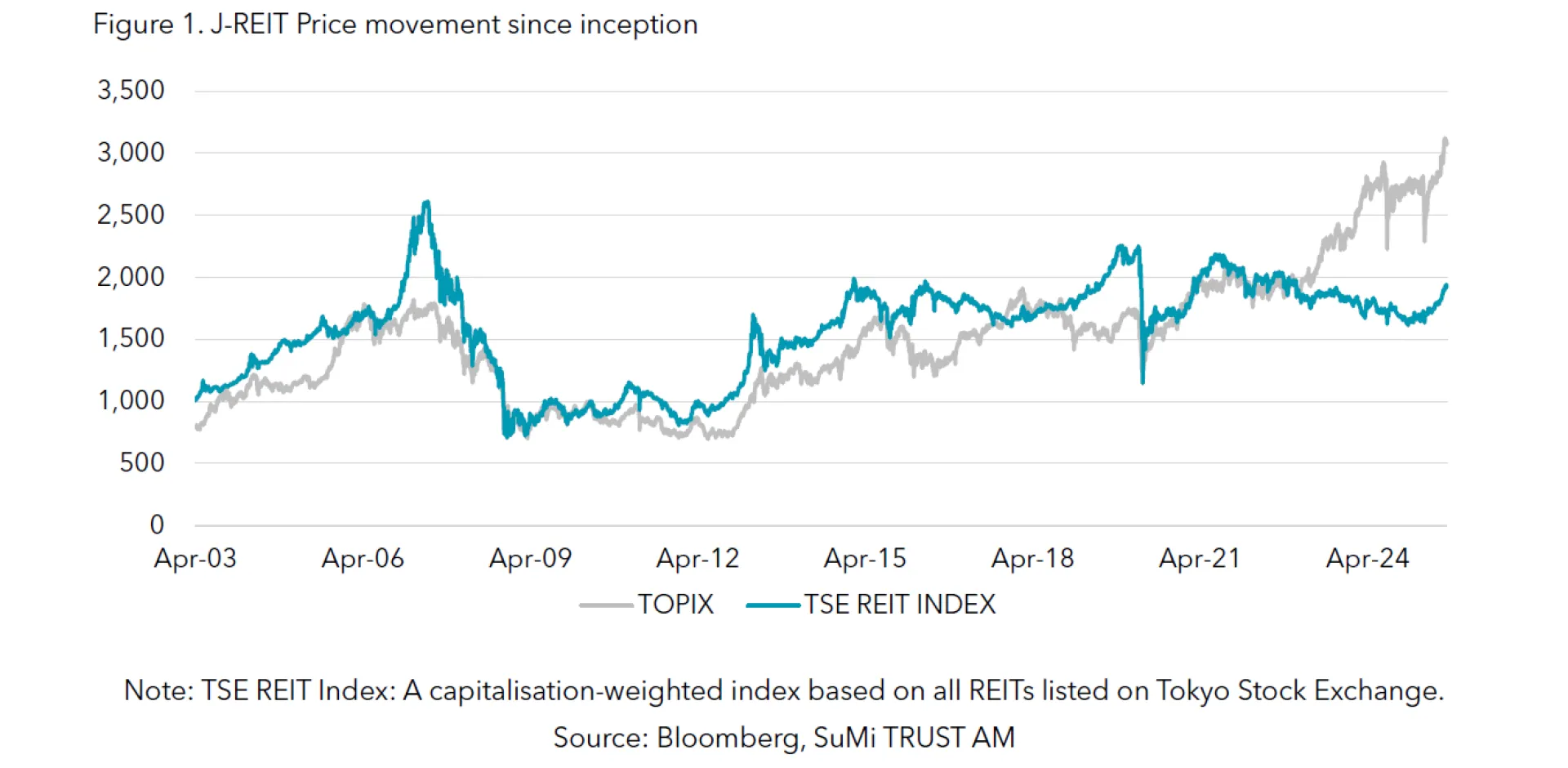

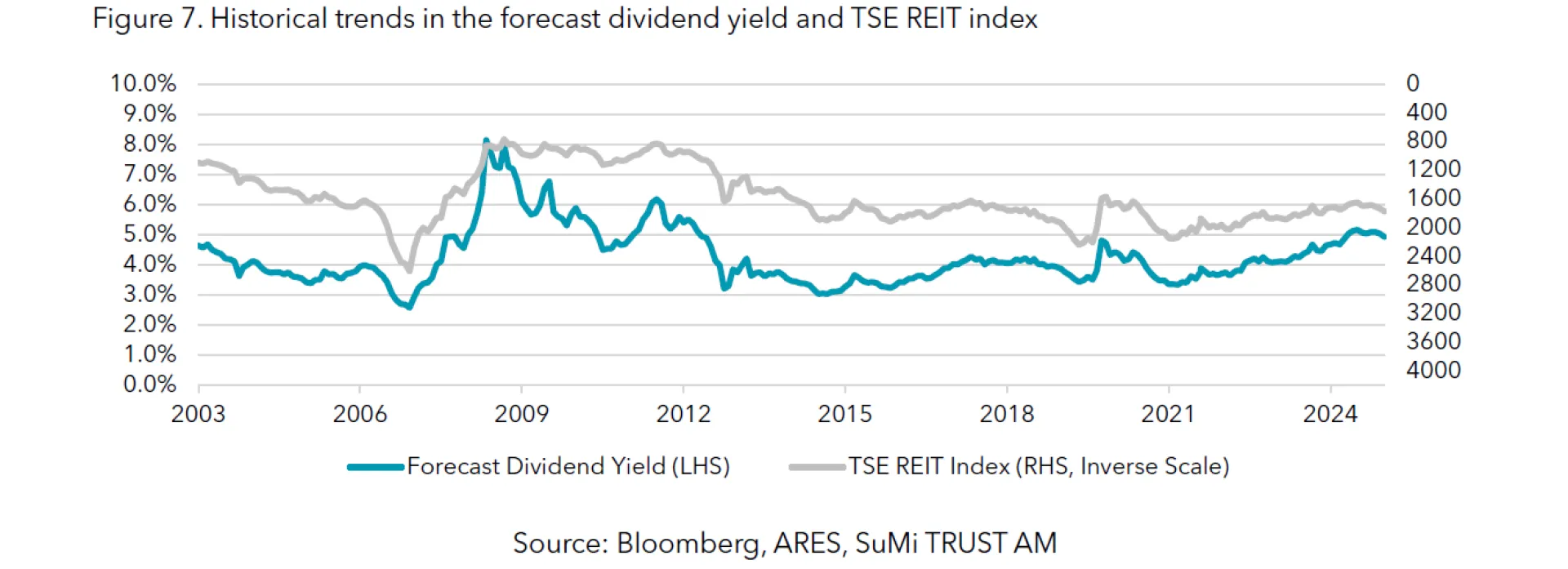

After tumbling and rapidly recovering following the pandemic, the market was rangebound for three and a half years. Various factors contributed to this downward pressure on J-REIT prices, but here I would like to touch on the interest rate and supply/demand elements.

The global rise in interest rates has diminished the relative appeal of REITs compared to government bonds and similar instruments. In mid-2021, the J-REIT market started experiencing short-term overheating, leading to profit-taking, and the global REIT market was hit hard when the Federal Reserve began a series of significant interest rate hikes in March 2022. Additionally, the Bank of Japan's decision to begin a series of interest rate hikes in March 2024 added further pressure.

