Executive Summary

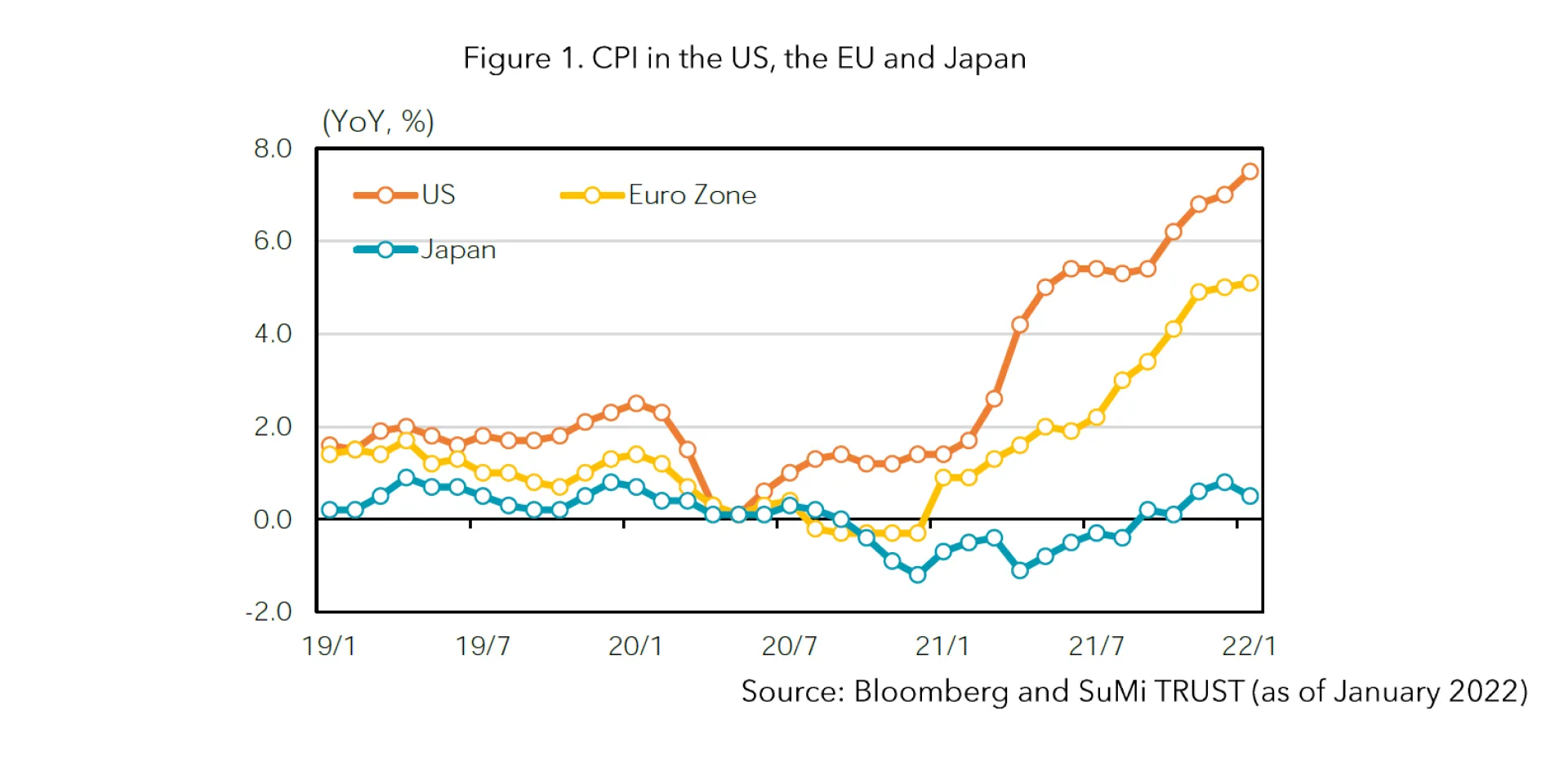

- While prices are soaring globally, Japan's CPI (Consumer Price Index) stood at 0.5% YoY (year-on-year) in January 2022, a very low level compared to the US. Housing costs and automobiles prices are the main contributors for the difference between Japan and the US. We expect Japan’s CPI will moderately rise in 2022 and hover around 1.0-1.5% all items less fresh food basis.

