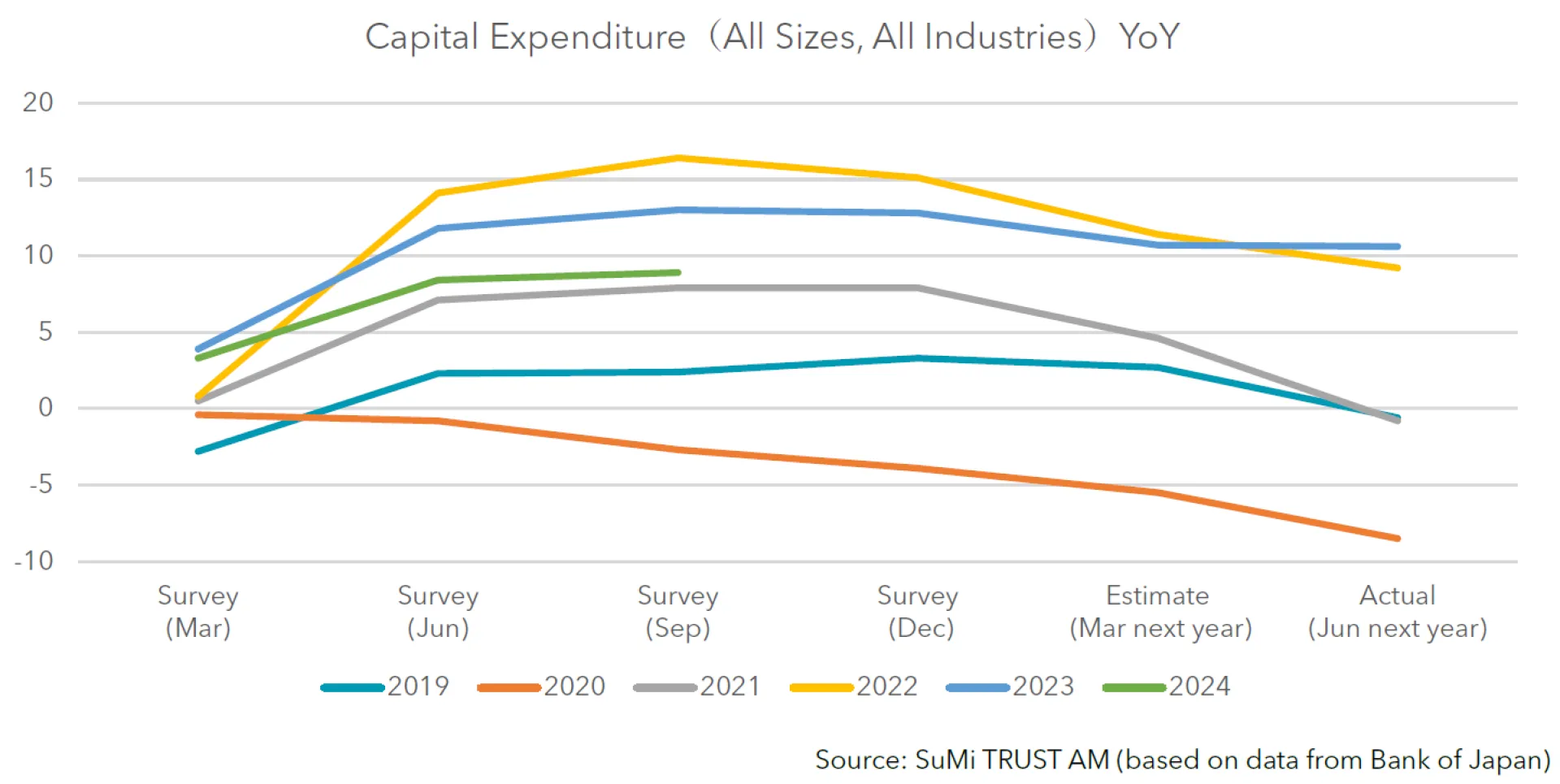

In terms of capital expenditure, we believe that companies will maintain current levels as they tackle various challenges in the mid- to long-term. These investments will include productivity improvements, data center-related initiatives, restructuring of corporate supply chains, and measures to lessen the burden of ongoing structural labour shortages.