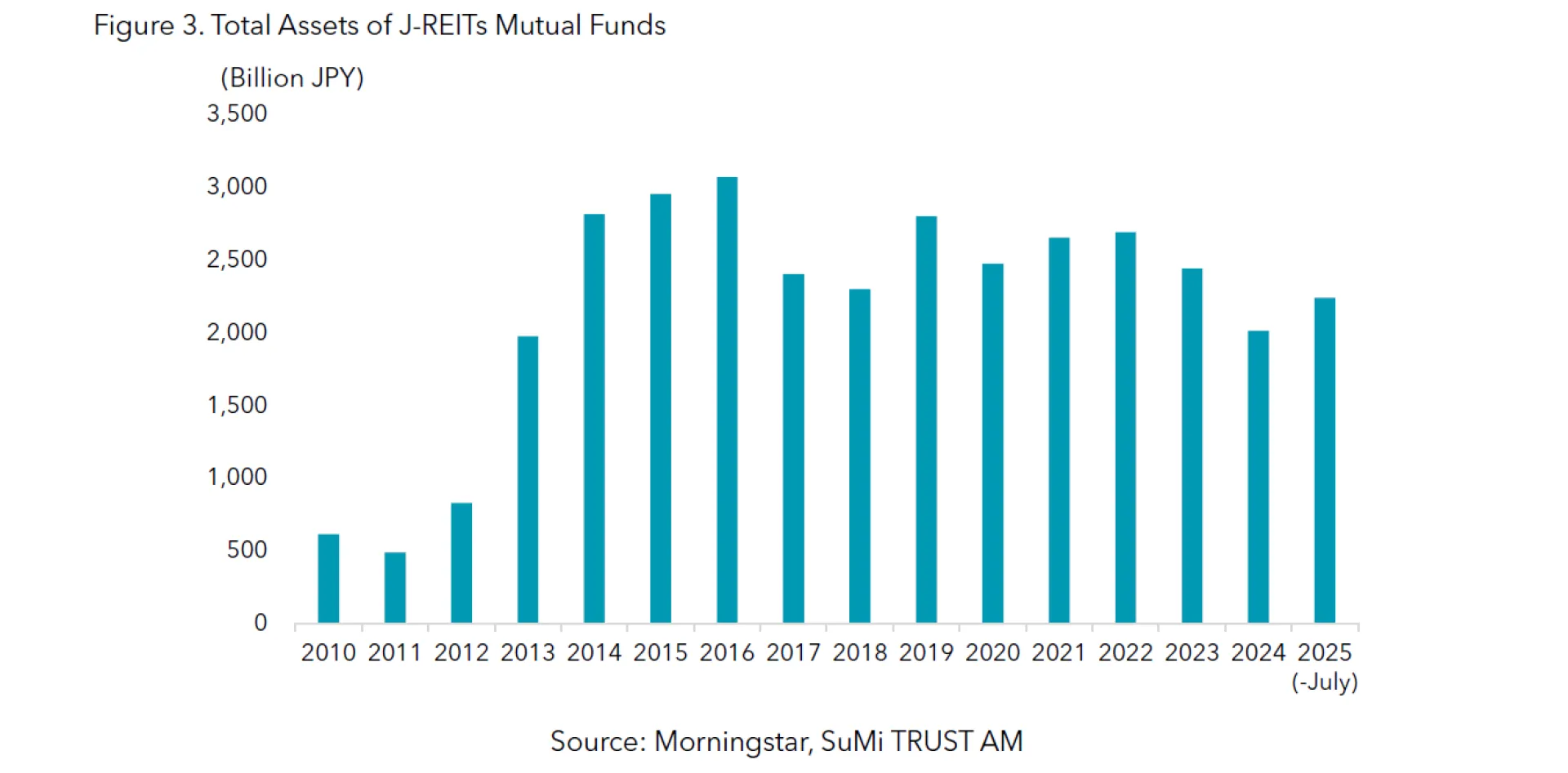

On the supply and demand side, retail investors investing via mutual funds sold their J-REIT holdings due to unfavourable treatment from the new NISA tax-free investment scheme introduced in 2024. Under the old scheme retail investors preferred a monthly distribution-type mutual fund falling under the NISA growth investment scheme; however, these have been excluded from the new scheme. In other words, removing the tax-exempt status of the vehicle of choice for retail investors in a country with significant household savings has been a headwind for J-REITs. However, these adverse catalysts are gradually waning, as will be discussed later.

