The End of an Era for Goods Arriving on Time?

Most people in Japan take for granted the notion that if they order goods then, by and large, they will be delivered on time. However, while this sounds ordinary at face value the successful delivery of goods on schedule is, in fact, a luxury that is at risk of disappearing unless substantial measures are taken to mitigate the ‘2024 Logistics Crisis’.

This crisis stems from a severe shortage of labour in the logistics industry. The danger was first discussed in a 2022 report by NX Research Institute titled, The Impact of the 2024 Logistics Crisis. The report highlights that, without intervention, the implementation of updated regulations on employee working hours from April 1st 2024, could result in a significant shortage in transport capacity for goods in the coming decade. The report predicted a 14.2% shortfall in 2024, with the situation deteriorating to reach a potential shortfall of as much as 34.1% by 2030.

A Crisis Born from Good Intentions: Improving Harsh Working Conditions for Drivers

The genesis of the 2024 crisis lies in labour reforms aimed at improving the harsh working conditions of logistics drivers. On average, drivers work approximately 20% longer than employees in other professions, and this has been a longstanding issue. In addition to this physically demanding role, the annual wage of drivers is approximately 10% lower than the average across all professions. This has resulted in difficulties in attracting new drivers and many workers leaving the industry altogether.

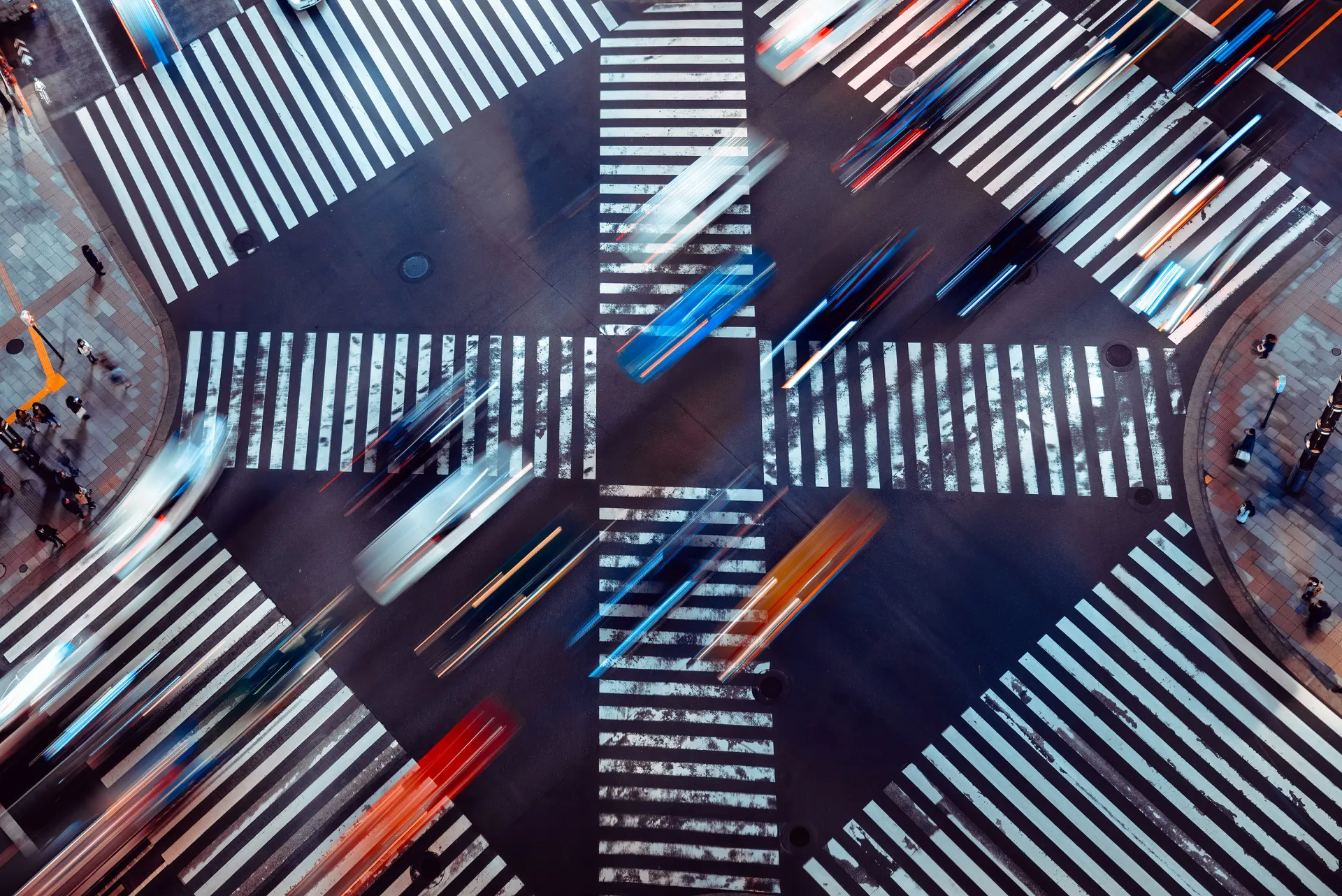

To address this poor work environment and stem the flow of workers leaving the logistics industry, the Standards for Improving Working Hours of Drivers were revised in December 2022 and enforced from April 1st 2024. The revisions include reducing the annual maximum number of hours worked by drivers to 3,300 hours (down from 3,516 hours), as well as other revisions detailed in Figure 1 below.

While the change in labour laws is exacerbating driver shortages in the short-term, in the long-term raising wages and reducing working hours is essential to attract and retain workers and ensure goods continue to arrive on time, mitigating the forecasted transportation capacity shortfalls of 14.2% in 2024 and 34.1% in 2030.

