Japan’s Consumer Prices make their biggest jump in over seven years

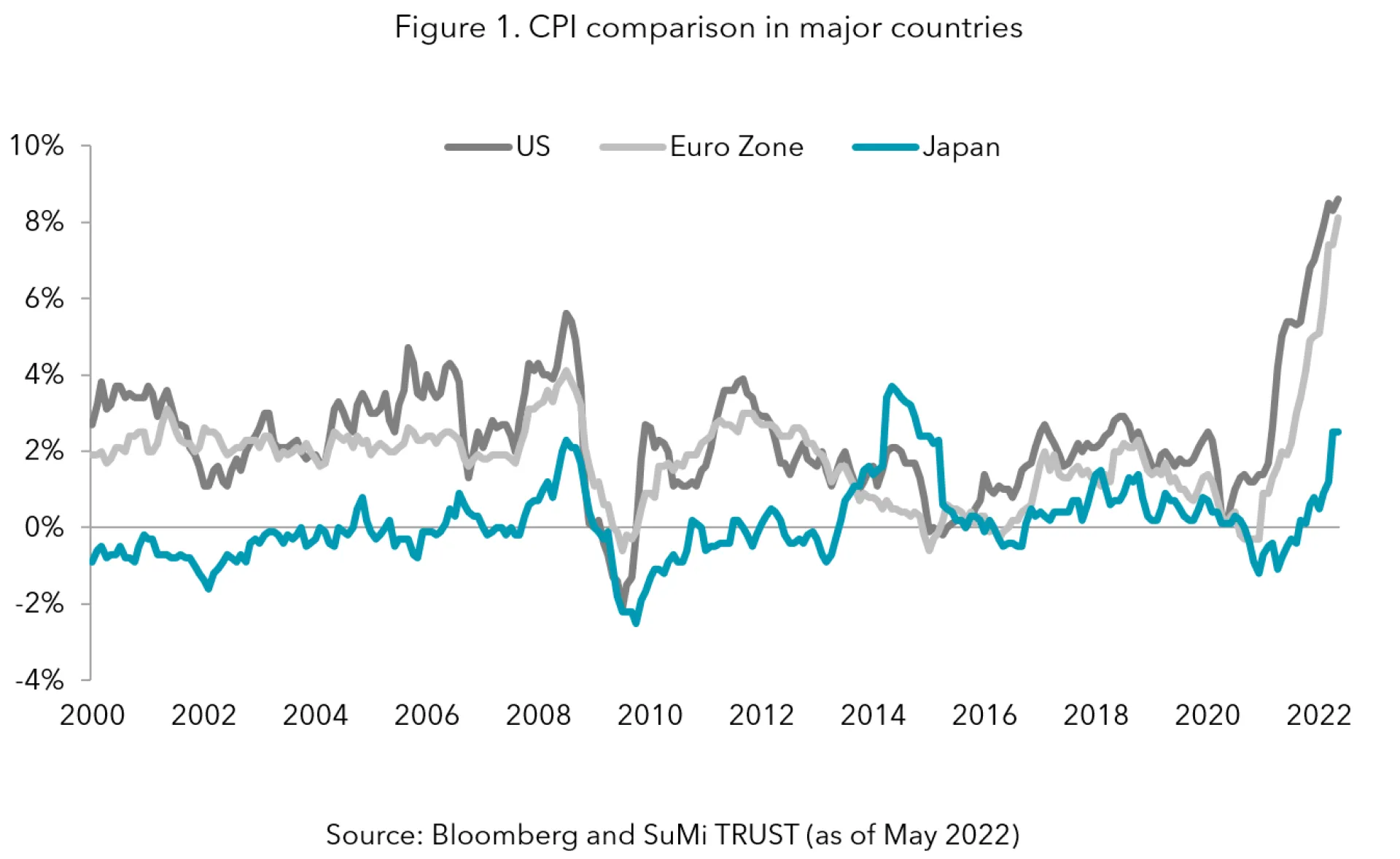

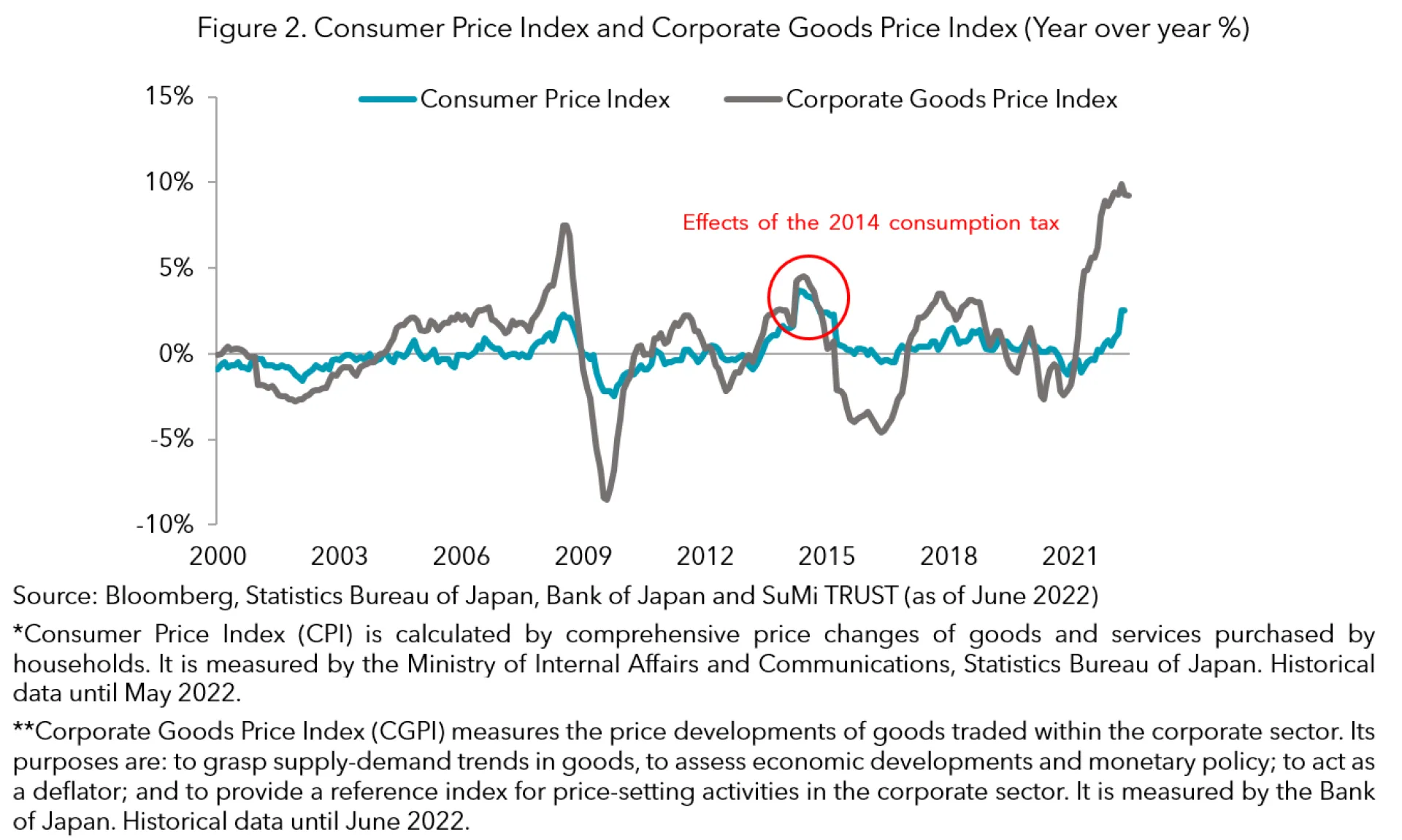

Inflation has been the largest threat to the global economy. Major central banks including the Federal Reserve Bank (FRB) and the European Central Bank (ECB) have been tightening their monetary policies to fight inflation. However, the story is slightly different in Japan. After decades of very low inflation, Japan’s consumer price index, a broad-based measure of prices for goods and services, increased 2.5% in May from a year earlier. While it is the biggest jump in seven years, it is much slower than the pace of increase in western economies (Figure 1). Meanwhile, the Corporate Goods Price Index (CGPI), which measures the prices for goods purchased by Japanese companies, jumped 9.3% in June compared to a year ago (Figure 2). A huge gap between the two economic indicators shows that Japanese companies are reluctant to pass on rising input costs to households because many retailers intend to maintain their market share amid the overcrowded landscape within the industry.