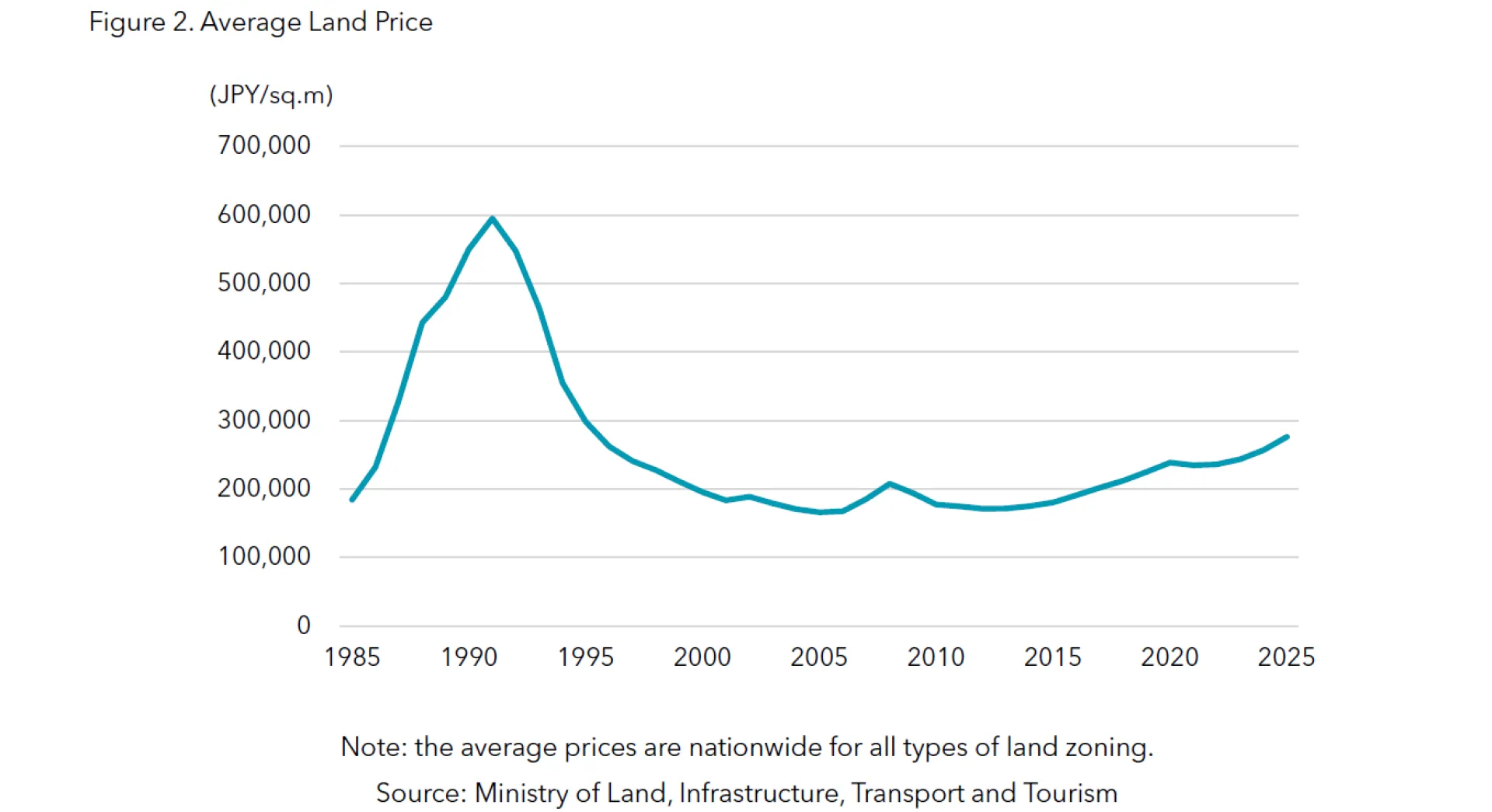

Stable Japanese real estate market

Meanwhile, the Japanese real estate market underlying J-REITs has remained robust. Let's examine the situation in the order of offices, residential properties, and hotels.

