Former Prime Minister Abe's Achievements

The Japanese people were shocked and saddened by the death of Shinzo Abe. Many have praised the former Prime Minister for his strong leadership in turning Japan's economy around, which prior to his tenure had been hit hard by the Global Financial Crisis and the Great East Japan Earthquake. During his eight years and eight months in office, as the longest-serving prime minister in Japan’s history, he demonstrated deft political skill as a leader by strengthening the Japan-US alliance and conducting economic diplomacy with a focus on China. He also raised Japan's global presence. He succeeded in signing the TPP (Trans-Pacific Partnership) even after the withdrawal of the US from the framework, which led to the formation of QUAD, the Quadrilateral Security Dialogue between Japan, the US, Australia and India.

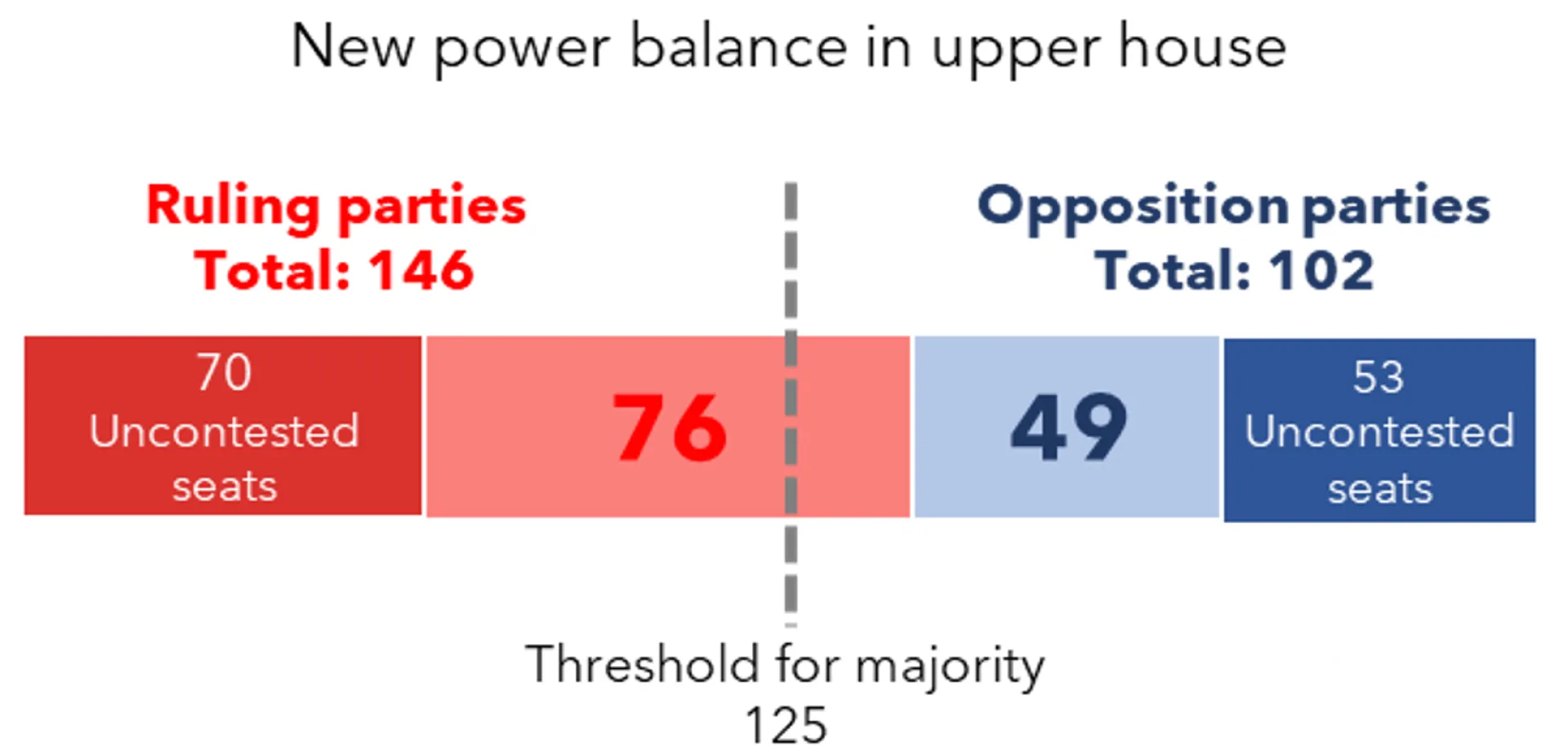

He continued to have a strong presence in the Japanese political scene even after stepping down in 2020 due to health issues. His death is expected to change the power map in the governing party. The cabinet reshuffle and the LDP executive appointments, which are expected to take place in August or September, will be an opportunity to examine the new balance.

Prime Minister Kishida's Economic Policy

One of the principles of the "new form of capitalism" that Kishida has been advocating is to strengthen distribution by encouraging wages and financial income increases, but some uncertainties remain. In a speech in the City of London in May, Kishida announced his intention to move forward with the "Income Doubling Plan," which includes a drastic expansion of NISA, a tax-exempt system for individual investors, and the creation of a new mechanism to induce people to invest their savings in asset management. He will have "three golden years" without a major national election, providing an opportunity for a long-term commitment to policies that include shifting from savings to investments. Kishida's policies include measures to combat high prices, support higher wages, decarbonisation, and digitalisation, but how smoothly he will be able to promote his policies will depend on the balance of power among the LDP lawmakers. Kishida prioritises narrowing down rich-poor disparities while there are strong voices from members of houses who are pro-competition within the party.

In the past, the increase in financial income taxation that Kishida proposed was so unpopular with the market that it had to be withdrawn. In the event that discussions on the revision of financial income taxation proceed, it is likely that a market-friendly design will be considered that reduces the tax rate for low-income taxpayers. Depending on the design, the system may contribute to economic growth through distribution to low-income taxpayers, who have a higher propensity to consume, by correcting the relatively large post-income redistribution gap from an international perspective. However, at the moment, the market sees it as simply a tax increase, so if it were to be revisited, close communication with the market would be essential.

Expected Monetary Policy

Despite some voices that wonder about the sustainability of the current monetary policy, many believe that the large-scale monetary easing, one of the pillars of Abenomics, will continue in the interim. BOJ Governor Kuroda indicated that he expects the inflation rate to remain around 2% for the time being but reiterated that the current easing will continue until the point necessary to sustain the price targets stably. In the meantime, the difference in the monetary policy of the US or European countries has weakened the yen, pushing up import costs.

With Kuroda's term coming to an end next April, the appointment of his successor is now in full swing. Some believe that the absence of Abe will change the dynamics within the ruling party and weaken the voices calling for the continuation of Abenomics. With the yen's depreciation contributing to price hikes, some believe Abenomics needs to be revised. Market participants expect two prospects: incumbent and former deputy Governors who served the BOJ for a long time. The appointment of the Governor requires prior approval of the diet, and the candidate will come to light early next year. The appointment of the successor will likely stimulate discussion on whether the BOJ will shift away from the current aggressive easing policy. We will closely monitor the situation.