II. Monetary Policy Outlook

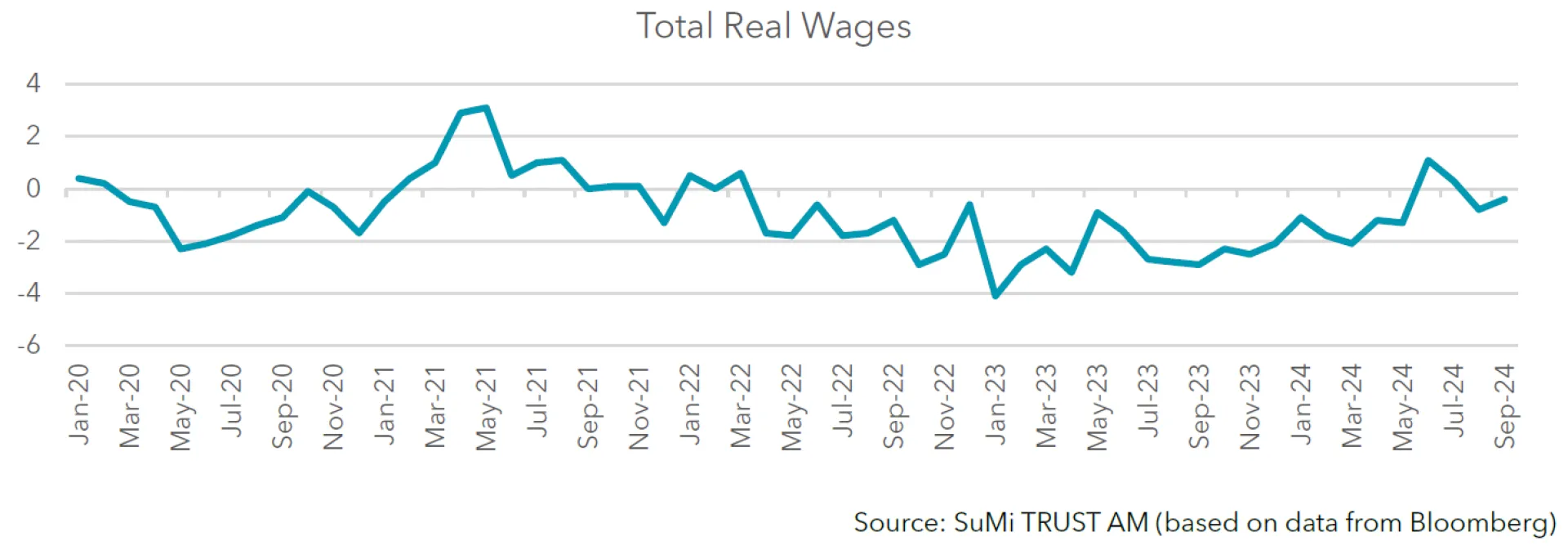

We anticipate that the BOJ will increase interest rates in December or January, and market participants will be able to evaluate the impact in the first half of 2025. In addition, with labour unions intending to push for a more than 5% increase in wages, payroll expenses should subsequently be passed through to the prices of goods and services.

The timing of BOJ communications with the market will be important in ascertaining whether a rate hike will come in December or January. Should rising wages and the price of goods maintain a ‘virtuous cycle’ in line with the BOJ’s target then we may see a further rate hike in June 2025. Further, should the foreign exchange rate approach 160 yen to the dollar, we expect that the Japanese government and the BOJ will consider currency intervention measures or additional rate hikes. Our forecast for Japan 10-Year Government Bond yields as of the end of June 2025 is between 0.75-1.50%.

