1. Outlook for the Japanese Economy

In 2021, Japan's economic recovery was noticeably slower than that of other major economies. Until around September, personal consumption, mainly of services, was sluggish due to the multiple state of emergency declarations following the outbreak of COVID-19, and exports and capital investment were also sluggish against the backdrop of supply constraints such as a shortage of semiconductors. However, since then, with the rapid spread of vaccinations in Japan and the significant decline in COVID-19 cases, the state of emergency was fully lifted in October, and economic activities have started to normalize at a rapid pace. In Japan, the vaccination rate reached the upper 70% range showing no signs of a slow down, unlike in Europe and the U.S. Booster vaccinations for medical personnel have started in December. In addition, the introduction of a "vaccine and test package" (a framework for balancing economic activities and infection control by confirming either vaccination history or negative test results) is under consideration to ensure that economic activities are not halted even if the number of newly infected people increases.

In 2022, the Japanese economy will recover, driven by consumer spending and capital investment, especially in services, as the normalization of economic activities progresses further. Although the growth rate will gradually slow down once pent-up demand is fulfilled, the economic recovery will continue as employment and wages begin to recover. The real GDP growth rate will continue to recover steadily, at +3.0% in FY 2021 and +2.7% in FY 2022, and GDP will pick up in 2022 to surpass the pre-COVID highs. In 2021, the normalization of economic activities gained momentum mainly in Europe and the United States, which were ahead of the curve in vaccinations. Still, we believe that 2022 will be Japan's turn.

