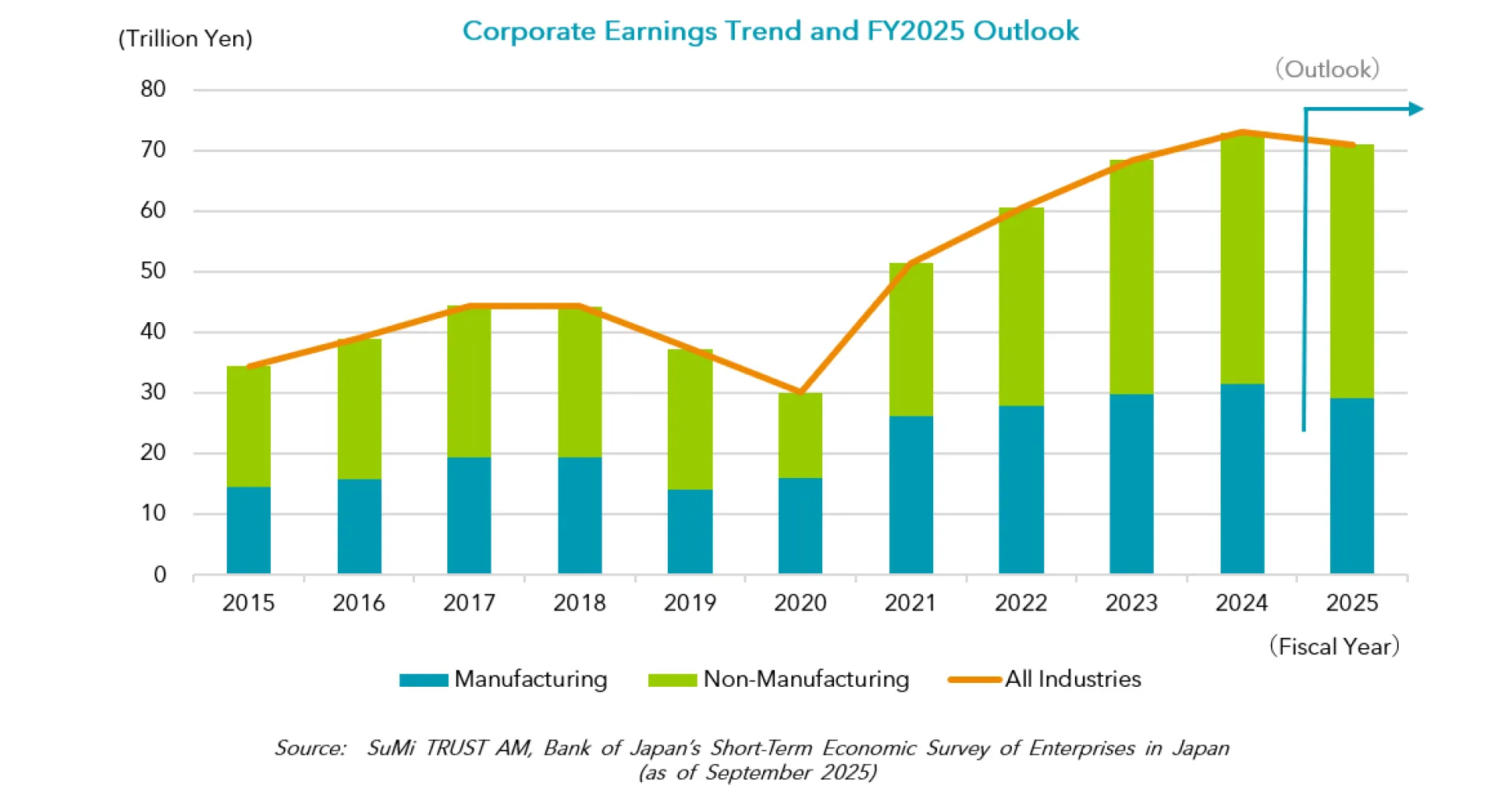

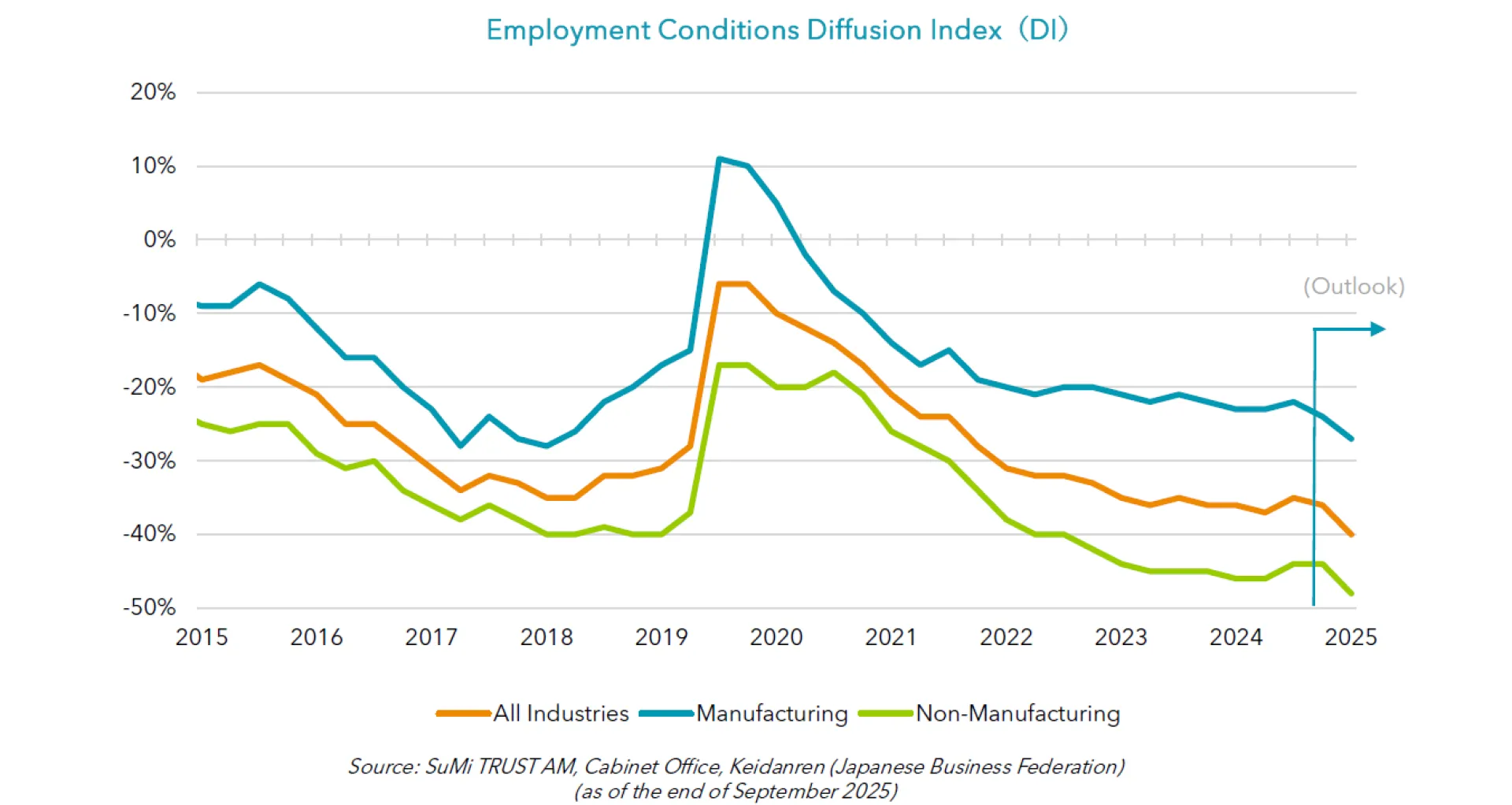

Strong corporate profits are likely to result in significant wage hikes in the 2026 spring wage negotiations. We believe that as price pressures on food products such as rice ease and consumer inflation settles, real wages will rise, and individual consumption should gradually pick up. Government policies, such as reducing gasoline taxes, will also further support household spending.

In terms of capital investment, demand for labour-saving technologies is increasing as Japanese companies face severe labour shortages. Additionally, demand for research and development investment in growth fields such as AI and decarbonisation initiatives remains strong. Provided that corporate profits remain at elevated levels, we expect capital investment to remain firm in the first half of 2026, particularly in these sectors.