Currently, market participants are paying close attention to the pace of the US Federal Reserve’s interest rate cuts. While the US economy is showing signs of resilience, there are waning expectations for interest rate cuts due to concerns that Trump’s economic policies may again cause inflation to accelerate. We expect some clarity about the pace of interest rates after Trump’s inauguration towards the end of January 2025, when he confirms which policies he will actively pursue. Our forecast for ten year US government bond yields as of the end of June 2025 is a range of 3.25%-4.25%.

III. FX Outlook

In the first half of 2025, the Japanese yen will likely move in response to developments in Japanese and US monetary policy. While the BOJ’s plans will take into account the economy, prices, and the general finance environment, we expect that they will continue to raise rates as planned since real interest rates are currently at a low level. The US Fed decided to cut interest rates for the first time in four and a half years at the Federal Open Market Committee meeting in September 2024. The market is continuing to pay close attention to the pace of any further rate cuts. Meanwhile, there are some market participants who expect the pace of Fed rate cuts to slow due to inflationary concerns stoked by Trumpian economic policy and the US economy stabilising. We expect these factors to be reflected in the FX rate, and we are forecasting the JPY to sit in a range of 140-160/USD as of the end of June 2025.

IV. Japanese Equity Market Outlook

The Japanese equity market should be able to maintain its current robust performance, buoyed by expectations for a soft landing for the US economy, improving corporate earnings in the service sector, and a positive outlook for shareholder return programs by Japanese companies.

