At the previous Bank of Japan (BOJ)’s Monetary Policy Meeting in December 2022, the BOJ widened the target band for 10-year Japanese Government Bond (JGB), the target of the Yield Curve Control (YCC), from 0%+/-0.25% to 0%+/-0.50%, in an attempt to improve market functioning. The market participants perceived this surprise change as the BOJ shifted towards monetary tightening. With the 10-year JGB interest rate hovering at the upper end of the range at +0.50%, and with Kuroda, who has been governor since 2013, stepping down in April when his term expires, the market is expecting the BOJ to further tighten its monetary policy. Ahead of Kuroda's final policy meeting on March 10, we will consider the possibility of YCC revision.

The YCC revision at last December's monetary policy meeting took the market by surprise, as the timing of the revision was unexpected, given the pattern of past monetary policy meetings and statements by senior BOJ officials. One of the reasons for the BOJ's policy revision was the content of the BOJ's Bond Market Survey for November 2022, which suggested that the bond market was dysfunctional.

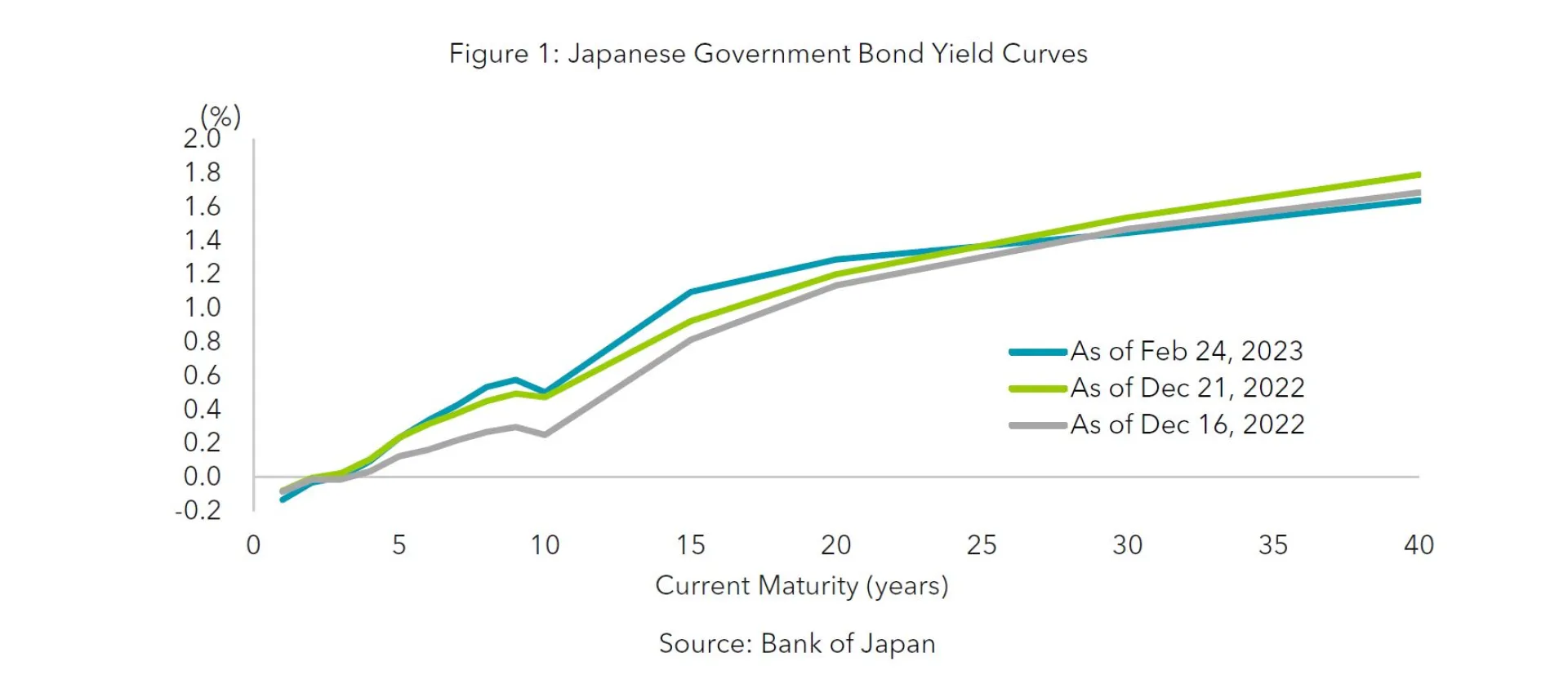

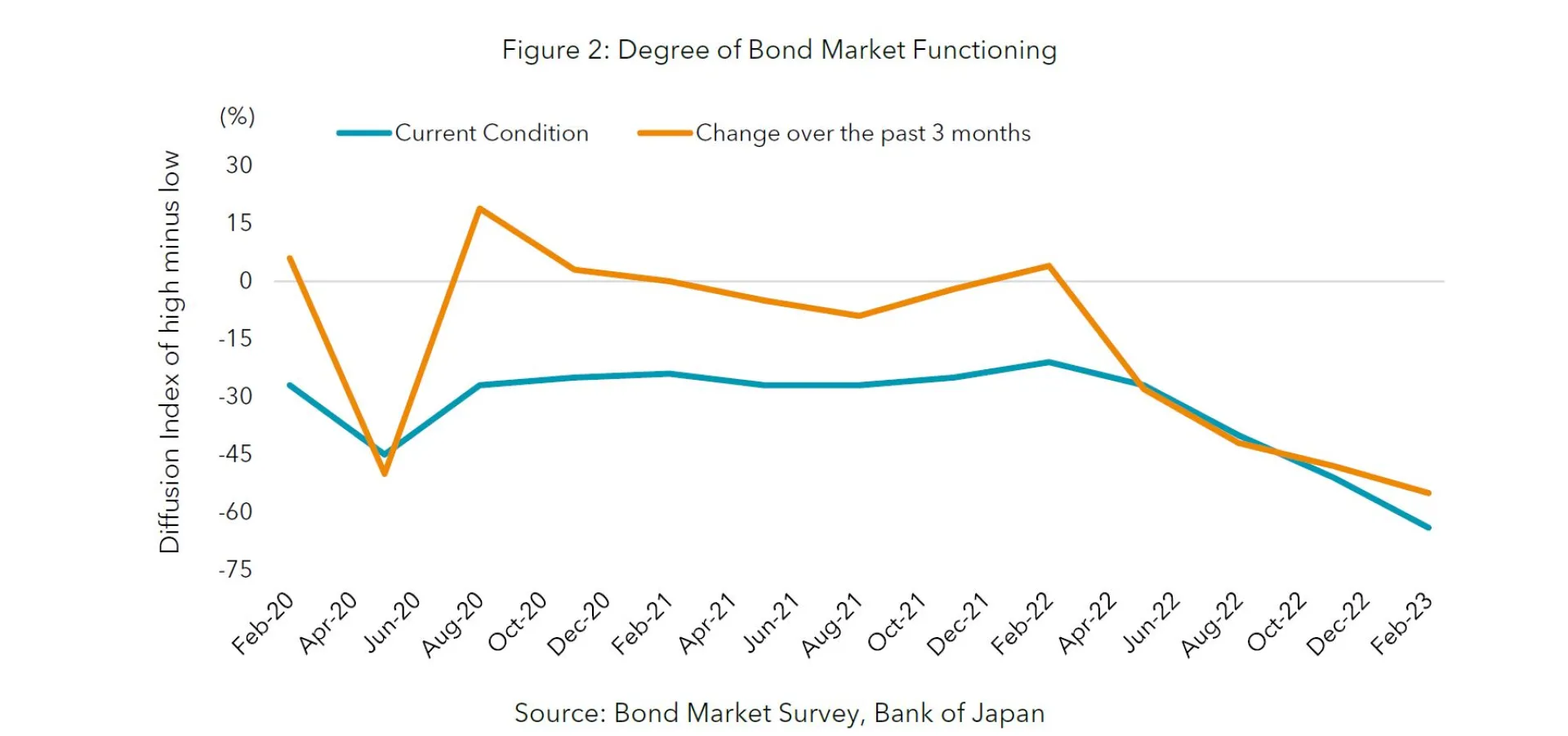

The BOJ conducts this survey four times a year in February, May, August, and November, and institutional investors such as life insurance companies and asset management companies are included. 70 companies responded to the most recent survey. The Diffusion Index (DI), a measure of the functioning of the bond market, was at an all-time low and the yield curve was also distorted. At the press conference for the December meeting, Governor Kuroda stated that he decided to revise the YCC in order to improve market functioning and the yield curve. Although the yield curve distortion improved temporarily, the yield curve has since been distorted in the form of a parallel shift from before the correction, with a concave shape seen where the yield curve was pinned at 0.5%, the new ceiling for 10-year debt.

