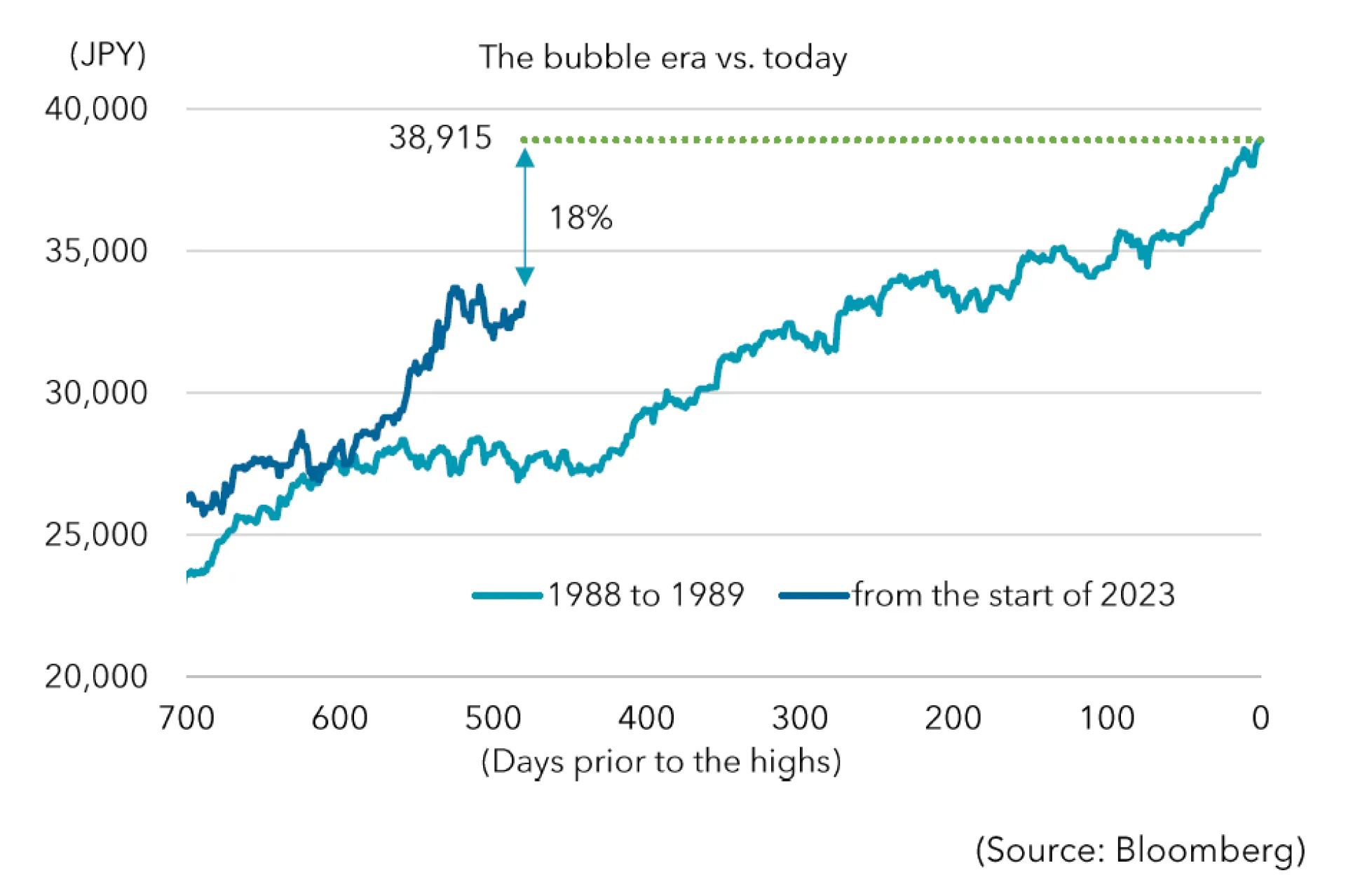

In fact, if we calculate the rate of return required for the Nikkei 225 to reach its highest point (38,915 yen) from a starting point of 33,172 yen (as of July 31, 2023), the rise will be just under 18%.