Figure 1

Government, Businesses, and Consumers Play a Role in Building a Resilient Logistics Industry

The Japanese government has taken the 2024 logistics crisis seriously. Not stopping with reforms to working hours, the government introduced a policy package to encourage greater innovation in logistics in June 2023 and a follow-up emergency policy package in October 2023. Additionally, government subsidies have been established to promote digital transformation (DX) in logistics.

Businesses have also recognised the 2024 crisis as a critical concern. On the consumer-facing front, some logistics companies have launched initiatives such as awarding points to customers who select delivery options like unattended delivery. This reduces the burden on drivers attempting to deliver a package to the same address multiple times when a customer is not home, one of the causes of excessively long working hours. Some corporate customers are collaborating with their peers to lighten the load on logistics companies; instead of dispatching multiple delivery trucks from each individual business, some companies are pooling resources and sharing a single delivery truck to be more efficient in terms of manpower and transport costs.

Logistics companies such as Yamato Holdings, SG Holdings, and Seino Holdings are all raising wages to compensate for any potential loss of income caused by the enforcement of reduced working hours. These costs have been passed on to individual and corporate customers. Although many logistics companies previously struggled to pass on price increases to consumers, there is increasing recognition of the important value of logistics which has made increases more acceptable. The profits generated from higher prices will be reflected in company earnings going forward, potentially reversing the financial performance of the logistics sector as a whole.

Moreover, consolidation within the logistics industry is viewed positively in this challenging environment. Notable acquisitions like SG Holdings buying C&F Logistics HD and Seino Holdings acquiring Mitsubishi Electric Logistics in 2024 indicate an effort by logistics companies to turn the crisis of 2024 into an opportunity.