Amidst this environment, the BOJ Bond Market Survey for February was released on March 1. The DI for the level of functionality (the ratio of respondents who answered that their level of functionality was high minus the ratio of those who answered that their level of functionality was low) hit a record low of -64 compared to the -51 recorded from the previous survey in November. There was also no improvement in the changes from three months ago. In the February survey, 28 companies answered that they were not able to trade their expected dealing lots, compared to 25 that were able to. In the November survey, 26 companies were not able to make dealings, while 32 companies were able to. It appears that the bond market is becoming less functional and trading is becoming more difficult.

As for the timing of the YCC revision, most market participants expect it to be implemented between April and June under the new regime after the change of governors. The comments made by the new BOJ governor, Mr. Ueda, at the Diet session indicate that he is willing to modify the YCC, which has been a factor in the dysfunction of the bond market, while maintaining an accommodative monetary stance.

The BOJ Bond Market Survey for February mentioned above also indicated that the median outlook for long-term interest rates (yield on newly-issued 10-year bonds) was 0.5% at the end of March (i.e. within the current YCC range) and 0.75% at the end of June, above the upper YCC range. According to the QUICK Monthly Bond Survey released on February 27, the majority of respondents (56%) expect the next monetary policy revision to be between April and June. Most economists are not expecting a March revision, although 10% do.

The market is expecting no policy revision, as the soon-to-be-retired Governor Kuroda is unlikely to make any decision at the March meeting. Our main scenario is the same: no policy changes will be made at this meeting. However, we at SuMi TRUST think it remains possible that the BOJ will make another revision to the YCC based on the results of the bond market survey in March.

The new governor, Mr. Ueda, will avoid drastic changes in the short term to mitigate the impact on the economy and the market. The first step would be the change in the range of the control of long-term interest rates (10-year JGB yields). As for speed of the change, rather than doing it quickly, we think it will be carried out carefully while maintaining dialogue with the market.