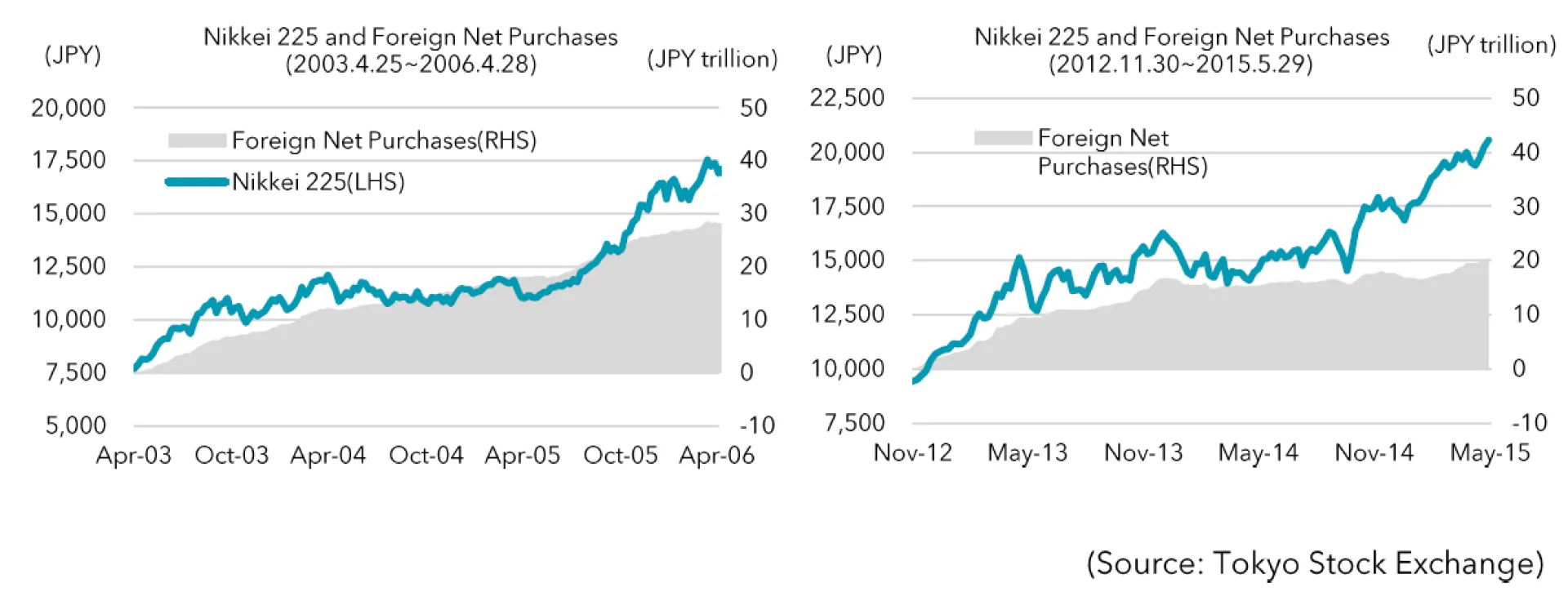

Net Inflow of Foreign Investment into Japanese Equities

Since the bubble collapsed in the early 1990s, foreigners have been prominent buyers from 2003 to 2006 during the Koizumi structural reform bull market*1 and from late 2012 to 2015 during the Abenomics bull market*2.

The following graphs show trends in the Nikkei 225 during past upswings as well as net purchases by foreign investors.

In the upswing during the Koizumi structural reform bull market that started in the spring of 2003, the Nikkei 225 rose about 130% in three years, and the cumulative amount of stock purchases by foreign investors during this period was about 29 trillion yen. Also, during the upswing of the Abenomics bull market that began in the fall of 2012, the Nikkei 225 rose about 140% in two and a half years, and during this period, the cumulative amount of Japanese equities bought by foreign investors was about 19 trillion yen.