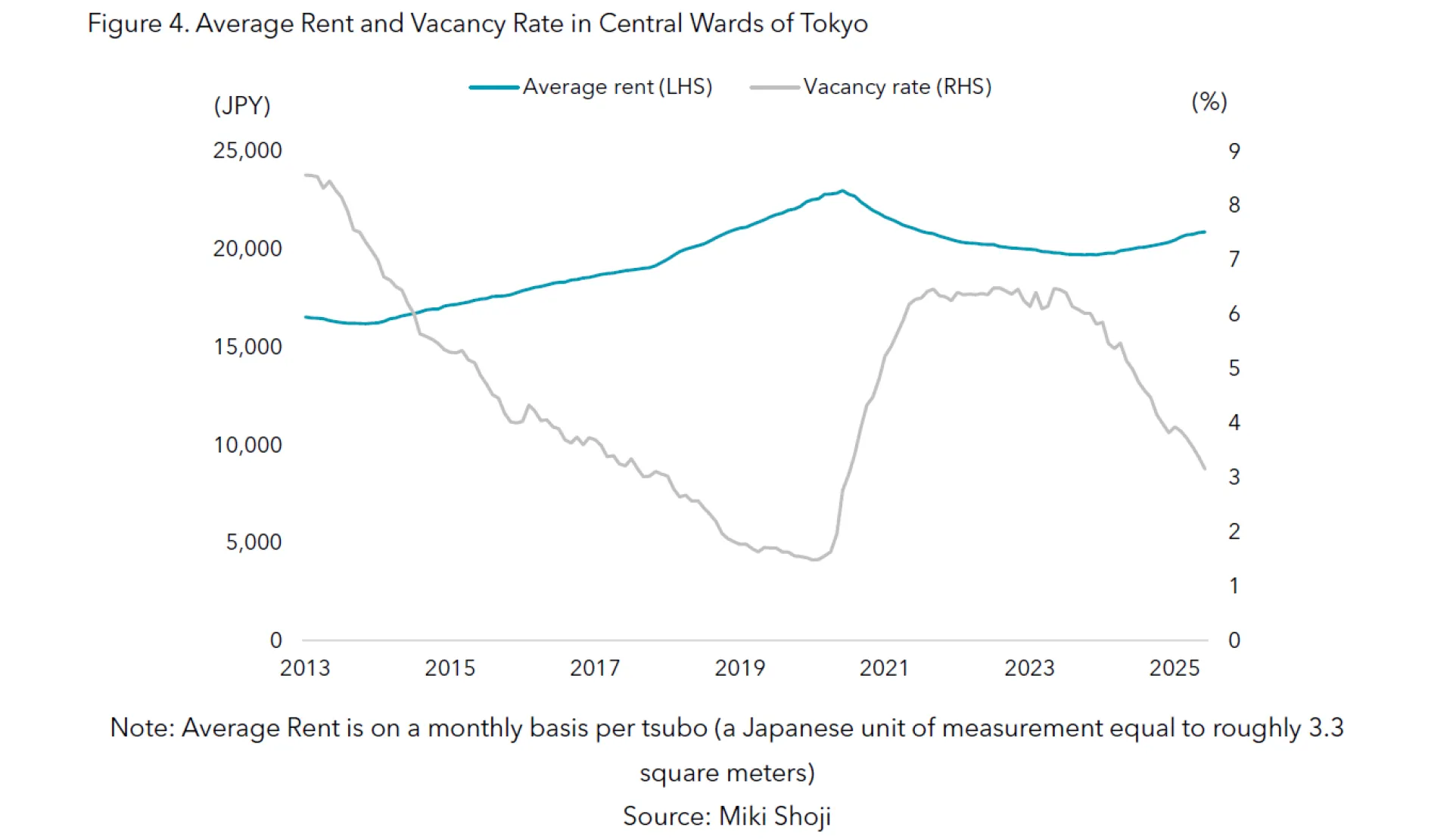

The main investment target for J-REITs has been the office market. Although hybrid work styles have become common in Japan since the pandemic, demand for prime real estate remains strong. Vacancy rates rose sharply for a time but began to decline in central Tokyo from mid-2023 onwards. As a result, office rent prices have been on an upward trend since last year. There have always been concerns about the large supply of new office buildings, but these concerns are beginning to ease. This is due to delays in many building projects caused by labour shortages in the construction industry. Construction costs are also rising year by year, making it necessary to set higher rents for newly finished buildings. Not all offices can command higher rents, but J-REITs own many commercial properties in the Tokyo city centre. We can expect office rents to rise gradually in the future.