Regarding external demand, exports are expected to slow as overseas economies face downward pressure following the introduction of tariffs by the United States - including the U.S. itself. However, growing global demand for AI-related products is likely to provide some support for Japanese companies, especially for exports of electronic components and semiconductors.

II. Monetary Policy Outlook

We anticipate attention to centre on whether the Bank of Japan proceeds with additional rate hikes. Persistently high inflation, clarity emerging on US-Japan tariff negotiations, and ongoing corporate wage increases have created a more favourable environment for tightening monetary policy. However, with the inauguration of the Takaichi administration, seen as supportive of continued monetary easing, some market participants believe the Bank of Japan will take a more measured approach on rate hikes.

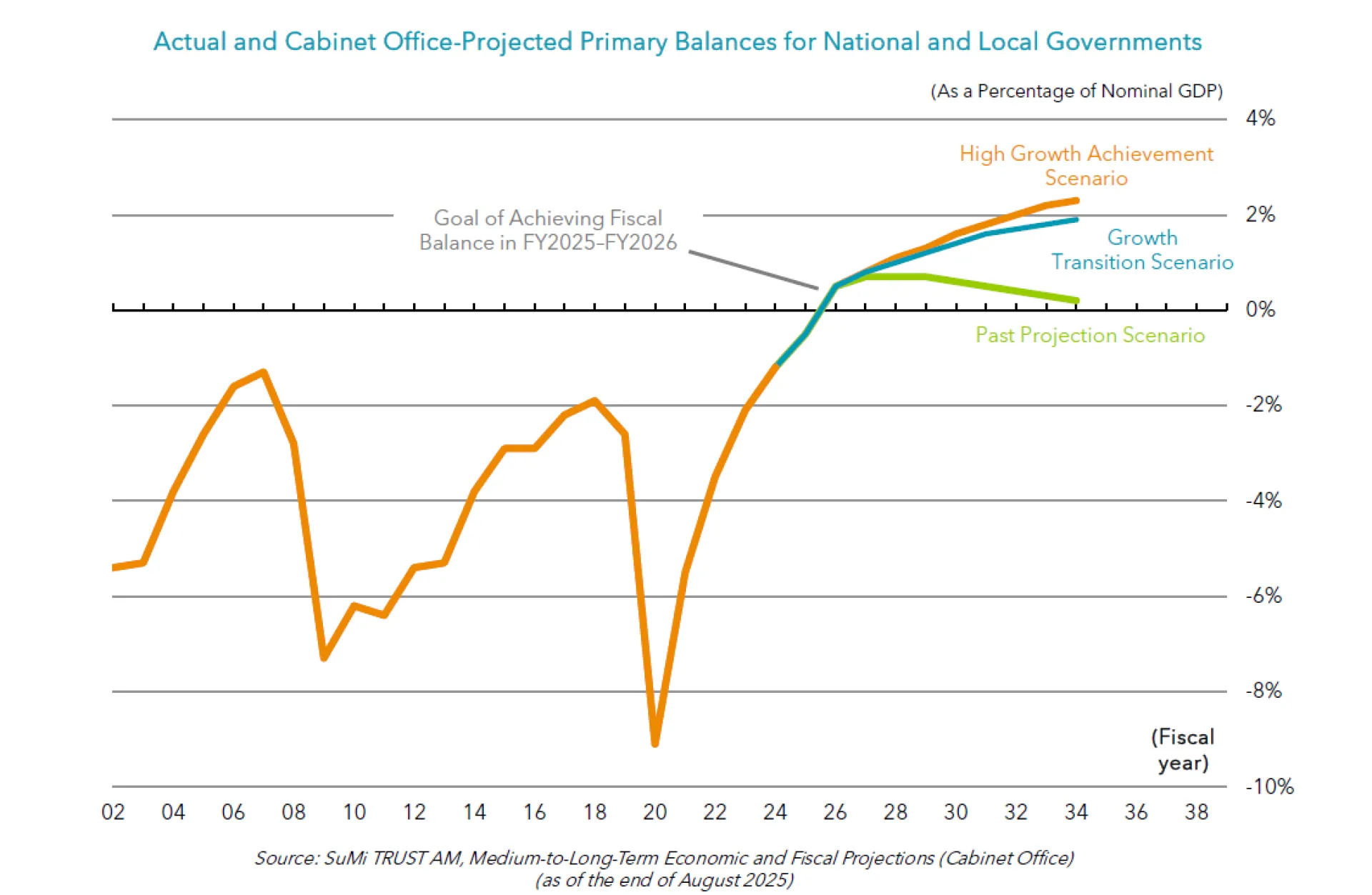

We expect the yield on 10-year Japanese government bonds to remain within a range of 1.25% to 2.00% during the first half of 2026. Under the Takaichi administration’s commitment to “responsible proactive fiscal policy”, the target of achieving a primary balance surplus by fiscal years 2025–2026 has effectively been postponed. This expansionary fiscal stance is likely to exert upward pressure on long-term interest rates. At the same time, the Ministry of Finance is considering introducing a framework for periodic mid-year reviews of the government bond issuance plan beginning in fiscal 2026. If implemented, this greater flexibility could serve as a stabilising measure for the super-long-term bond market.