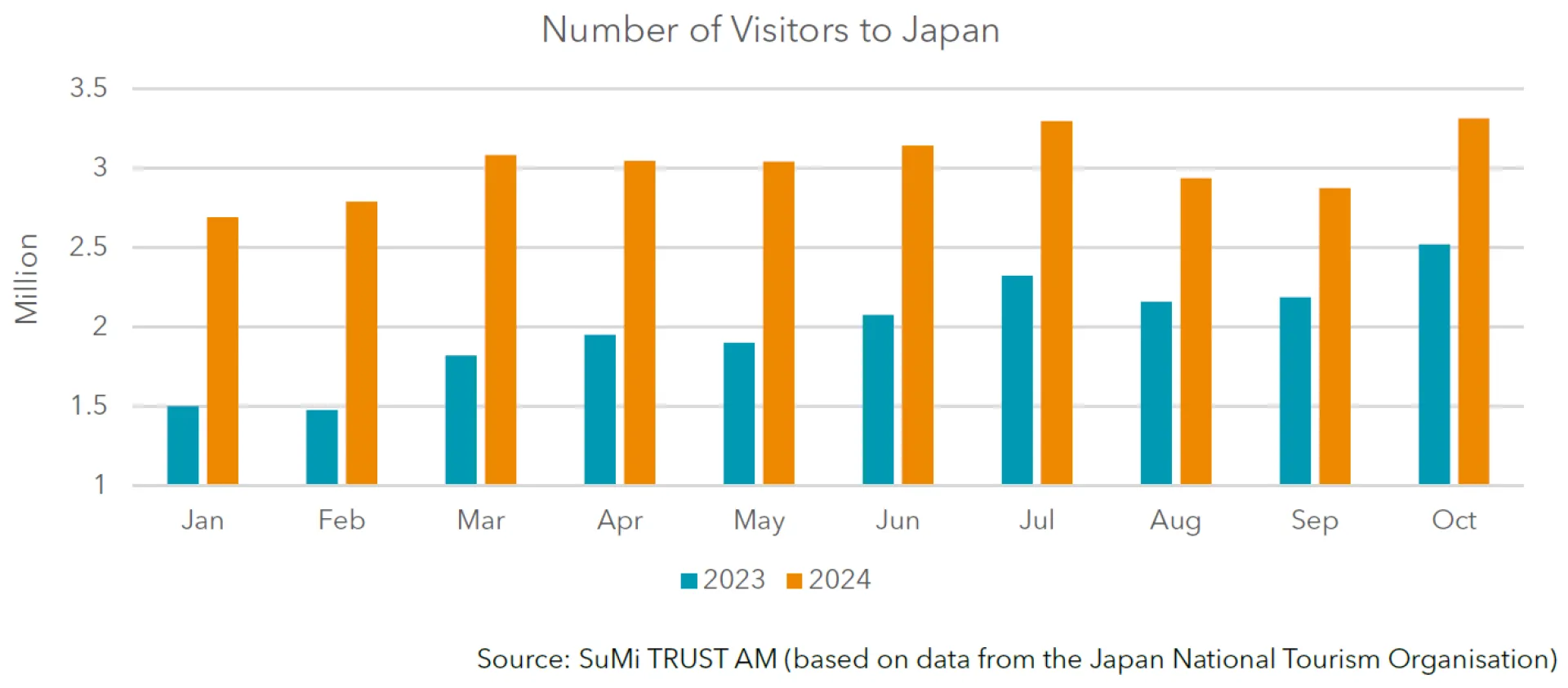

We expect to see a recovery in service sector earnings on the back of increasing numbers of overseas tourists visiting Japan as well as a boost in personal consumption thanks to rising real wages and an improvement in the labour environment. The annual number of international visitors to Japan in 2024 reached 30 million in October, the fastest that the milestone has been reached since recordkeeping began. Figures released by the Japan Tourism Agency show that overseas tourist travel expenditure by category for the July-September quarter in 2024 was 1.95 trillion yen (approx. 13 billion USD), up 41.1% year-over-year. Per capita travel expenditure was also up 6.7% year-over-year at 223,195 yen (approximately 1,500 USD).