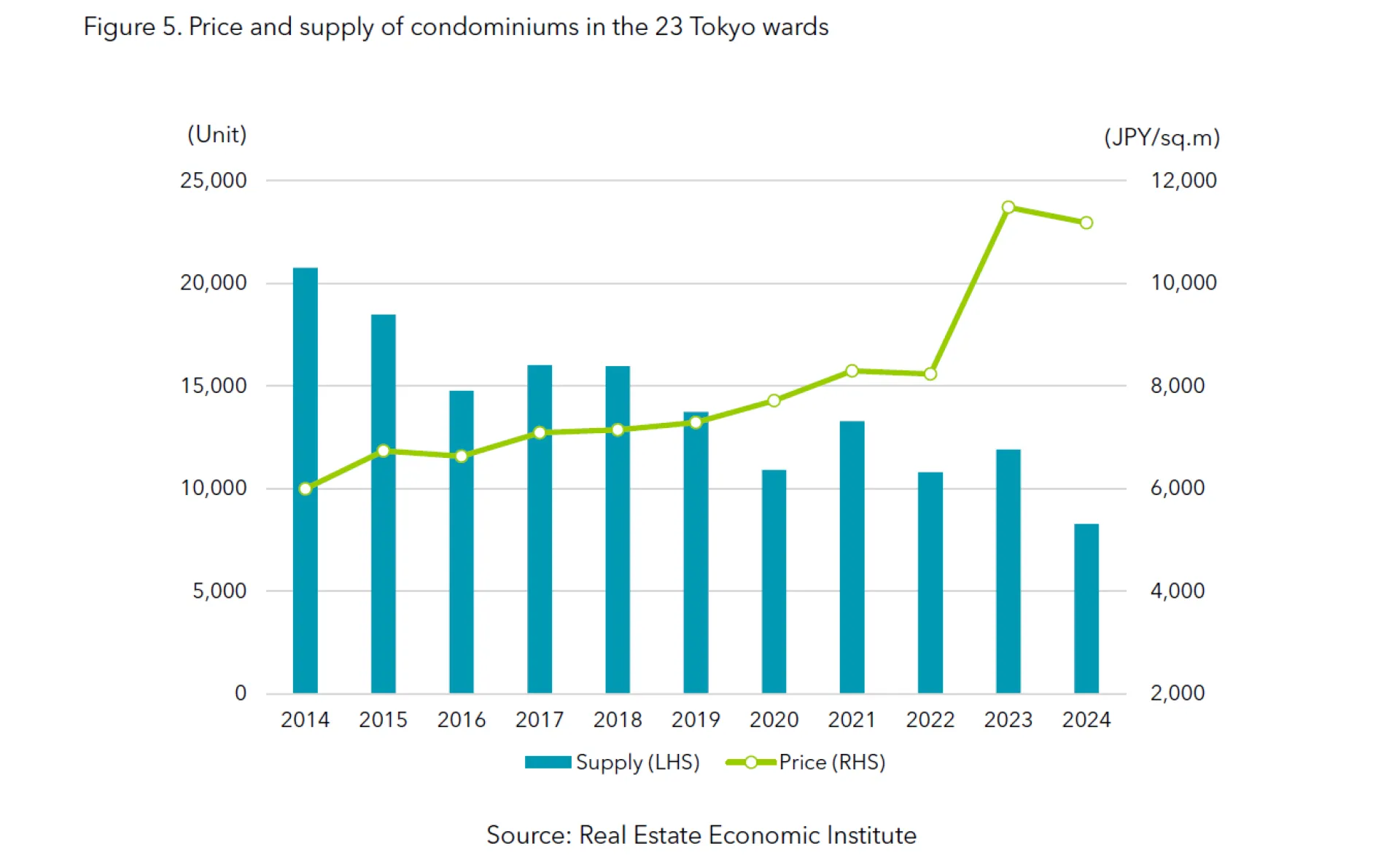

Next is the residential market. Japanese condominiums are seeing rising price trends due to a structural decline in supply. In Tokyo's 23 wards, the number of new condo units for sale has dropped to half of what it was a decade ago. Previously, factories and warehouses that had closed due to corporate restructuring were converted into condominiums. Now, such land releases have largely subsided, and suitable sites for homes are scarce in central areas. Those hesitant to purchase high-priced units are forced to opt for rental housing. Rental rates for condominiums are now beginning to rise gradually, benefiting residential REITs.