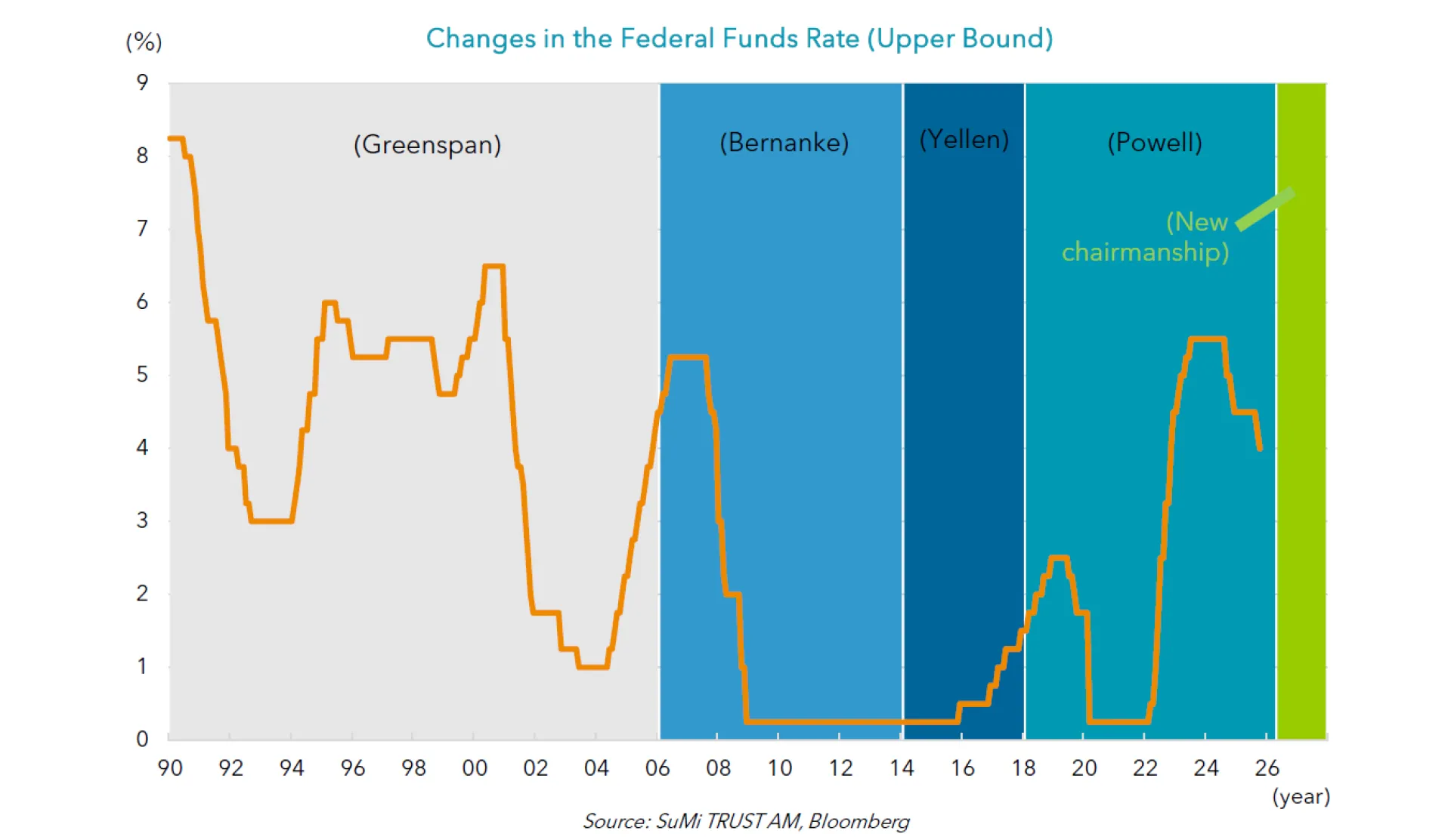

We expect the yield on 10-year U.S. Treasury bonds to range between 3.50% and 4.25% in the first half of 2026. In November, the U.S. Treasury announced that it has begun reviewing the possibility of increasing issuance of medium- and ultra-long-term securities, drawing attention to the eventual size of these issuances. Another critical factor will be the Federal Reserve’s monetary policy stance given the scheduled departure of its chair in May.

III. Japanese Equity Market Outlook

With the TOPIX rising more than 20% in 2025 as of mid-November, caution over elevated valuations is emerging in Japan’s stock market. In particular, AI-related stocks may face short-term pressure amid concerns about sentiment-driven investment in the U.S. On the other hand, the negative impact of U.S. tariff policies has not materialised significantly in the fiscal 2025 interim results, and exporters have benefited from a weaker than expected yen. Furthermore, the backdrop for Japanese equities has shifted markedly, driven by the Takaichi administration’s emphasis on growth strategies, and the end of Japan’s long-standing deflationary environment, both acting as supportive factors for equity prices.