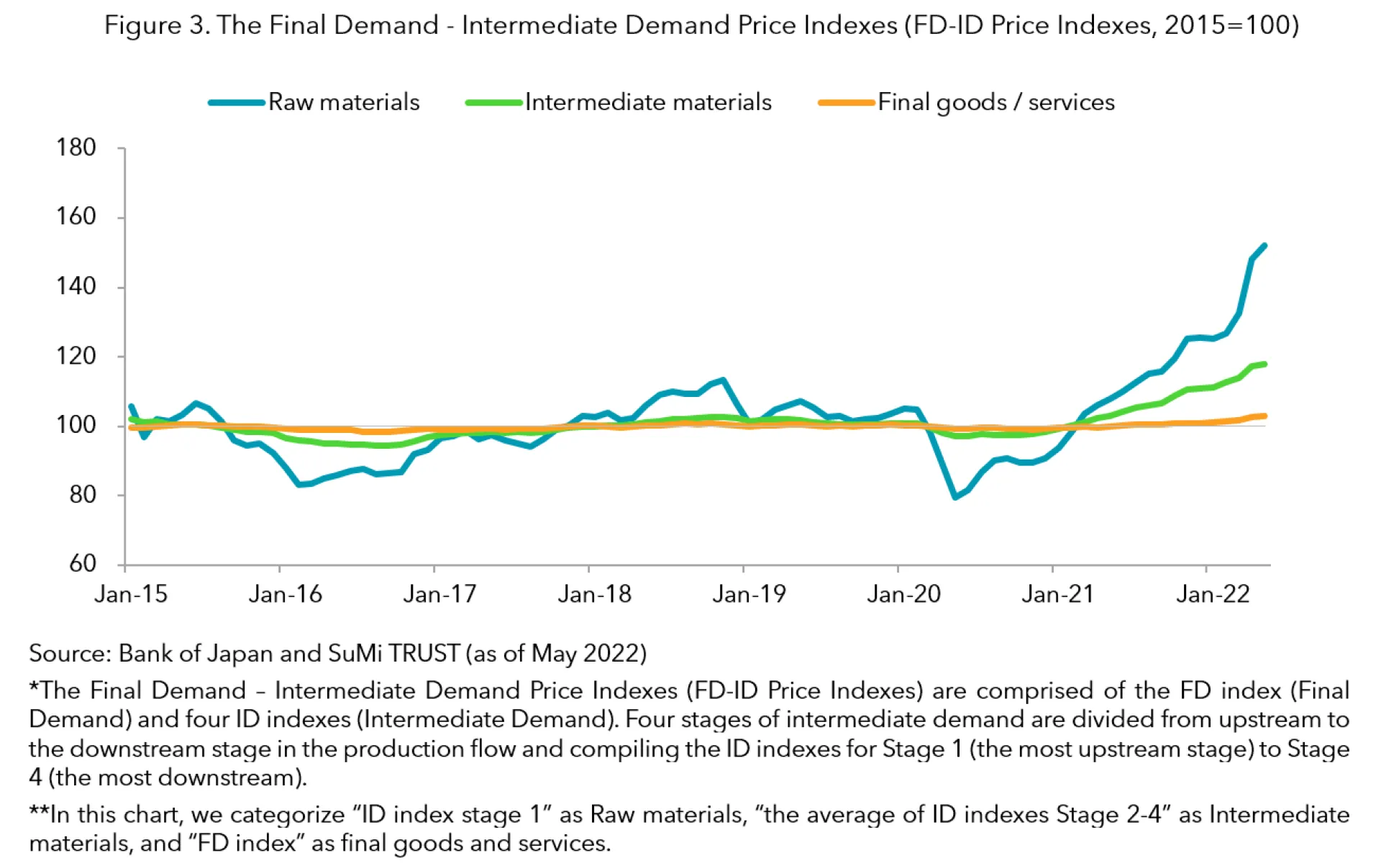

Amid the Final Demand – Intermediate Demand Price Indexes (FD-ID Price Indexes), newly introduced indexes by the Bank of Japan, showing aggregating prices of goods and services by demand stage, the price for raw materials continued to spike in May and increased by 41.3% from a year earlier (Figure 3). The price for intermediate materials also increased 14.6% year over year. Global commodity inflation and the Japanese Yen’s depreciation to two-decade lows have pushed up input costs for Japanese companies. Despite the input costs being at an elevated level, the price increase for final goods is somewhat muted with only 3.0% YoY growth in May. Meaning Japanese companies have not passed on rising input costs to households, which have created a gap between CPI and CGPI % change rates.

If Japanese companies continue to absorb the increase in costs instead of passing it through to households, inflation can potentially squeeze their margin and compress their earnings. However, we do not expect that to happen in the near term. Within all industries, the weight of import costs is roughly 15% of the total cost, which includes goods, services and employment. Even with the 40% rise in the import price index, it will only increase their costs by about 6%. Since Japanese companies’ sales from overseas account for 40% of their total sales, the 15% decline in the Yen will be more than enough to offset the cost increase. In addition, the Japanese government has already launched relief packages to fight inflation (1.5 trillion yen to address soaring crude oil, 6.5 trillion yen to support small to mid-size businesses on an overall project scale basis) which will likely take pressure off those companies that struggle with inflation.