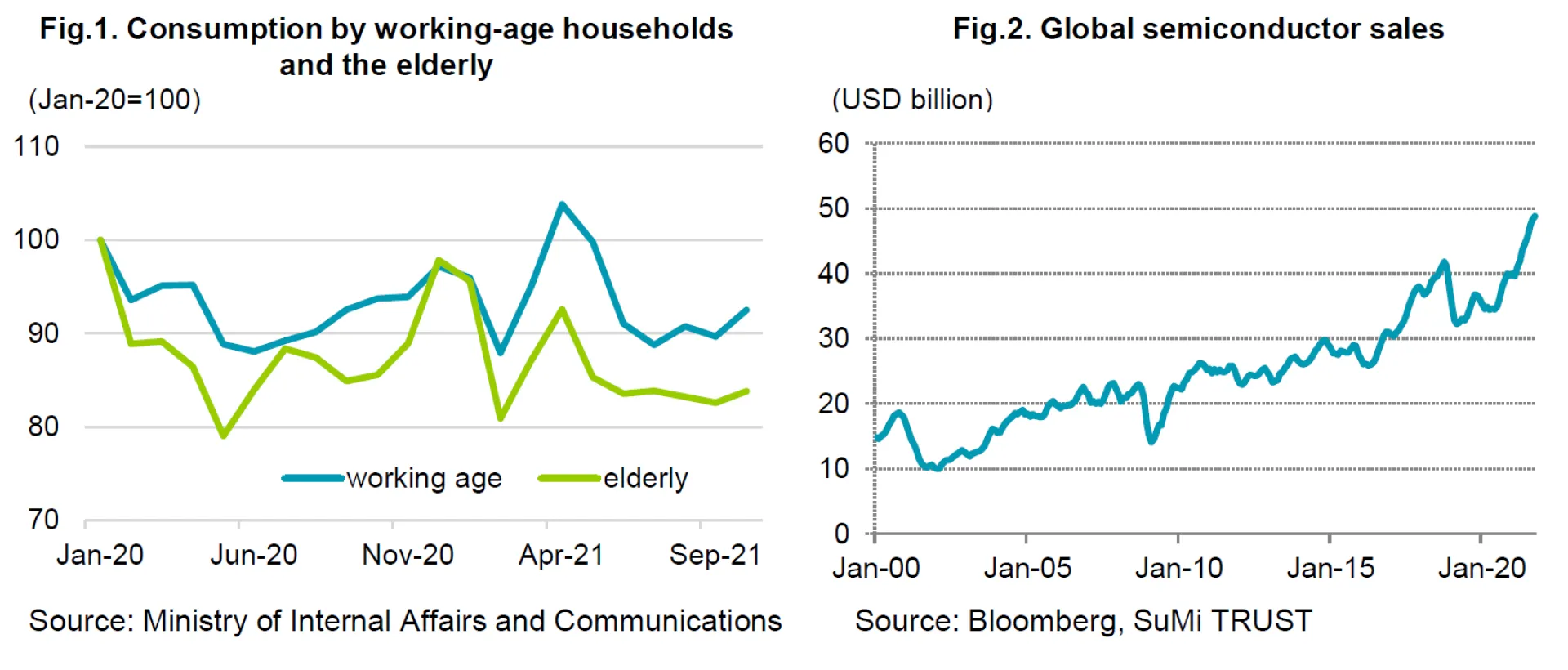

In terms of consumer spending, the fourth declaration of a state of emergency was lifted at the end of September, and this, combined with the spread of vaccines, will lead to a recovery in people going out and service consumption. In terms of consumption trends by age group, the return of working-age households has been rapid, while the return of the elderly has remained sluggish (Figure 1). This suggests that many elderly people continue to maintain a cautious attitude towards the risk of infection. The elderly are likely to have greater consumption potential in the aftermath of COVID-19 because (1) they were more restrained in their consumption due to COVID and are likely to have greater pent-up demand, (2) they have more leisure time, and (3) their net worth is relatively high. If the pandemic continues to be controlled, we can expect a recovery in service consumption led by the elderly. Although there is a strong sense of uncertainty, the normalization of economic activities through boosters and "vaccine and testing packages" will proceed, and as employment and wages begin to recover, personal consumption will continue to recover, albeit with fluctuations.

Capital investment will pick up significantly, as the progress of vaccinations has made it easier than before to forecast the normalization of economic activity. In fact, capex for FY 2021 has been higher than usual, with a year-on-year increase of 9.3%. Against the backdrop of the global economic recovery, machinery investment, especially in the manufacturing sector, is expected to pick up. In the non-manufacturing sector, although it remains difficult for the face-to-face service industry, such as restaurants and lodging, to invest aggressively, we believe that investment in the construction of logistics facilities, digitalization, and labor-saving and efficiency improvement will continue to expand against the backdrop of labor shortages.

Although supply constraints due to supply chain disruptions remain highly uncertain, we believe that they will gradually dissipate from the beginning of next year. Against the backdrop of the temporary closure of factories due to the spread of COVID in Southeast Asian countries, shortages of parts and materials were seen in the automobile industry and other manufacturing industries. However, the situation in Southeast Asian countries has improved significantly and factories have reopened. The shortage of parts and materials will gradually ease in the future (see "Inflationary Pressures in Japan").

