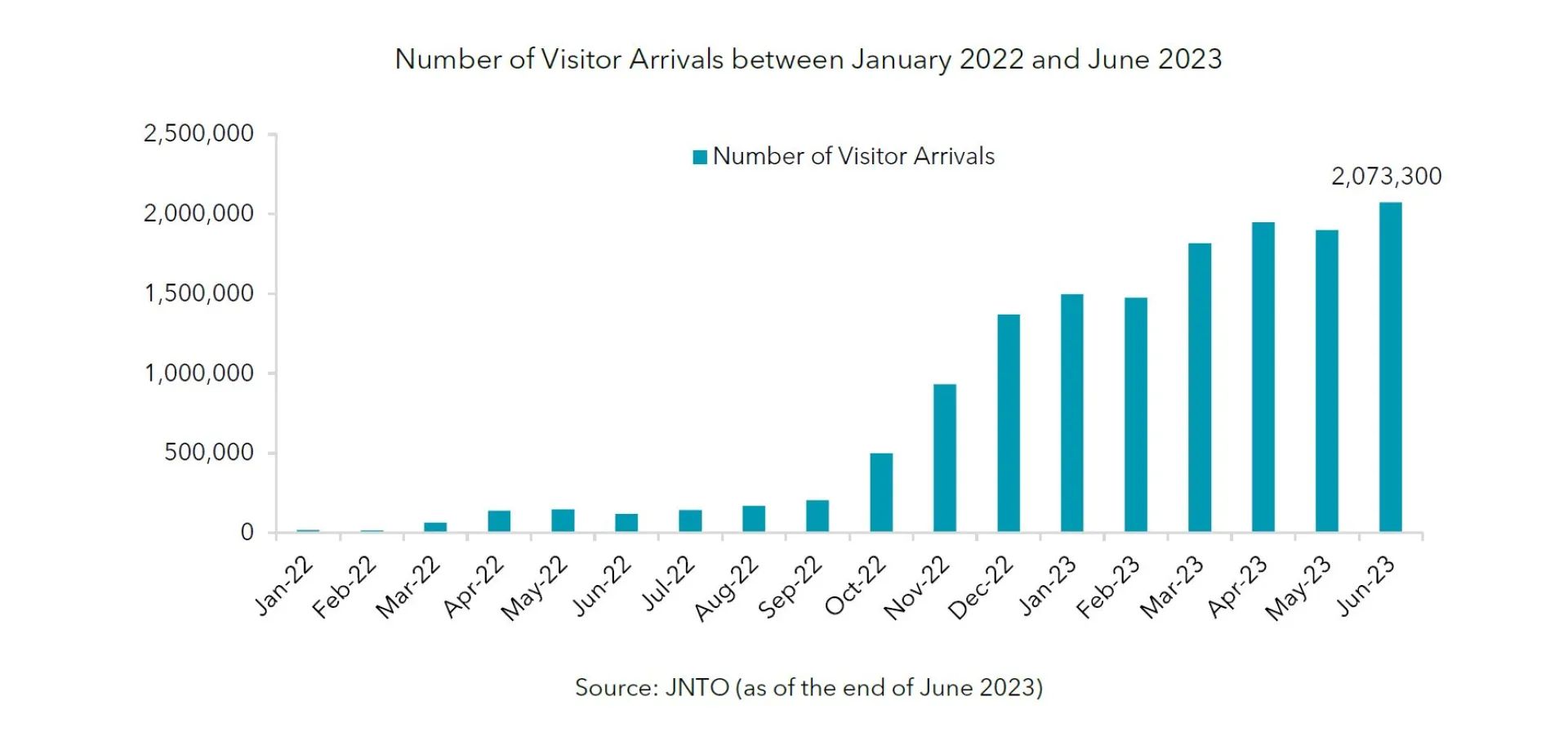

There is however, one key difference in this strong inbound demand compared to pre-Covid 2019: there are no large groups of Chinese tourists. Before Covid, Chinese tourists were seen traveling in large buses to tourist attractions all over Tokyo and driving to large shopping malls to buy large quantities of Japanese electronics and cosmetics. Today's tourists do not include these large groups, but rather much smaller groups. The data shows that currently most tourists are from Korea, Taiwan, and Hong Kong. Surprisingly there are more tourists from the US than China, despite the US being comparatively much further away from Japan.

Only 13% of Chinese tourists have returned compared to pre-Covid-19 levels

According to data from the Tourism Agency, in 2019 the number of Chinese tourists among the 31.88 million recorded international visitors was 9.59 million, or 30.1% of the total. By the end of June 2023, the number of Chinese tourists was 590,000, accounting for only 13% of the total visitors in 2023 when compared with the period of January 2019 to June 2019.