Profit has not deteriorated while input costs have been rising

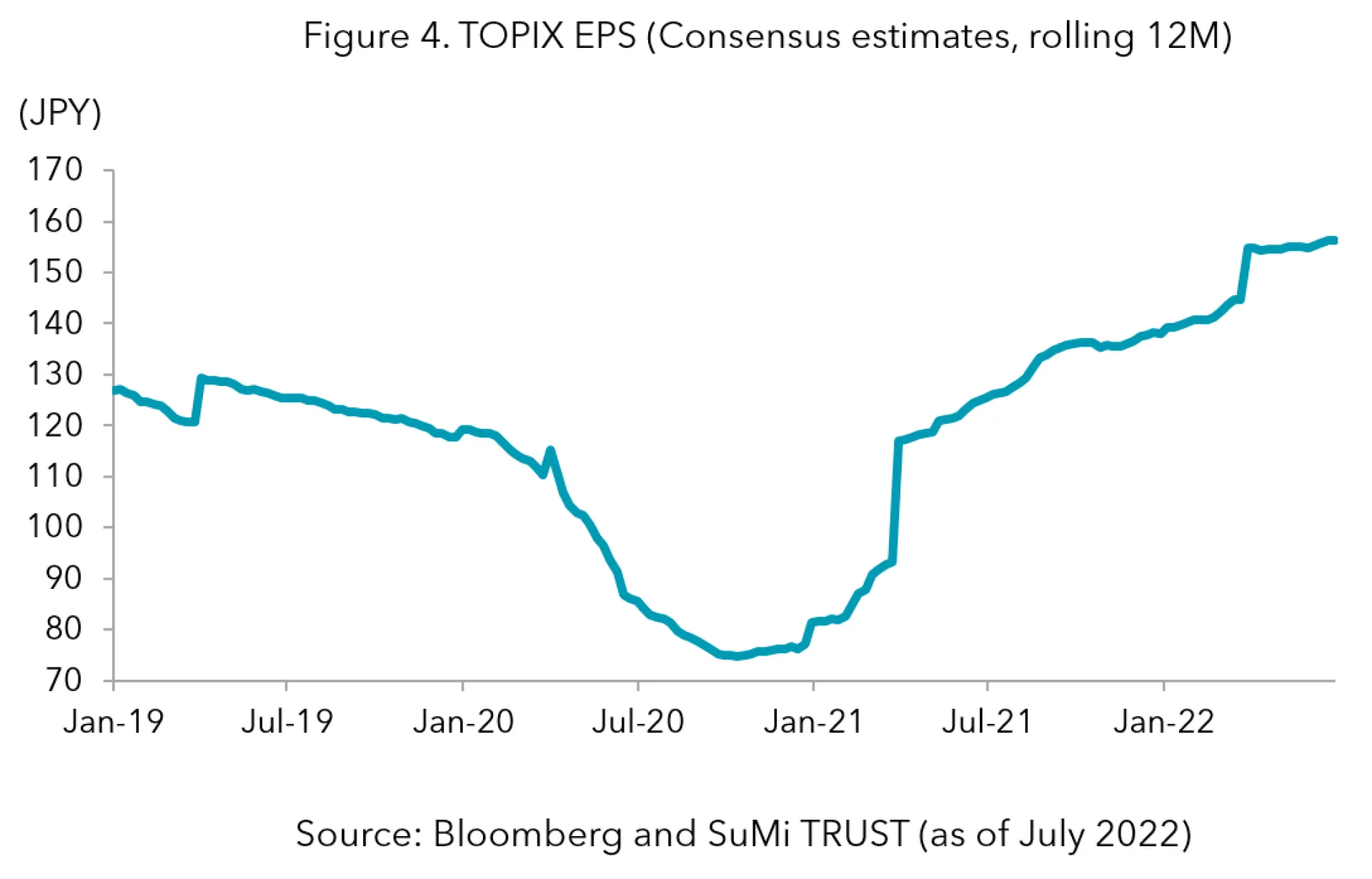

So far, there have been no signs that inflation is putting pressure on corporate earnings. According to the Financial Statements Statistics of Corporations conducted by the Ministry of Finance for Q1 2022, Japanese companies’ sales/earnings growth rate (year-over-year) were 7.9%/13.7% respectively, showing substantial improvement as the economy resumes. The figures were also pushed up by increased exports and expansion of sales from overseas operations in JPY terms due to the currency’s decline against the US dollar. The profits of TOPIX companies are projected to remain on an upward trajectory (Figure 4).