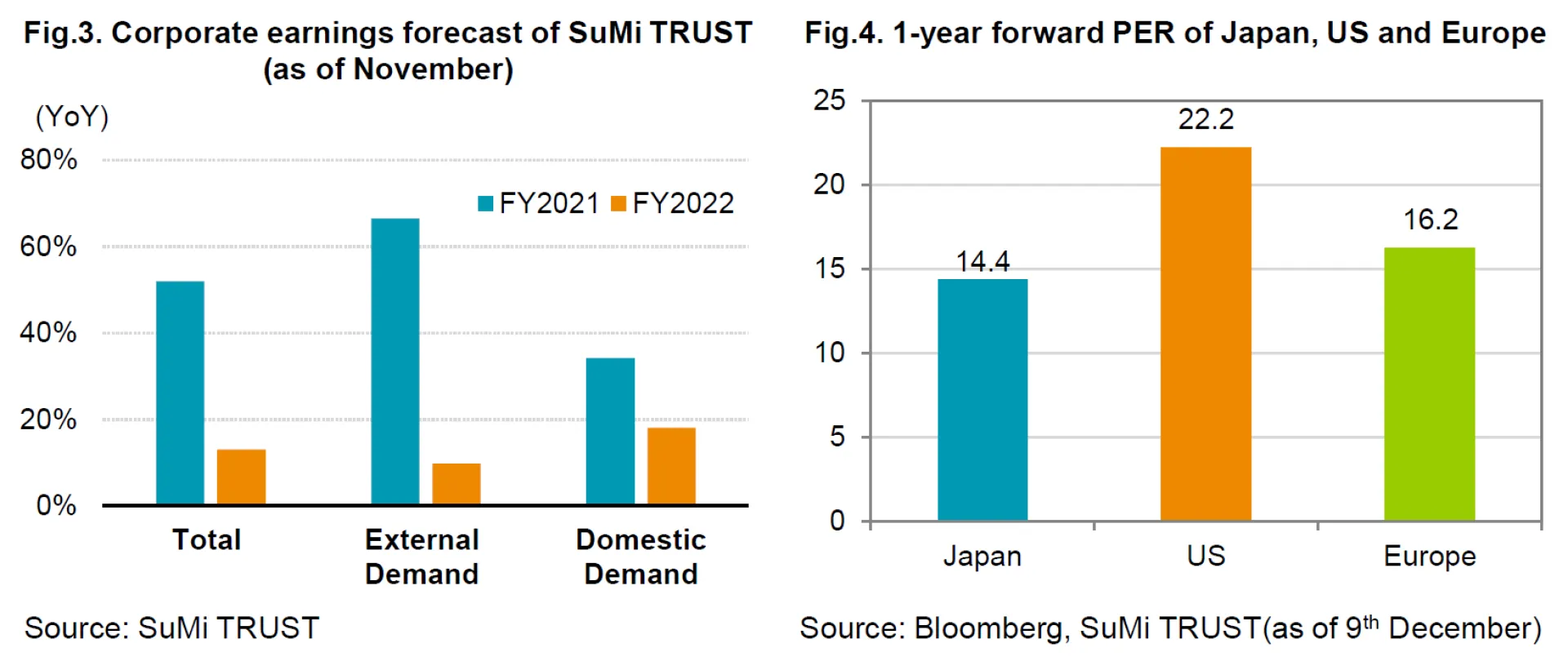

On the other hand, even if COIVD recedes globally, we believe that the semiconductor shortage will not be completely resolved. A look at global sales of semiconductors shows that there has been a strong trend before COVID, and global demand for semiconductors has been getting even stronger (Figure 2). Given that the underlying demand itself is strong, the recovery in economic activity is unlikely to be significantly disrupted by supply constraints. As global demand for digital products is expected to continue in the future, it will be necessary to invest in the expansion of semiconductor supply systems, but it is said to take several years to start a new production line for semiconductors, which are extremely precision-oriented components. While the supply constraint of semiconductors is gradually being resolved as countries actively invest in expanding their semiconductor supply systems, we should be prepared for it to take at least several years before it is completely eliminated.

2. Outlook for monetary and fiscal policies

While the effects of COVID are expected to remain for the time being, accommodative monetary policy and expansionary fiscal policy will continue under the Kishida administration. We see Prime Minister Kishida's economic policies to be similar to those of Abenomics and Suganomics of the past. With the Upper House election scheduled for the summer of 2022, we believe that the Kishida administration will adopt populist policies in order to win the election and lay the foundation for a long-term government.

With regard to monetary policy, no major changes are expected given that Governor Kuroda's term of office runs until April 2023. We expect the Bank of Japan to continue with its current accommodative monetary policy while the Fed and other major foreign central banks take steps to normalize their monetary policies.

Fiscal policy is likely to remain on an expansionary path for the time being. On November 19th, the Kishida cabinet approved a record fiscal stimulus package of JPY 55.7 trillion, which is roughly equivalent to USD 500 billion. In addition to initiatives against COVID-19 and support for the resumption of socioeconomic activities, other measures include growth strategies, distribution policies, and promotion of a national resilience plan. Specifically, the measures include the resumption of the “Go to Travel” travel support program, the development of digital infrastructure in rural areas, research and development in advanced science and technology, attracting Taiwanese foundry giant, TSMC, and other advanced semiconductor production bases to Japan, and the provision of JPY 100,000, about USD 900, to children under the age of 18 with a limitation of parents’ income. The government will also provide tax incentives to companies that raise wages, offer up to JPY 2.5 million to small and medium-sized companies whose sales have decreased by 50% or more compared to pre-COVID levels, and raise wages by 1-3% for nurses, elderly care and childcare workers. Although the government estimates that these measures will boost GDP by about 5.6%, they will probably only have the effect of boosting GDP by a little more than 1% in FY 2022 due to the generally distributive nature of these measures and the lack of policies to boost demand.