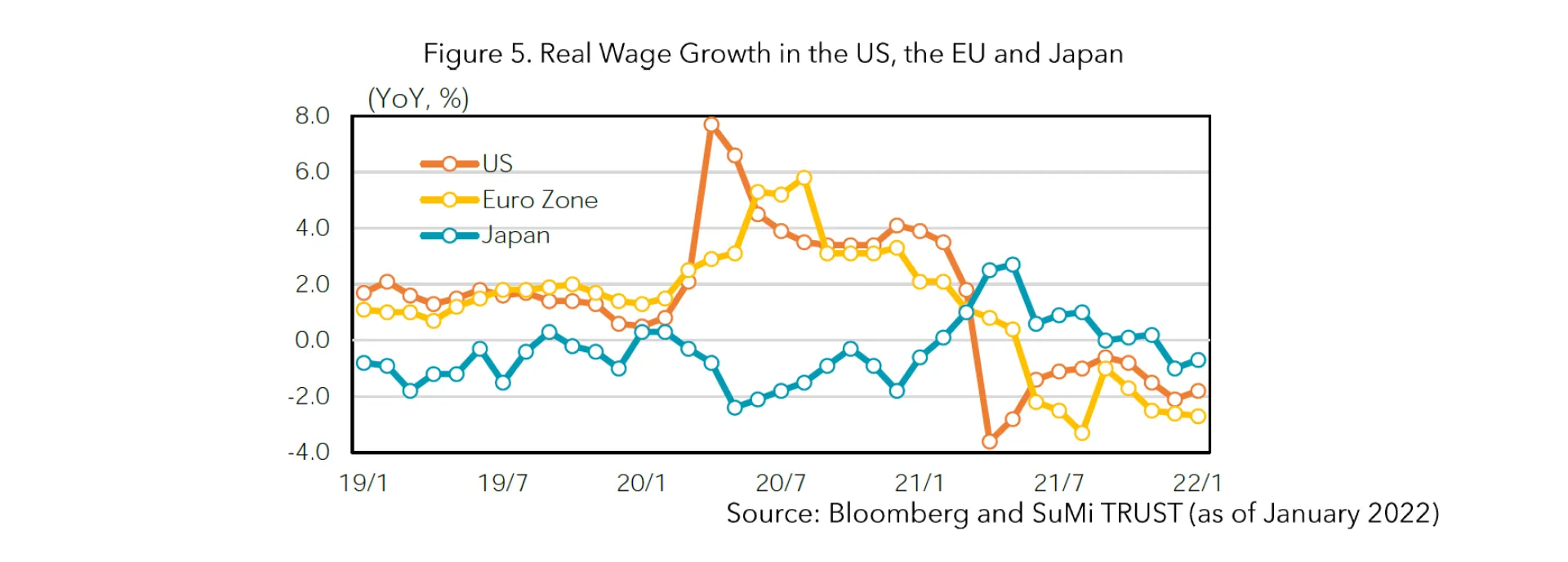

- Real wage growth rate is negative in the US, the EU and Japan. In Japan, it is expected to turn positive due to nominal wage growth and relatively mild inflation.

- Unlike the Fed and the ECB, the Bank of Japan is expected to continue its monetary easing policy due to Japan’s lower pace of inflation, which will support the economy and the market.

Contribution analysis of CPI – a comparison between Japan and the US

As prices continue to rise globally, the confrontation between Russia and Ukraine has added further pressure for commodity prices to increase. In the US, in addition to rising commodity prices, supply chain disruptions and increased labour costs also pushed up prices, and the CPI rose 7.5% YoY in January, the largest increase in about 40 years. On the other hand, Japan's CPI has remained far lower than that of the US and the euro area at +0.5% YoY.