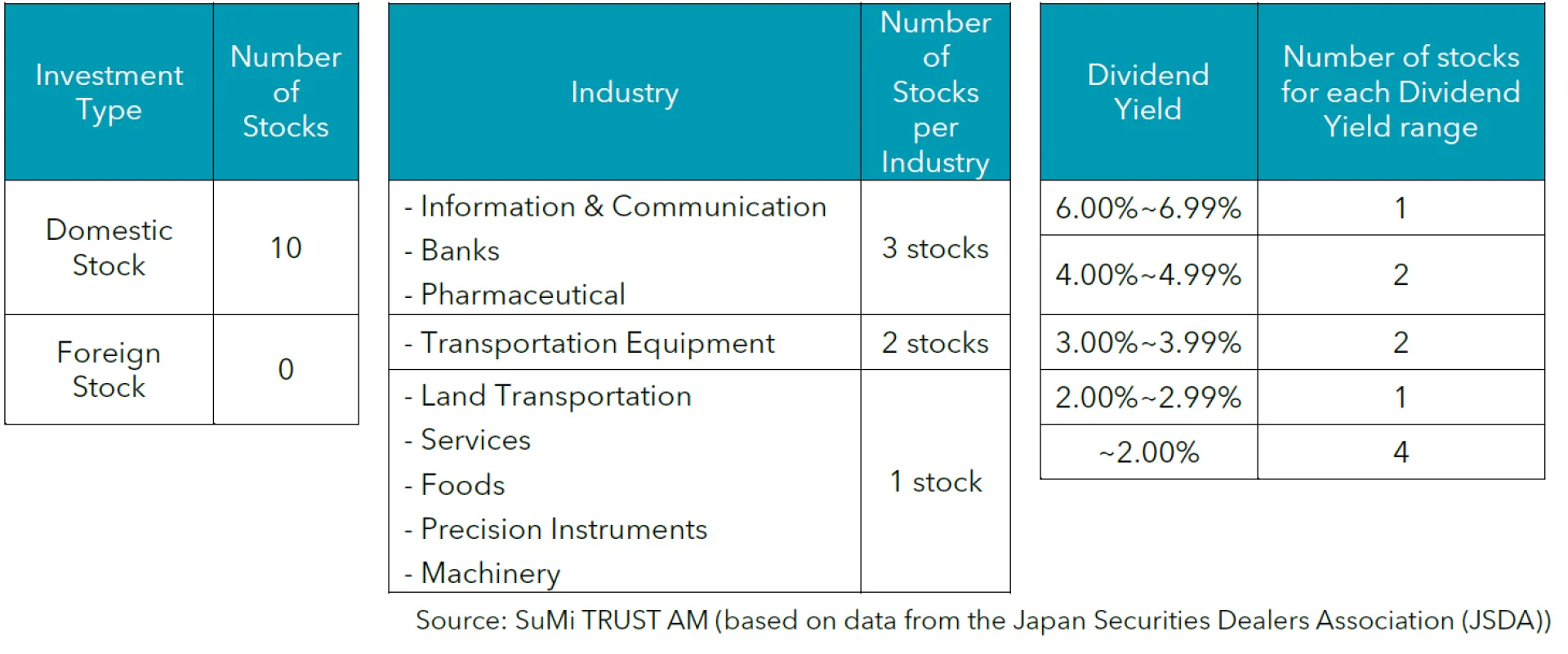

The new NISA (Nippon Individual Savings Account) system is also doing extremely well. According to figures released by the Japan Securities Dealers Association, individual investors using NISA were focused on the growth stocks of domestic companies and this helped support the Japanese equity market in 2024. Figures released by the same organisation for the year as of October 2024 revealed the number of new NISA accounts and user trends for ten asset managers (five major, five internet-based). In summary, average account openings per month were 1.7 times higher in the period from January to October 2024 compared to the same period from last year. Growth investments made via a NISA account were 4.2 times higher, reaching a total of 8 trillion yen (approximately 53 billion dollars). Analysis of the NISA accounts showed that in October 2024 the ten most-purchased stocks in the growth space were all domestic companies, and half of them were either in the Information and Communications or the Transportation Sector. In addition, the data showed that NISA account holders favoured stocks with high dividends, shareholder returns, or those that had stable management. Overall, the inflow from NISA accounts was a boost for the domestic equity market in 2024.