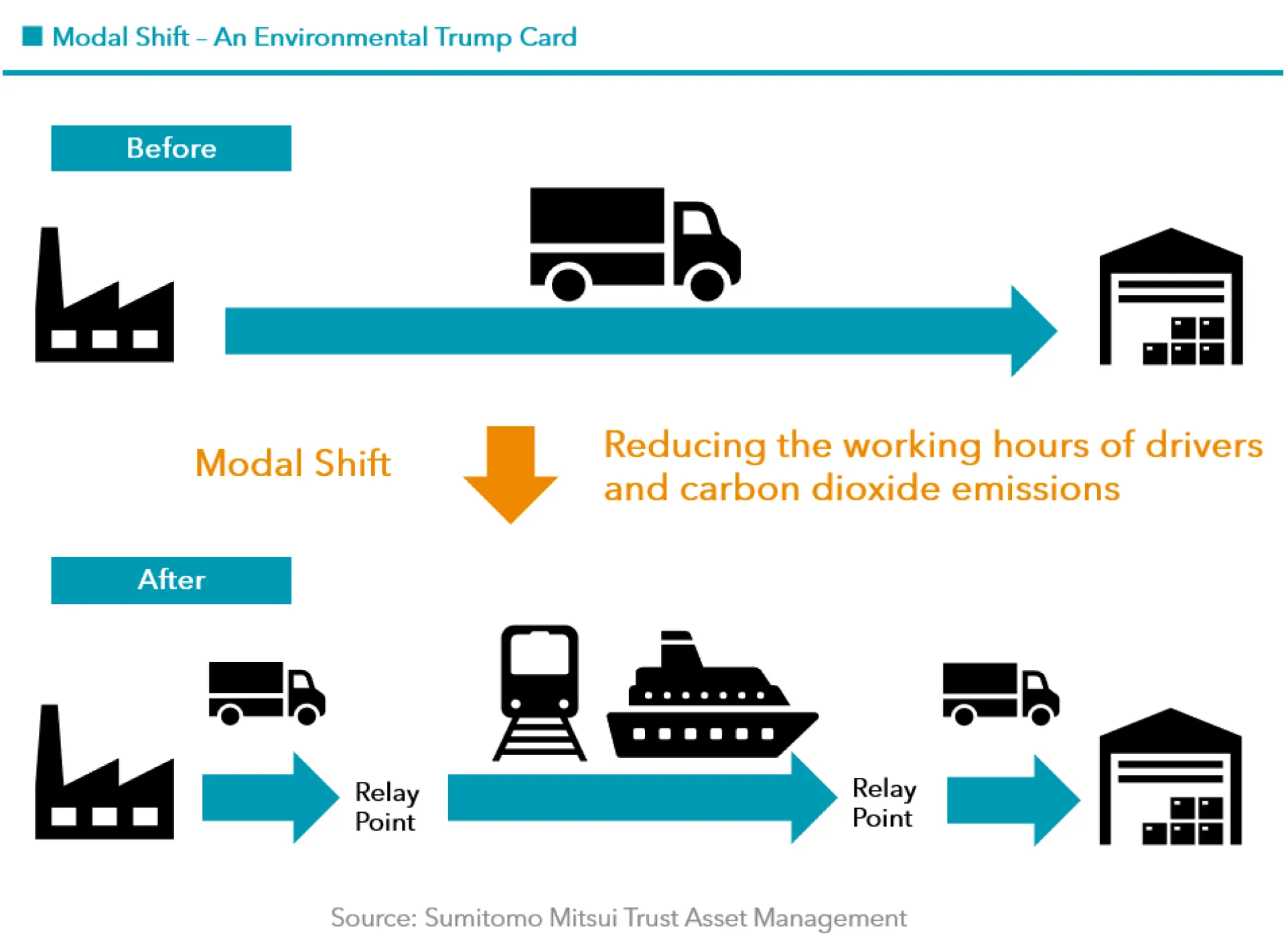

Expected Modal Shift Could Be an Environmental Trump Card

One potential solution to the 2024 crisis is the "modal shift," (Figure 2) which refers to the transition of goods transport from one form of transportation to another. This shift in Japan involves replacing trucks with transport by rail or ship. This represents an environmentally and socially responsible alternative to current road-based delivery services.

Examples of this modal shift in Japan include the use of Shinkansen (bullet trains) for freight services by JR companies—services such as Hakobiyun by JR East, FRESH WEST by JR West, Tokaido Mach-bin by JR Central, and Hayap! Bin by JR Kyushu. These services facilitate the speedy delivery of fresh foods and medical supplies, meeting urgent logistics needs while addressing driver shortages and reducing carbon dioxide emissions. However, modal shifts do come with drawbacks, such as longer transportation times. Therefore, logistics companies must strategically choose transportation methods when considering efforts to reduce carbon dioxide.

The government supports modal shifts, viewing the 2024 crisis as an opportunity to transform a challenging business situation into a chance for a more environmentally friendly logistics industry.

Figure 2

In Conclusion

As seen in this article, wide-ranging measures have been taken by both the government and businesses to mitigate the impact of the 2024 crisis in logistics. Observing these developments, I believe this crisis can be a unique opportunity to re-evaluate the value of goods transportation through consolidation and partnerships, and to reduce carbon dioxide through a strategic shift in transportation methods. We will continue to observe developments and innovations in the logistics industry going forward.