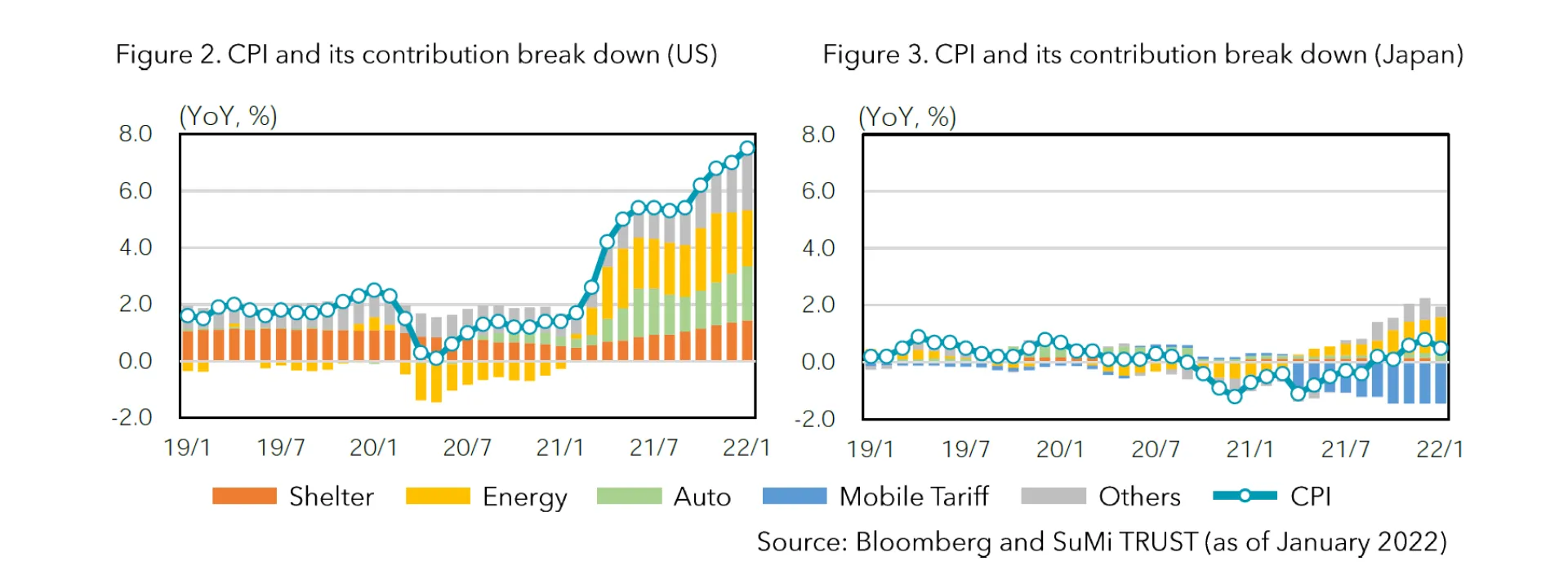

The breakdown of US CPI shows that gasoline, housing costs and automobiles are the major contributors to inflation. Housing costs have continued to rise and the prices of cars have risen sharply due to supply chain disruptions. In comparison, price increase in housing costs and automobiles has been negligible in Japan. Although the contribution of energy is large, it is offset by the effect of lower mobile tariffs. As for automobiles, Japan is also impacted by supply chain disruptions, however, consumers are more likely to accept delays in delivery times.

Housing costs in Japan have remained virtually unchanged relative to the US and Europe. Although there are differences in housing situations and demographics, property price or rent increases remain uncommon without refurbishment.