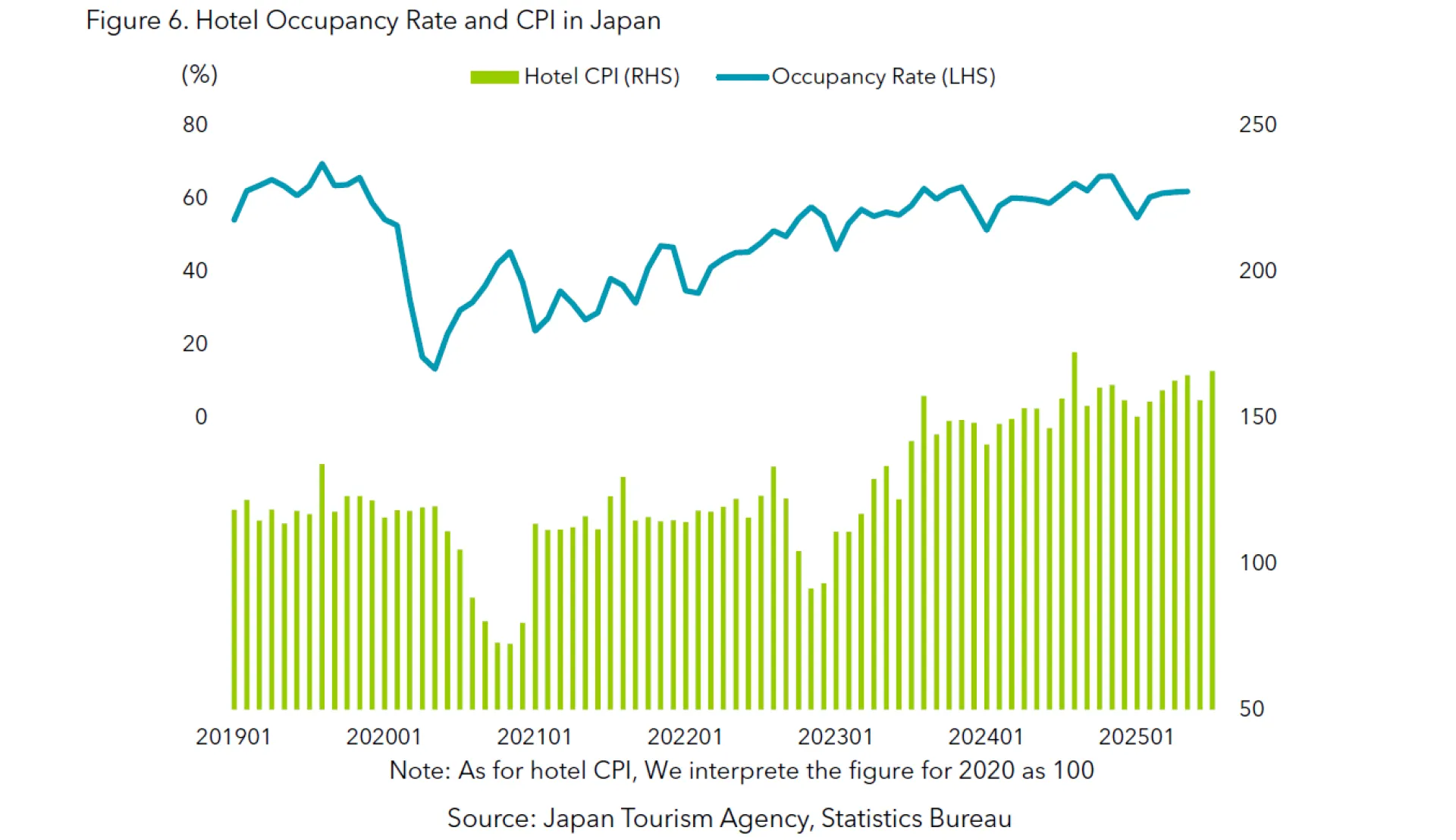

Lastly, I will introduce the hotel market, which has been growing in recent years. The number of foreign tourists visiting Japan exceeded pre-pandemic levels last year, reaching 36.9 million. With the length of stay also increasing, hotel occupancy rates are tightening, and hotel room rates are on an upward trend. The government has set a target of raising the number of foreign visitors to 60 million by 2030, and steady demand is expected in the medium term.