As a source of funds for his economic stimulus measures, Prime Minister Kishida had advocated raising taxes on financial income by the wealthy, but had decided to forgo this idea due to opposition. For the time being, funding is expected to be provided by the issuance of government bonds. With the Bank of Japan's purchases of government bonds, this is unlikely to lead to a rise in interest rates.

3. Japan market outlook

In 2022, Japan's stock market will maintain an upward trend as economic activity is expected to normalize in earnest amid continued accommodative monetary by the BOJ and expansionary fiscal policies. We expect corporate earnings of Nikkei 225 constituent stocks to grow by 52.0% YoY in FY 2021, a significant recovery from the record drop in FY 2020 due to COVID, and to grow steadily by 13.0% YoY in FY 2022. In FY 2021, we saw a recovery in earnings led by foreign demand-related stocks, but in FY 2022, we expect domestic demand-related stocks to lead the way as domestic economic activity normalizes (Figure 3). Many companies have improved their balance sheets by cutting unnecessary fixed costs as a result of the COVID, and we expect a number of them to post record profits in FY 2022. In terms of valuations, Japanese stocks lag behind European and U.S. stocks, with 1-year forward PER of 14.4 times, and given that they are expected to continue to perform well, we believe that they are undervalued (Figure 4). In fact, as of December 2021, the total amount of share buybacks by companies for the fiscal year is approaching the record high set in FY 2019, indicating that management believes that the outlook for corporate earnings is favourable and that the stock price is undervalued. By the end of next year, we expect the Nikkei 225 to rise to 33,000 and the TOPIX to 2,200.

In 2022, we expect economic resumption-related stocks to outperform as economic activity normalizes. On the other hand, given that not everything will return to the way it was before COVID, such as telecommuting taking root in society as a result of COVID, the degree of normalization of economic activity will vary by industry. While it is difficult to envision a return to pre-COVID levels for railways and restaurants on weekdays (e.g. izakaya bars) due to the wide spread of telecommuting, there should be significant room for recovery in the leisure, amusement, and domestic travel-related sectors, which are mainly driven by holiday and senior demand. The resumption of the "Go to Travel" travel support program is also likely to benefit these industries. We are also bullish on the cosmetics industry (see "Normalization of Economic Activity after the State of Emergency")

Aside from stocks benefiting from resumed economic activity, we are bullish on the IT sector. COVID has made it clear that Japan lags in digitalization, and companies have increased investment in IT to improve their competitiveness. Orders received by information service companies have reached record highs. This is being seen not only among large corporations but also among small and medium-sized enterprises. In addition to corporations, we can also expect to see increased IT investment in the public sector, including government, healthcare, and education, as they promote digitalization.

4. Risk factors

Finally, risk factors would include an outbreak of a highly virulent new COVID variant, as well as higher energy prices and supply constraints due to supply chain disruptions.

But our main scenario is that the global trend of normalization of economic activities will accelerate with the spread of vaccines and orally administered drugs. However, until more information on the Omicron strain is available, we will not be able to make any predictions. The number of people infected with the Omicron strain is increasing in the U.S. and Europe, and we need to pay close attention to the risk that global economic recovery will be set back by the outbreak of the Omicron strain.

In addition, high energy prices are a concern for Japan, which is highly dependent on fossil fuels such as crude oil. Due to seasonal factors, energy prices are likely to remain high throughout the winter. In the past, Japanese companies have been hesitant to pass on higher costs to consumers in an environment of moderate upward pressure on wages. Even in the same industry, there is likely to be a large disparity in future earnings depending on how companies respond to rising costs, and we will be watching closely the response by each company.

Supply constraints due to supply chain disruptions will also need to be monitored closely. The global shortage of semiconductors and disruptions in global supply chains are putting downward pressure on production and exports in the automobile and other manufacturing industries. Although the main scenario is that these supply constraints will gradually dissipate from the beginning of 2022, there is a strong sense of uncertainty as to whether they will be resolved smoothly (see "Inflationary Pressures in Japan").