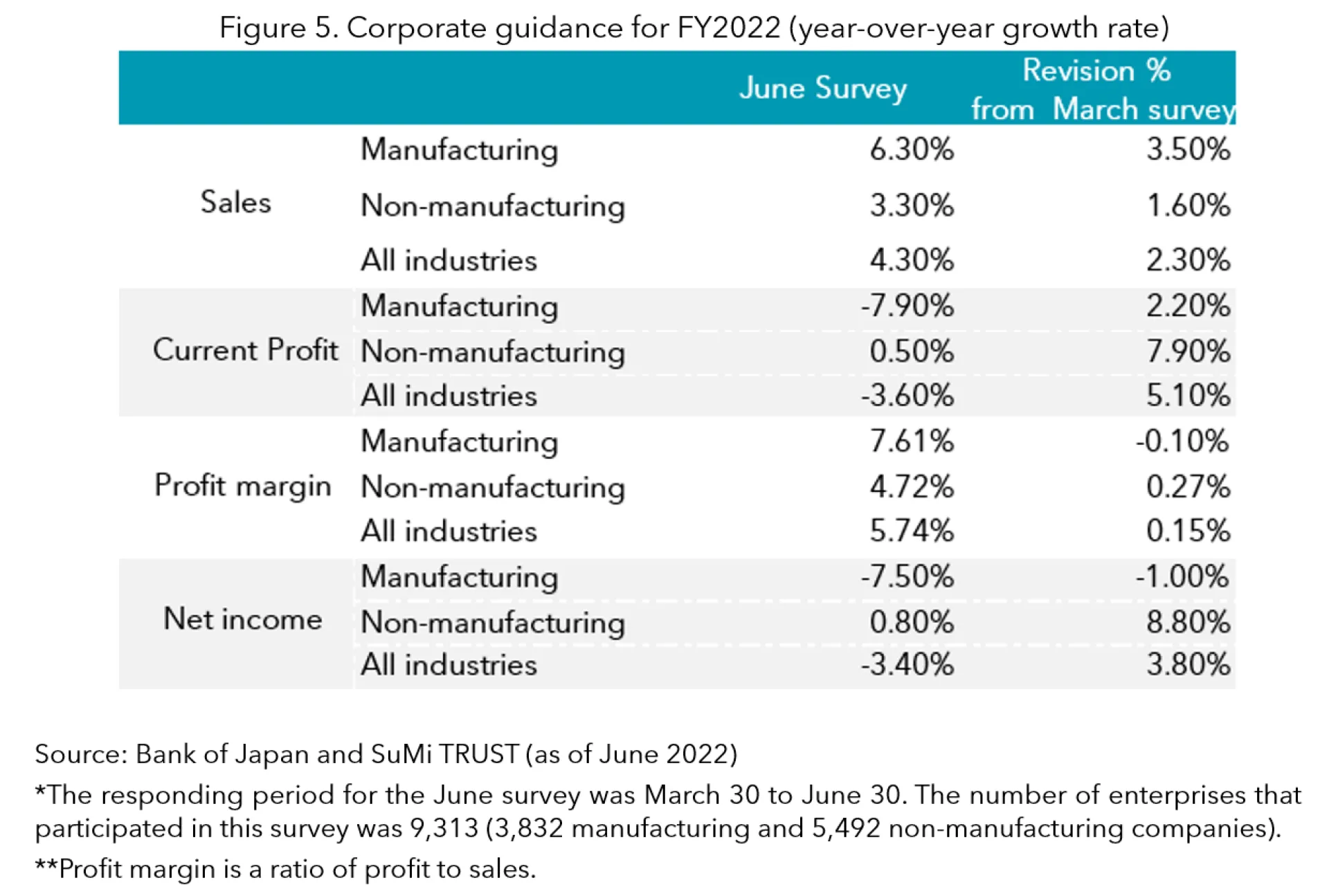

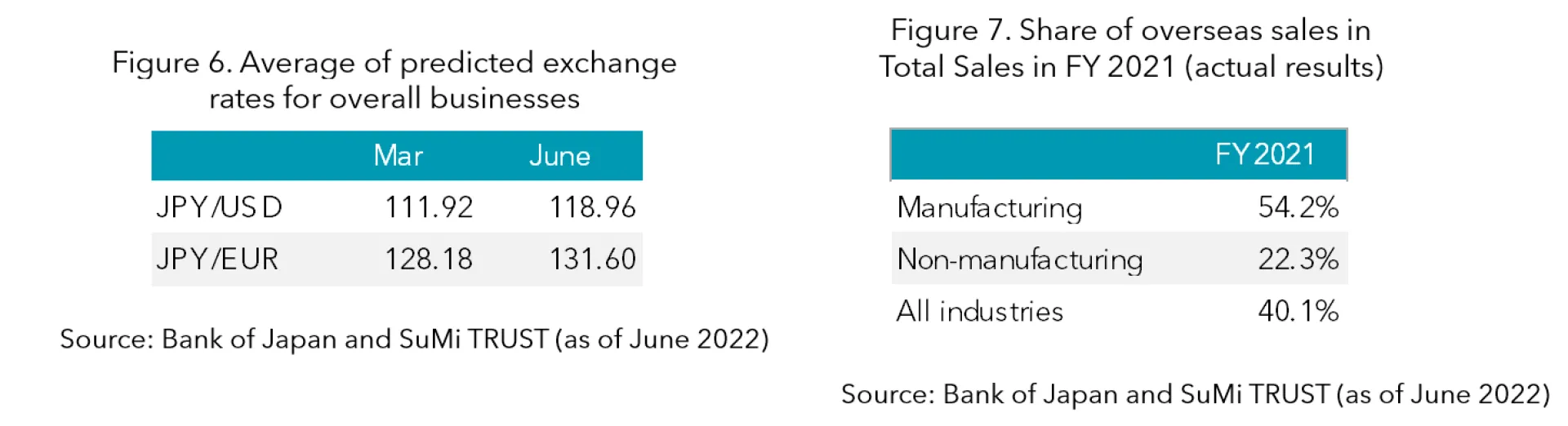

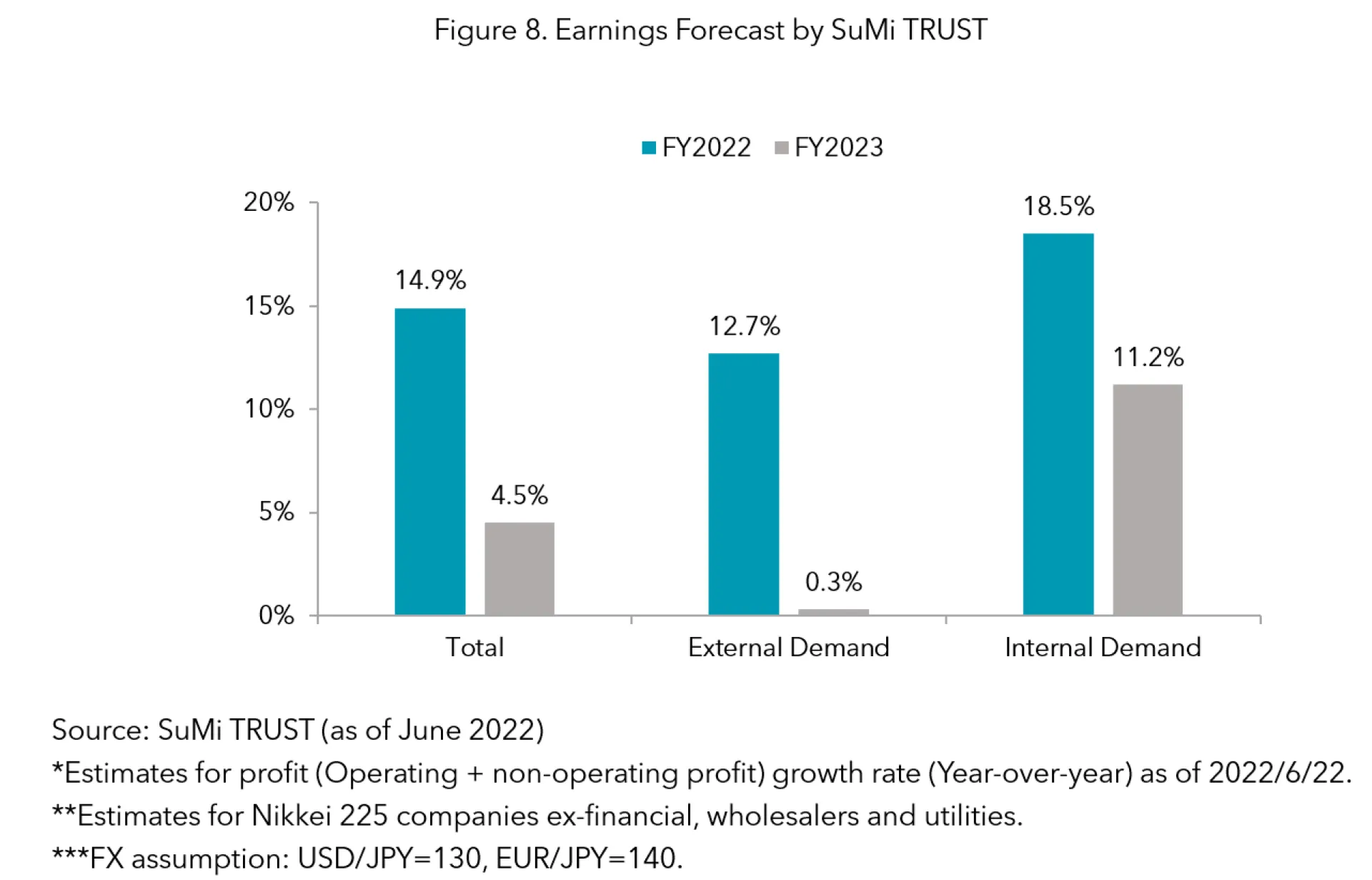

While streets are bullish on corporate earnings, many Japanese companies are guiding conservatively. According to the June Tankan, a short-term economic survey for enterprises in Japan conducted by the Bank of Japan, Japanese companies that participated in the survey are expecting their sales for FY2022 to be up 4.3% y/y while estimating their profit for FY2022 to be down 3.6% y/y. Given the bullish outlook for sales, we believe the profit guidance may be somewhat conservative and there is still significant room to absorb cost increases associated with inflation. In addition, the companies are still not fully taking the weak yen into account for their guidance. Their JPY/USD FX assumption for FY2022 stands at 119 yen overall and exporters are expecting 117 yen for their assumption for FY2022. While it is revised up from March, it still stands at quite a conservative level, which should support upward revision of profit going forward (Figure 6). In addition, the percentage of overseas sales of Japanese companies is 54% in the manufacturing industry, 22% for non-manufacturing, and 40% for all industries (Figure 7).

Based on research by our analyst team, SuMi TRUST expects profit for FY2022 to be up 14.9% year-over-year (Figure 8). Our estimate for operating profit growth rate was 4.7% a month earlier (as of May 24), with internal demand driving the estimates higher while external demand remains solid. We predict recovery in consumption to drive internal demand and the weak yen to support earnings on the external demand side. Our assumption for JPY/USD FX stands at 130 yen.