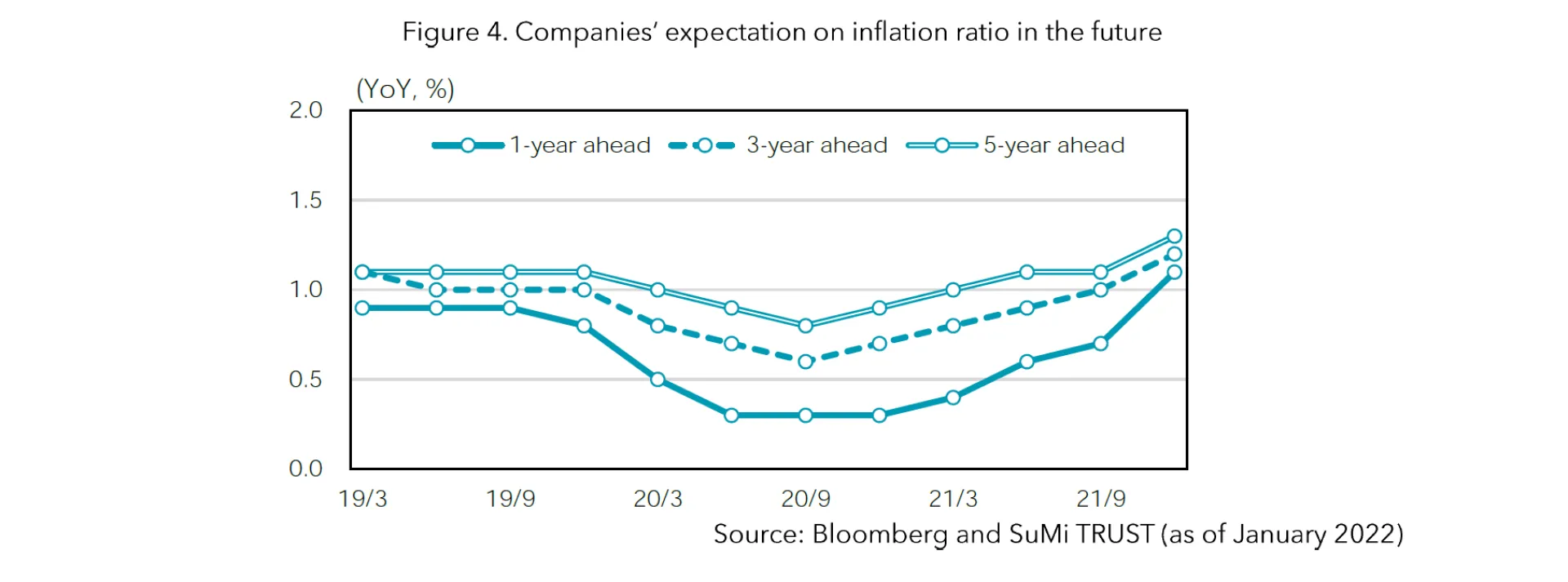

Our outlook is Japan's CPI to increase at an annualised rate of 1.0-1.5% in 2022 (all items less fresh food basis). Companies that have pricing power due to their competitive position or high market share, have started to pass on costs to customers as corporate prices increase in response to higher import and commodity prices. In addition, the negative contribution from lower mobile phone tariffs in April 2021, which lowers CPI by about 1.5% YoY, will disappear after April 2022. However, not all companies have enough pricing power to increase prices, and Japanese companies tend to remember losing customers after raising prices when commodity prices increased in 2013-14. Thus, prices will increase only by a limited degree on a macro level, and it is unlikely that Japan's CPI will stabilise above 2.0% YoY, which is the Bank of Japan’s target for exiting its ultra-loose monetary policy.

Real Wage Growth in Japan

Our outlook for consumer spending considers real wage growth, which is nominal wage growth minus price increases. Looking at real wages in each region, Japan has been at the highest level since April 2021. Although all regions are still in the negative zone, the extent of Japan's negative growth is limited. As moderate wage growth is expected going forward, real wages in Japan will return to the positive zone.

In the US, wages have grown significantly since the middle of last year due to labour shortages, especially in the service sector, which is one of the factors pushing up CPI. When business stagnated due to the spread of COVID-19, people were laid off, especially in the service sector. As economic activity has resumed, people are being hired again, but not enough labour force has returned yet. Thus, the gap between supply and demand in the labour market is accelerating wage growth. In contrast to the US, layoffs in Japan were limited and did not experience a severe labour shortage. In fact, Japan's total cash payroll in 2021 grew at a low rate of +0.3% YoY.