If pre-pandemic levels of tourism from China return, the sector with the most potential for recovery is retail, including department stores. During the pandemic, department stores have been improving their customer service to accommodate foreign tourists in anticipation of a post-Covid recovery of foreign tourists. For department stores, Chinese tourists have been one of the major customer groups since before pandemic, and they have high expectations for the recovery of Chinese tourists, as shown by their commitments to actively hiring Chinese-speaking staff. In addition to department stores, drugstores selling pharmaceuticals and cosmetics are among the retailers with high expectations for the recovering in tourism from China. Department stores, drugstores, and other retail-related companies have been focusing on improving their ability to handle foreign tourists (especially Chinese tourists) during the pandemic. For example, Matsukiyo Kokokara & Co. has been preparing for the increase in the number of foreign visitors to Japan by converting two-thirds of its mainstay drugstore outlets to duty-free stores.

Despite these expectations for foreign tourists, especially Chinese tourists, the situation has not yet met the company's expectations. I would like to highlight what I believe are the three key reasons for this and possible future developments.

Reason #1: Fewer flights between Japan and China

Where did Chinese tourists go after China's zero-Covid policy was terminated in January? Well, it appears they have turned to domestic travel. Since China's policy against Covid was stricter compared to other countries, Chinese tourists, who were now free to travel, flocked to domestic travel. Against this backdrop of domestic demand, air travel within China was not allocated to international flights, leading to a supply shortage and higher prices.

Against this backdrop, airfares are heading back toward pre-Covid levels: a September flight ticket between Shanghai and Tokyo, roughly 120,000 yen as of May, had dropped to 50,000 yen by mid-July. The average round-trip price for 2019 before Covid was 40,000 yen, suggesting that the airfare spike is steadily beginning to subside. As for the number of flights, the number has recently recovered to 80% of the 2019 level from April to June, and demand for international travel is recovering from July onward. Thus, lower airfares and an increase in the number of flights will support the recovery of tourism from China.

Reason #2: Longer waiting times for visas

The second reason is that it is taking longer for Chinese travelers to obtain the necessary visas to visit Japan. After the pandemic, the short-term visa waiver measures that had previously been granted to Japanese nationals were suspended. As a result, the Japanese government has been issuing visas for Chinese nationals in accordance with the status of visa issuance for Japanese nationals on the Chinese side, so it has taken longer than usual to issue visas. This has resulted in a flow of tourists to countries that do not require visas. However, there are signs of improvement here as well, and travel between China and Japan is easier as the time to obtain a visa is gradually decreasing.

Reason #3 Group tourism has only just been permitted

China did not allow group travel to Japan after the pandemic, but the Chinese government finally lifted the ban on group travel to Japan on 10 August. Although the Chinese government allowed the resumption of group travel to a limited number of 20 countries in February of this year, these 20 countries included Thailand, Russia, Cambodia, Laos, the Philippines, and other countries cooperating with the Xi Jinping administration, and many other countries with which the two countries have good relations or developing countries. Later in March, more countries were added to the list, including France, Italy, Spain, Brazil, Portugal, Vietnam, and Mongolia. On the other hand, Japan, the U.S., South Korea, the U.K., Germany, Canada, and Australia were still excluded until this August.

So far this year, the visitors to Japan have been those who were able to obtain a multi-visa valid for five years, and relatively speaking, were mainly affluent people. In order to achieve a full-fledged recovery in the number of tourists, it is essential for the mass segment, which accounts for 30-40% of all Chinese tourists, to visit Japan, and now that the ban on group tourism has been lifted, it is expected that these groups will come to Japan.

Conclusion – Japan’s goal of becoming a tourism-oriented country is far away

China’s influence on Japan's inbound tourism is significant. A full-fledged recovery in tourism from China will undoubtedly be key in Japan's quest to become a tourism-oriented country. The Japanese government has set a government target for 2030 of 60 million foreign visitors to Japan and 15 trillion yen in inbound tourism spending, which is quite high considering that the pre-pandemic number was 31.88 million visitors per year. In fact, according to an independent survey conducted by our research analysts among those involved in inbound tourism, the consensus for the achievement rate was around 80% (48 million visitors/13 trillion yen). We, therefore, have high expectations for the tourism promotion measures that the government is likely to focus on in the future to achieve the target. We will continue to monitor the trends of Chinese tourists and the government's policies, and seek to identify stocks that will benefit from inbound tourism, one of Japan's growth stories.