Economic recovery on track

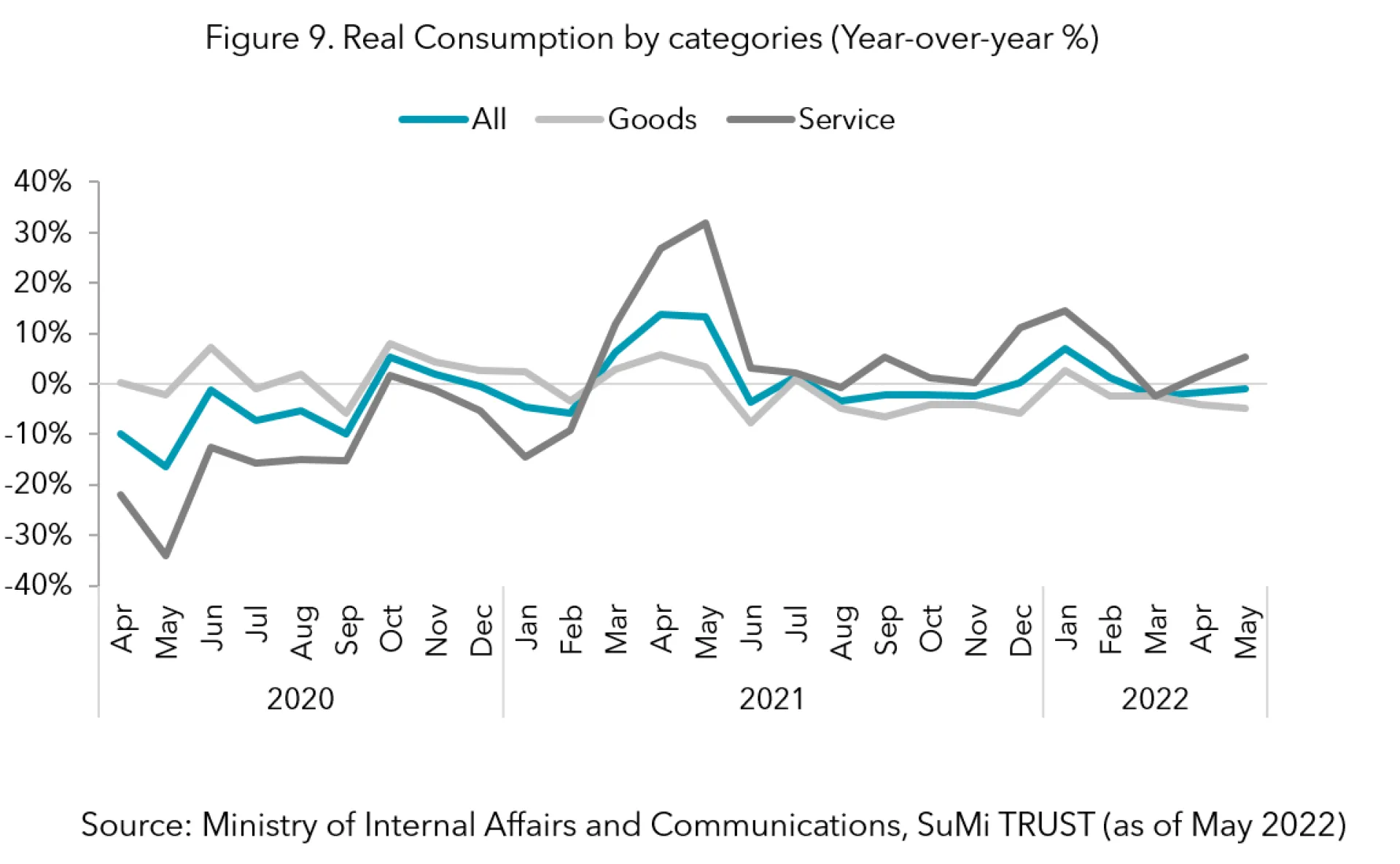

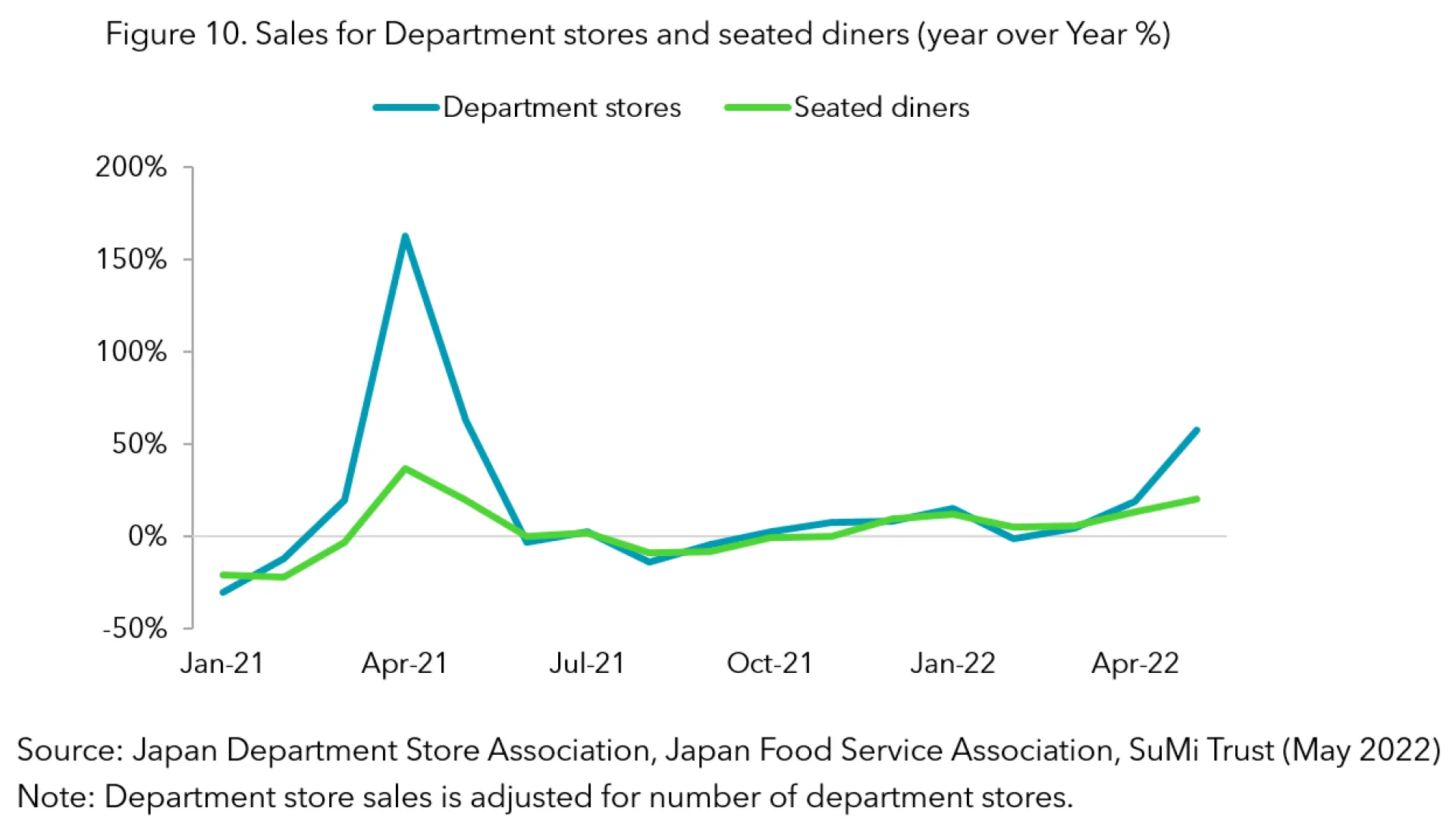

Despite high inflation, consumer spending in Japan remains resilient and recovery is on track. According to a household survey conducted in May 2022, real consumption expenditure (for households of two or more persons) declined 1.9% from a month earlier after rising for two consecutive months. However, the breakdown (Figure 9) shows that consumption in services has accelerated whilst ongoing supply chain disruption weighed on spending in auto purchases. Within service spending, the first major holidays in three years with no restrictions resulted in spending in lodging to grow 80.2% year over year. We expect consumers to spend more on services that were restricted during the pandemic such as eating out, lodging as well as travelling. The data from the Japan Food Service Association also shows that seated dining has continued to recover at a fast pace.