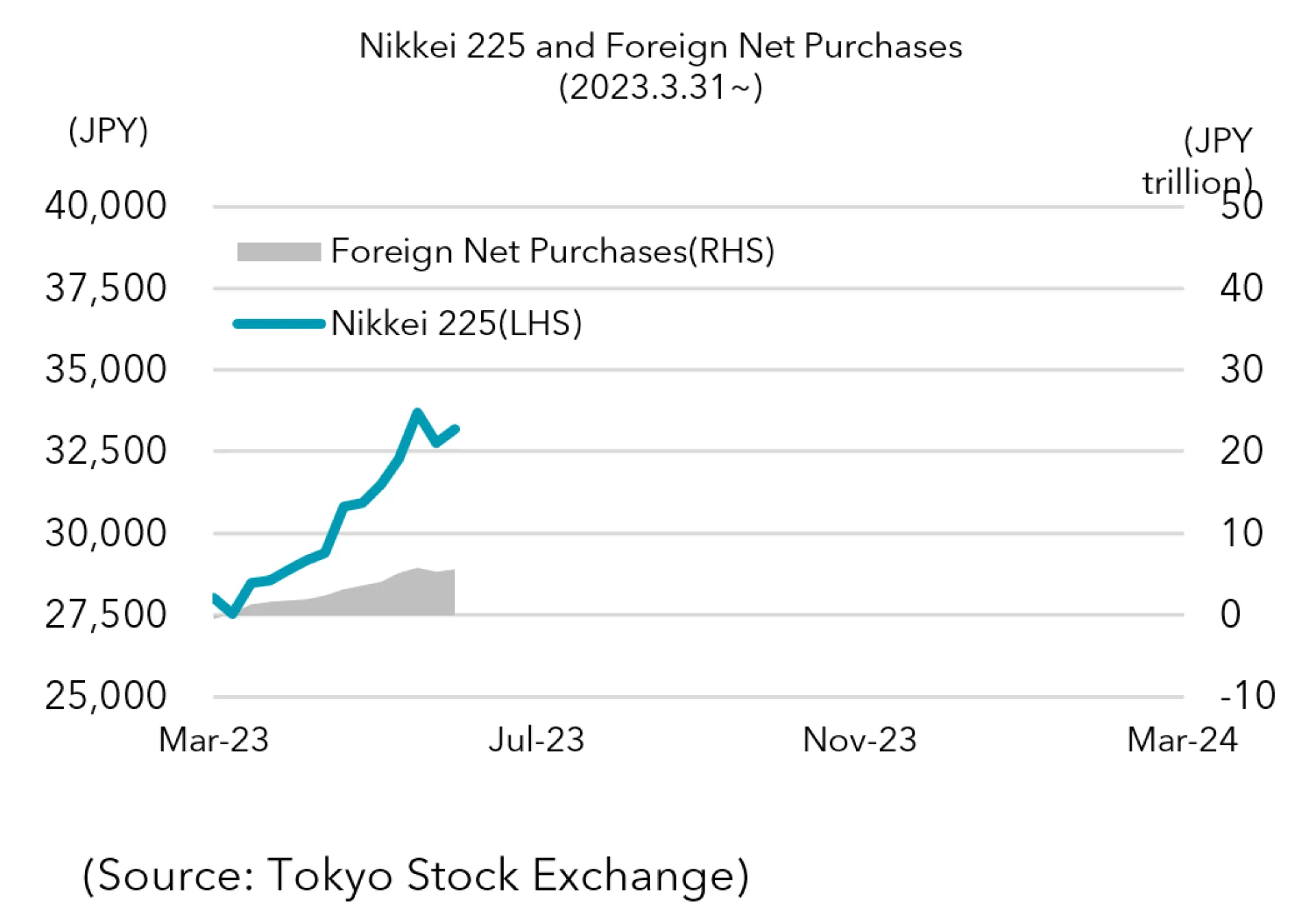

Turning our eyes to the current upturn, starting from the low of 27,010 yen on the Nikkei 225 at the time of the regional banking crisis in the U.S. in March 2023, the Nikkei 225 rose 25% in the following four months, and foreign investors purchased 6 trillion yen of Japanese equities, which is far smaller than that of the Koizumi structural reform bull market and the Abenomics bull market. Whilst the past bull markets were led by politics, the current upturn is due to the expectation of a virtuous economic cycle backed by inflation and higher wages, which was not seen in the last 30 years in Japan. Together with the statement by the Tokyo Stock Exchange (“TSE”) calling for the improvement of capital efficiency and Warren Buffett's comments about buying Japanese stocks, we won’t be surprised if foreign investors continue to purchase Japanese equities in the same amount as the past bull markets.

*1 Under Prime Minister Koizumi’s administration from 2001 to 2006, the Japanese equity market rose due to expectations of structural reform. Especially from April 2003, the market rose backed by the expectation for progress on the discussion about the privatisation of Japan’s postal services.

*2 The stock market rose for two and a half years from November 2012 as expectations grew that Prime Minister Abe would win the election with his pledge for ultra-easy monetary policy, aggressive fiscal policy, and economic growth strategies to encourage private investment.

Investment Amount of the Foreign Investors

As of the end of June 2023, the total market capitalization of listed equities worldwide was $108.9 trillion (Source: Market Statistics - Focus | The World Federation of Exchanges (world-exchanges.org)) In estimating the potential purchasing power of Japanese stocks by foreign institutional investors (which is based on the assumption that major global institutional investors who have a large impact on flows due to changes in asset allocation, account for 70% of total assets, and that they are linked to the MSCI World Index whose Japanese equity constituency was about 6.14%, at the end of June 2023), the estimated amount of Japanese equities held by global institutional investors is approximately 679 trillion yen (or approximately $4.7 trillion). Subtracting the domestic institutional investor holdings of 441 trillion yen (as of the end of June 2023 according to The Stock Distribution Survey 2022, by investor category, calculated by multiplying the value as of end-March 2023 by the rate of increase of TOPIX), 238 trillion yen is the estimated amount of Japanese equities that would be held by foreign institutional investors if they applied a benchmark weighting.

As of the end of June 2023, the estimated amount of Japanese stocks held by foreign investors was approximately 232 trillion yen, implying that there is an additional 6 trillion yen of purchases of Japanese stocks to be made if investors applied a benchmark weighting. In addition, Morgan Stanley's forecast indicates that earnings per share is expected to grow +10% this year and +10% next year, making Japanese equities more attractive to foreign investors. According to Reuters, in the past, purchases of Japanese stocks by foreign investors have had the effect of boosting the Nikkei 225 by 500 points per trillion yen of net purchases.

(Source: https://jp.reuters.com/article/column-ikeda-yunosuke-idJPKBN2Y61QP)

Conclusion - Foreign investors still have capacity for further investment

From a flow perspective, we see further potential for foreign investors to invest in Japanese stocks, as their purchases are still at 6 trillion yen, despite structural changes in Japan due to inflation and higher wages, and the long-term effects of improving capital efficiency.

We expect a return to Japanese equities as investors appear to be underweight against the benchmark and the relative attractiveness of Japanese equities in the region.

Although the Japanese equity market has performed well this year, structural changes have only just begun. The key in determining whether Japanese equities will extend their gains depends largely on continued inflation and higher wages. We will continue to closely monitor price trends and wage levels.