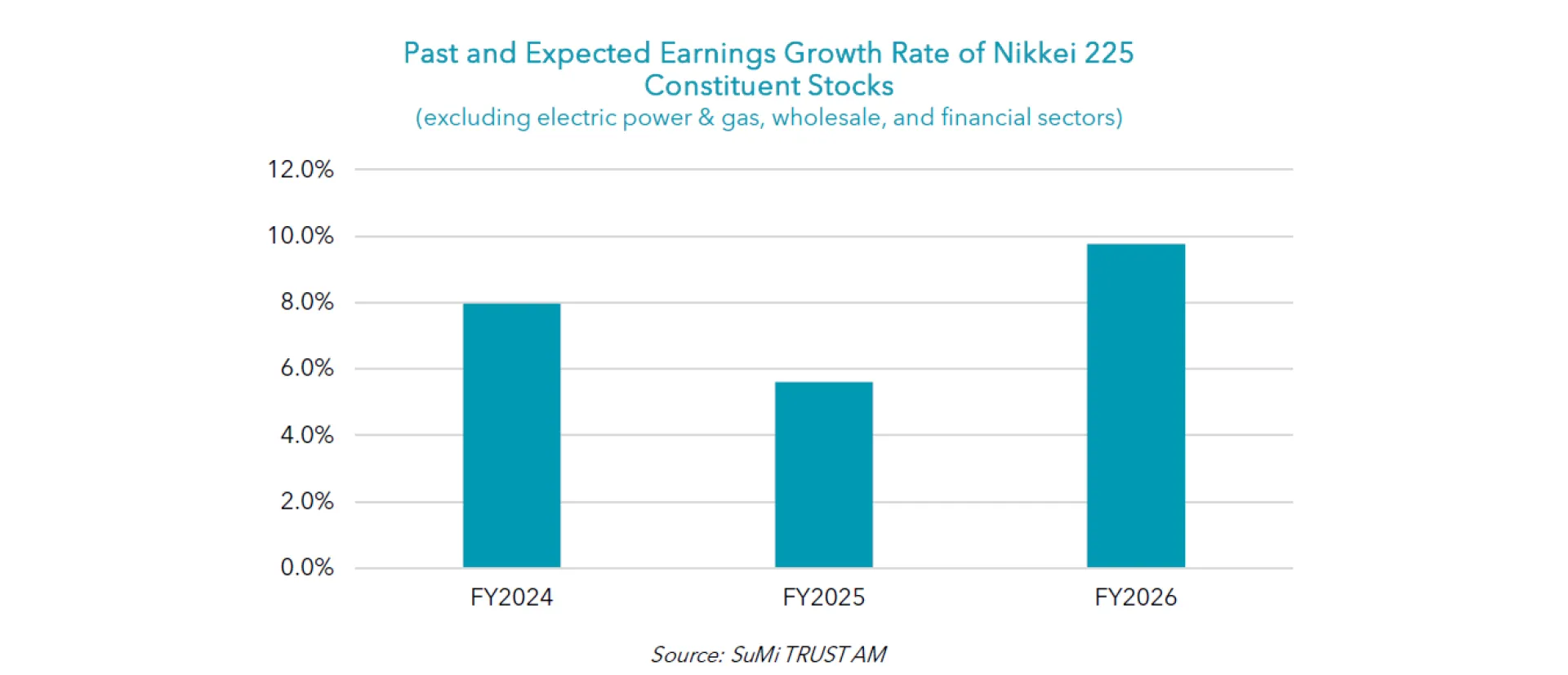

For the April–September 2025 period, a significant number of companies posted earnings above consensus estimates and also raised their full-year guidance. Sector-wise, upward revisions were not only notable among exporters such as automakers, electronics, and nonferrous metals, as well as AI-related firms, but also among domestic demand-driven industries including construction, railways, and services. Increased domestic demand coupled with labour shortages have had a positive impact on earnings. In sectors such as construction - where contractors previously had weak bargaining power and faced difficulty raising prices – there has been a clear reversal in the balance of power between clients and contractors, enabling firms to secure higher margins. We expect Nikkei 225 constituent stocks to deliver nearly 10% profit growth in fiscal year 2026.

In addition, the Tokyo Stock Exchange’s market reforms have prompted companies to place greater emphasis on capital efficiency. Share buybacks by firms with strong earnings or substantial surplus funds have continued, helping improve supply-demand dynamics in the equity market. Provided that corporate performance does not deteriorate in the second half, we anticipate additional buybacks.

The Takaichi administration has replaced the previous “Council for Realising New Capitalism” with the “Japan Growth Strategy Council.” The new framework emphasises policies centered on growth, promoting strategic public-private investments to drive economic expansion. Although policy implementation remains uncertain due to the administration’s minority government status, it enjoys record high approval ratings. Should the government’s policies gain momentum under strong public support, they are likely to act as a positive driver for equity markets.

Meanwhile, the initiative to establish Japan as an “asset management nation,” carried over from the Kishida administration, will continue, and we expect further enhancement of corporate governance to be one of the key pillars of next year’s policy agenda.

The projected range for the Nikkei 225 in the first half of 2026 is JPY 47,000 to JPY 55,000.

IV. FX Outlook