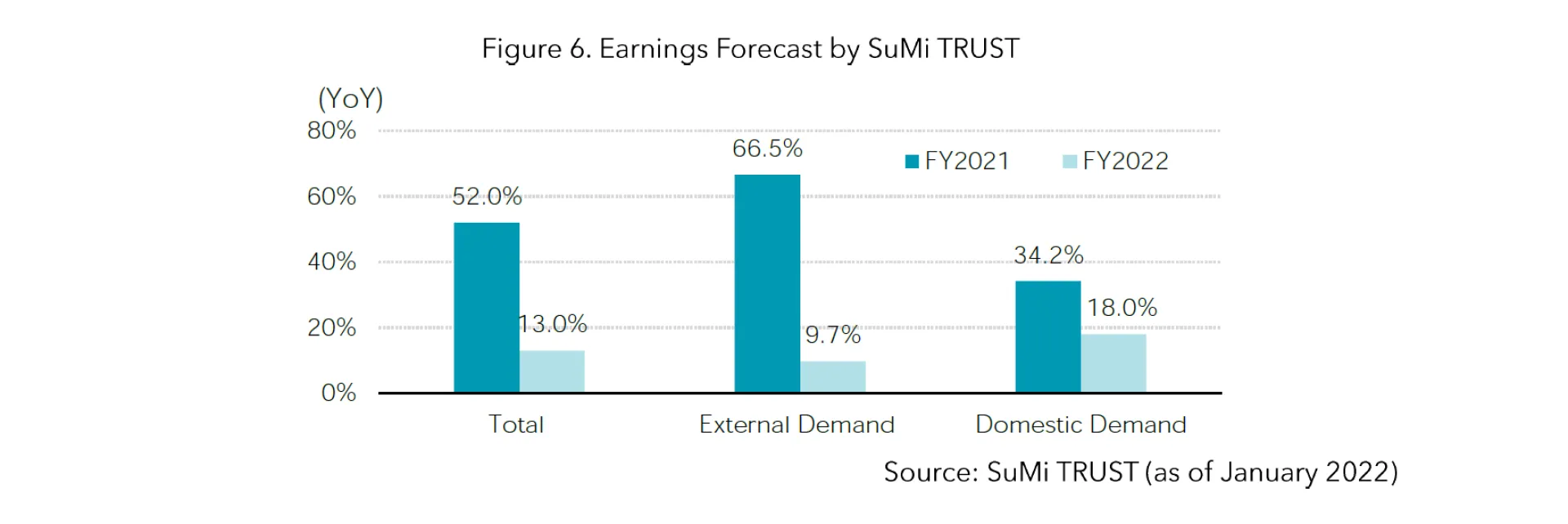

We expect the pace of wage increases in Japan to accelerate in the future. The Kishida administration has expanded tax incentives to encourage companies to raise wages through tax reform*1 for FY2022 starting in April 2022. In addition, from February of this year, official salaries for childcare, nursing, and care workers, were raised through subsidies by about 1.0-3.0%. Given the expected growth in Japanese companies operating profits in FY2021, which ends in March, and the following FY2022, wage increases are expected to be implemented throughout a wide range of industries. Overall, we believe that wages will grow by about 1.5% each year, a level that is slightly higher than the increase in prices.

Monetary Policy of the Bank of Japan

Due to differences in the pace of inflation, monetary policies in the US, Europe and Japan will also be different. Unlike the Fed and the ECB, the Bank of Japan is unlikely to drastically revise its monetary policy during the tenure of Governor Kuroda, whose term expires on 8th April 2023, until the target of the CPI is achieved.

Due to differences in real wage growth and monetary policy, Japan's economy has a relative advantage over Europe and the US. In the January-March period, the economy has stagnated due to the impact of measures taken by the government and local authorities to prevent the spread of the COVID-19. However, the number of new infections is now showing signs of peak out, and domestic demand is expected to recover as economic activity resumes.

Unlike last year when supply constraints plagued the manufacturing industry, production activity has been steady, and the domestic distribution system is working efficiently. Although there were concerns about China's economic slowdown, the latest manufacturing orders statistics indicate a healthy appetite for capital investment in China, and the corporate fundamentals of the export-driven sector is expected to remain strong. Since the labour market is not excessively tight, it is unlikely that labour shortages would accelerate price increases.

The stock market is currently being driven by factors other than corporate earnings. For instance, a focus on valuations against the backdrop of rising interest rates in the US and geopolitical risks surrounding Ukraine. Although we cannot predict when such uncertainties will diminish, we believe market participants will once again focus on corporate fundamentals. Considering Japan’s strong corporate fundamentals, we believe there is considerable upside potential for Japanese stocks.

*1 Tax reform to encourage companies to raise wages

For large and medium-sized companies, the deduction rate increases from 15% to 25% when employee salaries increase by 4% or more over the previous year. As an additional measure, the deduction rate increases by another 5%, to a maximum of 30% if employee education and training expenses increase by 20% or more over the previous year. For small and medium-sized enterprises (SMEs), the deduction rate will increase to 30%, if salaries increase by 2.5% or more. The deduction rate will increase by another 10%, to a maximum of 40%, if employee education and training expenses increase by 10% or more.

In both cases, eligible salaries will include bonuses and other lump-sum payments. For large and medium-sized companies, the current system requires an increase in the salary of newly hired employees to be eligible. This will be revised to reflect an increase in the salary of employees who are still employed. Additionally, for large companies that are reluctant to raise wages or invest despite growing profits, the application of tax credits for some special tax measures, such as the R&D tax credit, will be suspended.