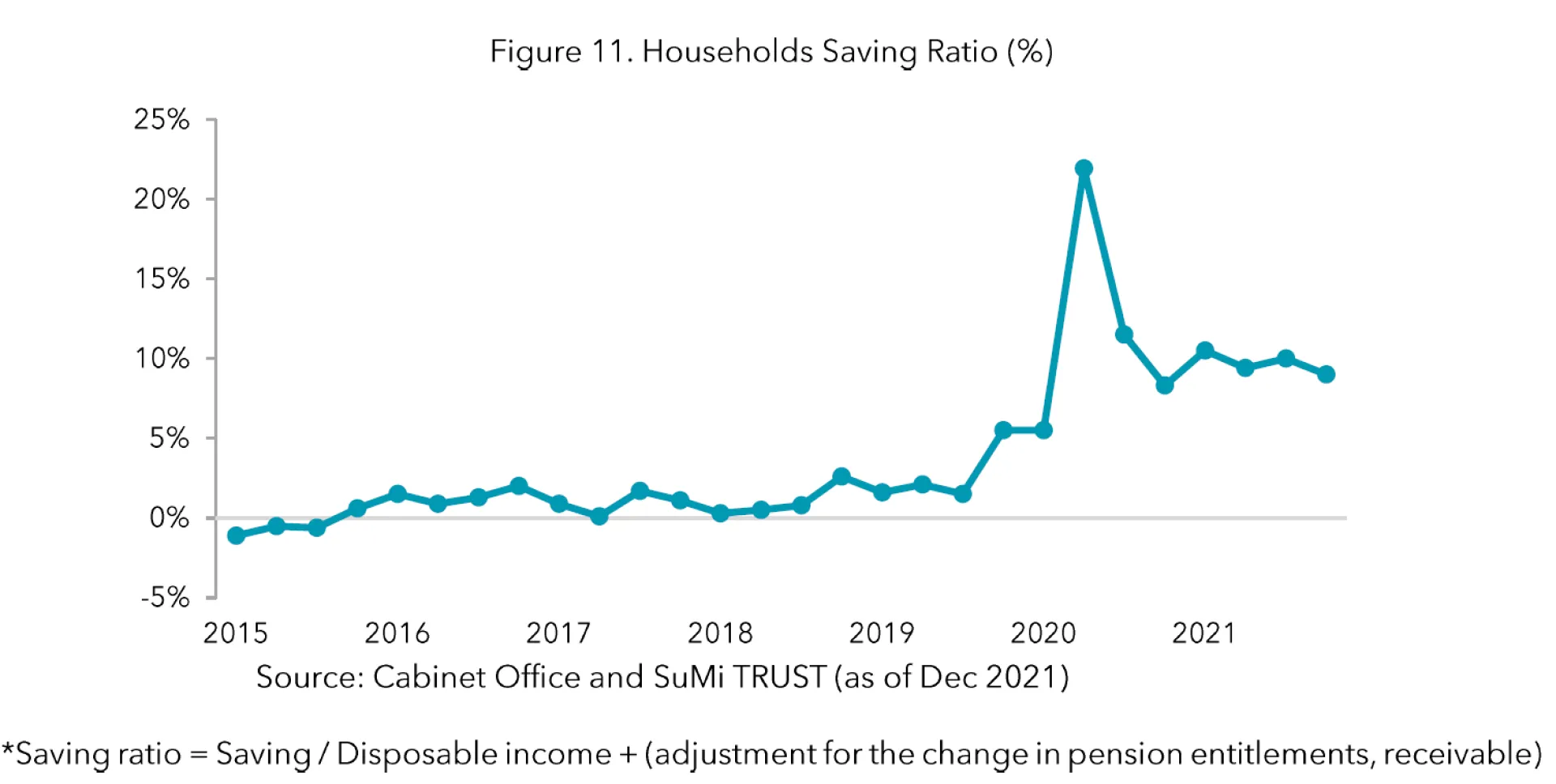

As for spending on goods, data from the Japan Department Store Association shows that consumption of luxury goods at department stores, where there is no supply chain disruption, is accelerating; showing pent-up demands are evidently strong (Figure 10). As COVID-19 restrictions have slowly lifted in Japan, recovery should continue. The appetite to spend will support recovery. In addition, household deposits accumulated during the pandemic are still close to a record high. Excess household savings will be a tailwind for pent-up demand (Figure 11). As there were a few factors to weigh on consumption last year such as the resurgence of new infection cases of COVID-19 or bad weather during August through September, year-over-year comparison looks positive going forward. Given there are several factors to support consumer spending, it is unlikely that global inflation will damage consumption in the near term.

In summary, Japan stands in a unique position where the country faces less inflation pressure compared to other countries. Since Japanese companies are leaving room in their guidance to absorb higher costs, it is very unlikely that companies will increase prices high enough to damage consumption. Hence, SuMi TRUST believes the recovery of the Japanese economy is on track. On the other hand, we understand that risk factors lie outside of Japan such as recession fears in the US or China that would potentially cause downward pressure on the global economy. We remain bullish regardless of uncertainty overseas, as the driver of Japan’s economic recovery will be domestic factors. We will pay close attention to the risk factors and the potential impact of external factors.