Outlook for the J-REIT market

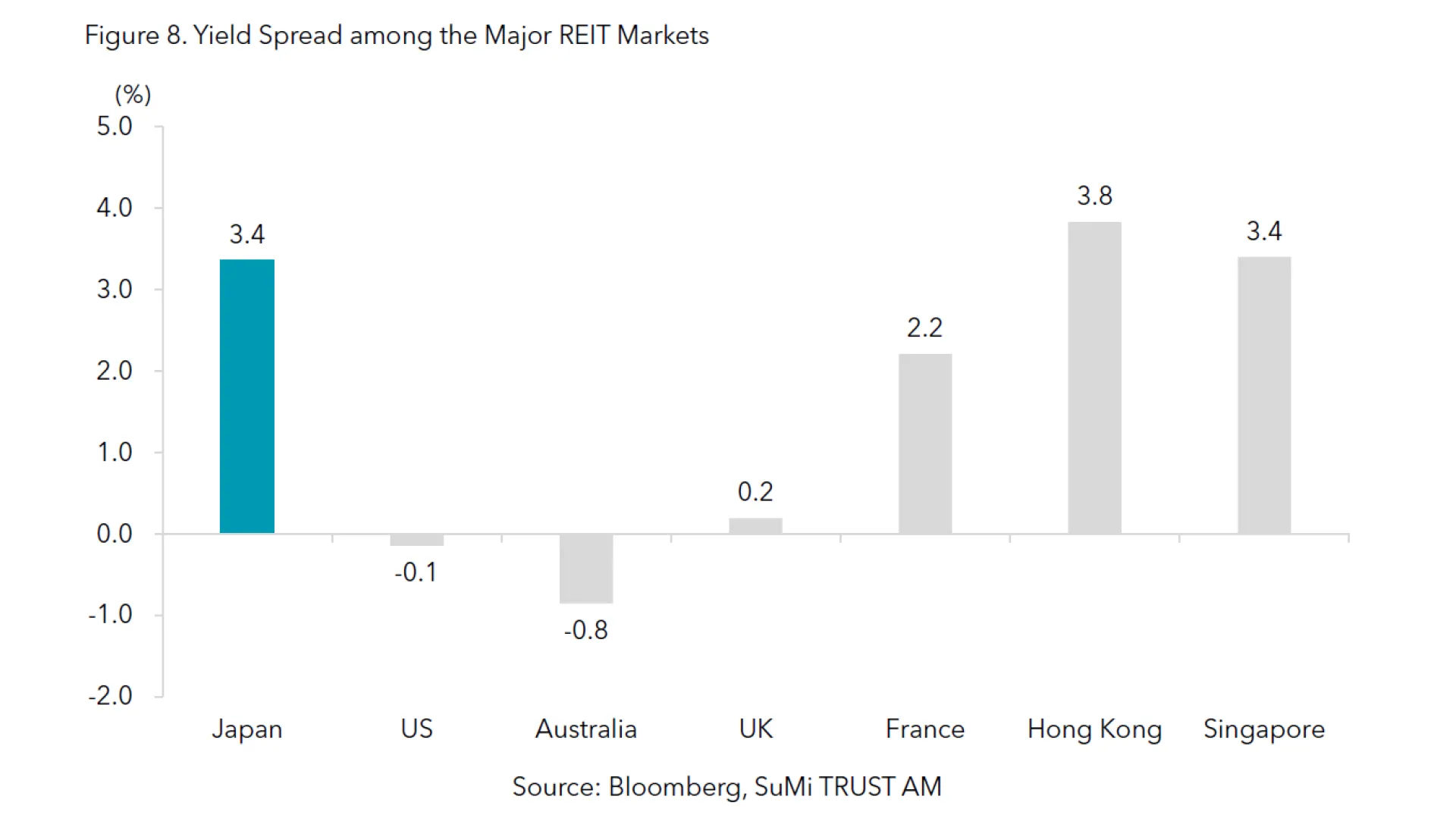

While the Japanese real estate market remains robust, J-REITs have been historically undervalued. The forecast REIT dividend yield remains in the 4% range, and the yield gap, calculated by subtracting the long-term interest rate from the dividend yield, stands at around 3%. This level remains attractive from an international perspective.

Interest rate and supply-demand factors that have been weighing on J-REITs until last year are gradually easing. The Federal Reserve began cutting interest rates in September 2024, and the prevailing view is that the Bank of Japan will only increase rates twice more indicating that actual impact on the property market is extremely limited.

In terms of supply and demand, there are signs that the downtrend in J-REITs has run its course, including retail investors becoming net buyers of J-REITs in May for the first time in eleven months. This trend continued in June. Meanwhile, the Liberal Democratic Party's Asset Management and Investment Promotion Council, chaired by former Prime Minister Fumio Kishida, has proposed establishing another new NISA scheme for the elderly and adding a monthly distribution-type vehicle to its investment options eligible for tax exemption. In response, the Financial Services Agency is considering introducing the plan in 2026. If implemented, this would contribute positively to supply and demand dynamics. Although they had been major buyers of J-REITs, foreign investors were net sellers last year, largely due to the exclusion of several J-REITs from the MSCI Japan Index. However, for the 2025 calendar year until July foreign investors' net trading position has turned slightly positive.

In response to sluggish stock prices, governance reforms for J-REITs have also begun. Many J-REIT managers have announced higher dividends and have set annual growth targets of 2% or more, indicating an awareness of the need to outperform the Bank of Japan's inflation target. These developments are prompting investors to reconsider the appeal of J-REITs.

We believe that J-REITs have already begun to enter a recovery phase, supported by the resilience of the real estate market, the undervaluation of J-REITs, and diminishing downside risks. Considering the uncertain investment environment characterised by rapidly changing U.S. foreign policy and geopolitical risks, global investors may be reaching a point where they should seriously consider investing in J-REITs, which offer stable and high dividend yields.