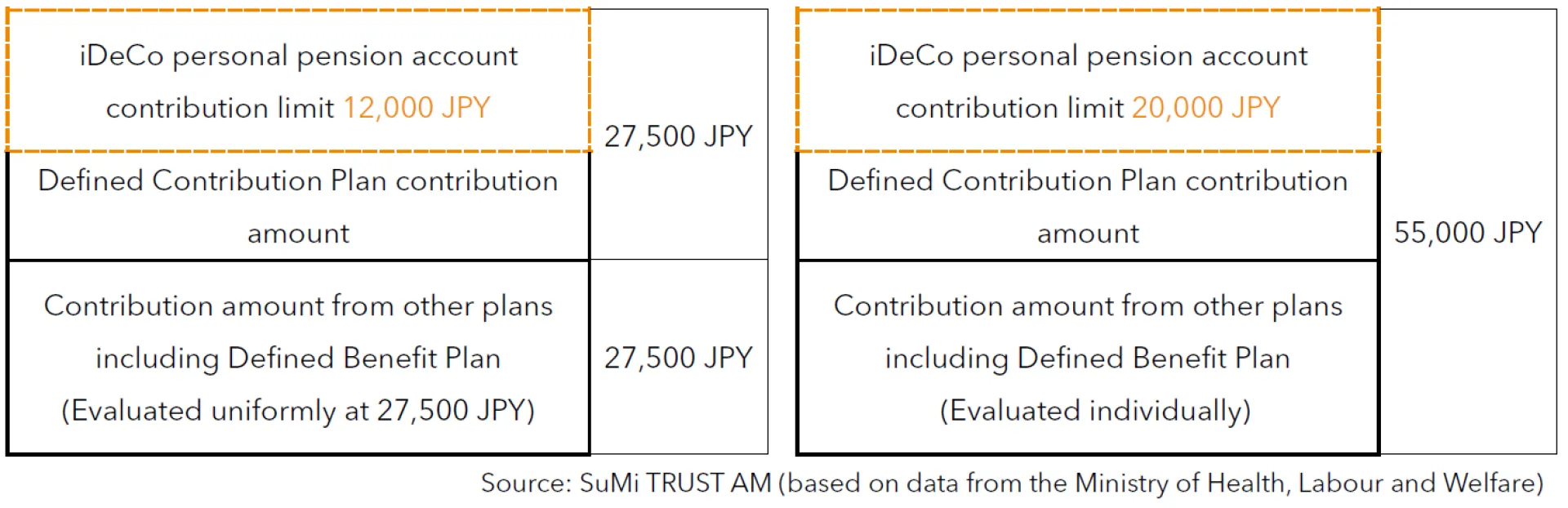

From December 2024, the iDeCo personal pension account contribution limit will be raised from 12,000 to 20,000 JPY. If combined with a pension gained through an employer, including pensions held by public servants, then compared to using a new NISA account alone the iDeCo now offers more substantial tax savings for individuals thanks to income tax reductions. This will likely increase buying demand even further.

V. Risk Factors

Risk factors include rapid fluctuations in the USD-JPY exchange rate and the potential that the incoming US administration will increase tariffs, the slowing Chinese economy, and geopolitical tension due to the ongoing conflict between Russia and Ukraine.

US president-elect Donald Trump has expressed his desire to place a blanket tariff of 10 to 20% across all imports as part of his economic policy. He has indicated he will raise taxes on Chinese goods specifically, and Japan also being a target of large tariffs would be a significant blow to Japanese companies who rely on exports.

The market is also cautious about any sudden fluctuations in the USD-JPY exchange rate which may be caused by the announcement of the BOJ’s next rate hike and the pace of US Fed’s interest rate cuts. The key to whether corporate earnings remain steady will be if the yen can maintain the assumed exchange rate of 145 yen to the dollar used by many Japanese companies in their earnings forecasts.

The risk of a slowdown in the Chinese economy causing a drop in demand will continue to be on our radar for the first half of 2025. In China, there continues to be weakness in real estate development investment and fixed assets despite the government launching a 10 trillion yuan economic package to support regional government purses. Real improvement is unlikely until efforts are made to address deep-rooted problems such as anxiety about household finances, a languishing real estate market, and the structural lack of supply and demand.

Finally, the military conflict between Russia and Ukraine is still ongoing. Tensions increased once again in November with the arrival of North Korean ground troops to support Russia and Ukraine using weapons supplied by the United States. This conflict continues to fuel high prices for oil and other resources, and continues to aggravate energy prices, which we expect will weigh on Japanese corporate earnings in the near future.

Hiroyuki joined SuMi TRUST AM in 2002 and has been Chief Strategist since October 2017.

Through over 20 years of experience working in the investment industry, he is well-versed in the investment management business and has a strong network in the industry as well as among financial authorities.

Hiroyuki’s primary focus is macroeconomy and financial market analysis. His insights based on his own analysis combined with information gathered from his broad network are widely acclaimed.

Hiroyuki is a Certified Member Analyst of the Securities Analysts Association of Japan (CMA).

Katsutoshi joined SuMi TRUST AM in February 2023, his primary focuses are market analysis and research, with a particular focus on interest rates, currencies, and fixed income markets.

Katsutoshi has about 18 years’ experience in the financial industry. Before joining SuMi TRUST AM, he was a bond strategist at Mitsubishi UFJ Morgan Stanley Securities, where he was responsible for developing fixed income portfolio management strategies.