We expect U.S. monetary policy trends to play a pivotal role in FX trends. Chair Powell’s term at the Federal Reserve ends in May 2026, and markets will closely monitor his successor’s stance, particularly regarding the likelihood and pace of further rate cuts. Domestically, a Bank of Japan rate hike could serve as a catalyst for yen buying, but a sustained trade deficit and lingering concerns over fiscal policy under the Takaichi administration are likely to keep downward pressure on the currency. We believe the dollar-yen exchange rate will trade within the ¥135–¥155 range by the end of June 2026.

V. Risk Factors

A key risk lies in the potential for corporate earnings to fall short of expectations, as uncertainty surrounding U.S. tariff policy remains high, and a global slowdown could trigger a sharp drop in exports and erode overseas-related income. While a weaker yen helps to boost exports, it also adds pressure on corporate profits through higher import prices and rising costs. Should earnings decline more than anticipated, momentum for capital spending and wage hikes could falter. Moreover, expansionary fiscal policy may push long-term interest rates higher, increasing funding costs and prompting companies to adopt a more cautious investment stance. On the consumer side, while food prices are expected to stabilise, unexpected factors such as adverse weather or volatile commodity markets could prolong inflationary pressures, dampening household spending.

The latter half of 2025 saw a sharp rise in equity prices, with the Nikkei hitting record highs. This surge was underpinned by strong expectations for corporate earnings driven by global AI-related demand, alongside optimism over the new administration’s economic policies emphasising proactive fiscal measures. Looking ahead, we expect robust fundamentals and genuine AI-related demand to support a continued upward trend in stock prices over the medium to long term. However, in the short term, the rapid gains fueled by expectations may lead to a temporary correction. Going forward, it will be important to take a longer-term perspective in assessing whether corporate performance and planned policies meet expectations.