1. Recent Market Movements

Since the beginning of December 2021, value stocks have outperformed and growth stocks have been sold off significantly in the Japanese stock market. A breakdown of the index shows that small-cap growth stocks have heavily sold off, in line with global markets. Before we look at the background to this, let's look at the market's movements and colours from last year. I would also like to look at the relative position of the Japanese stock market compared to the US.

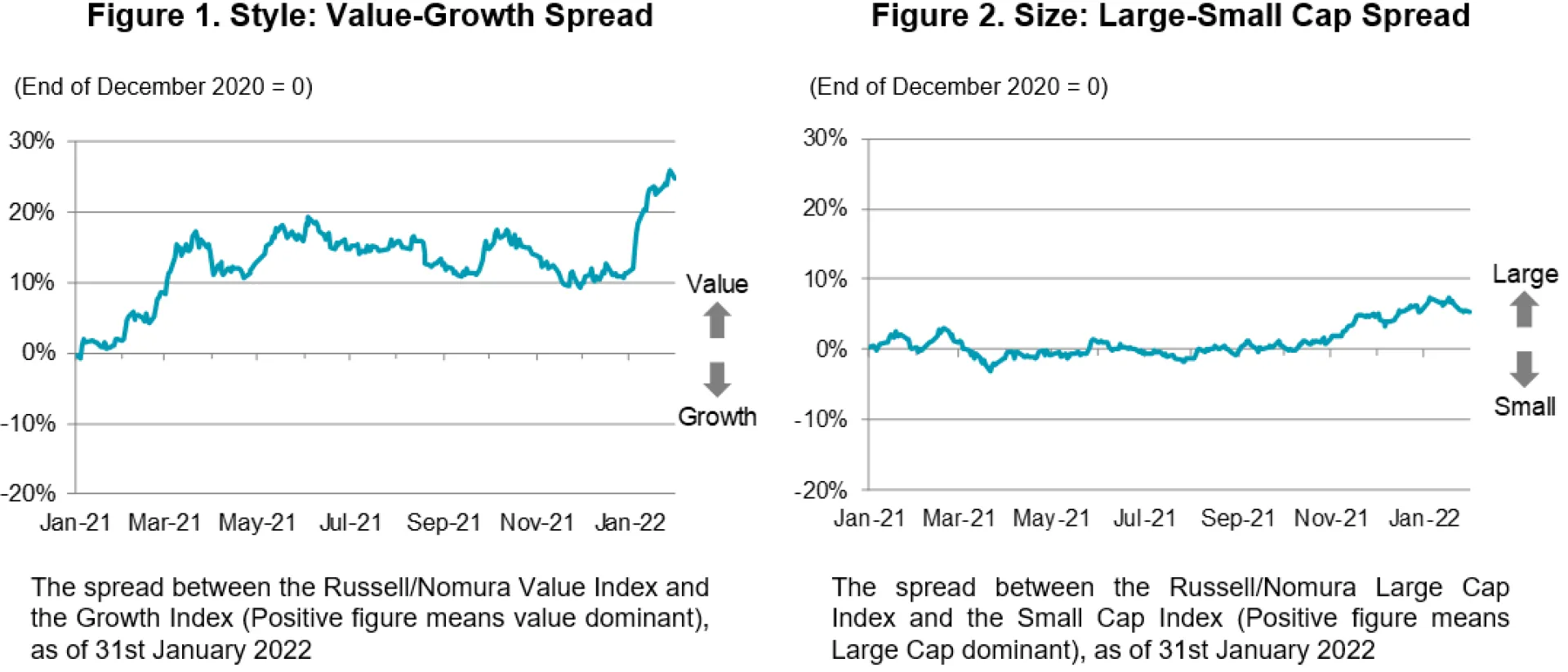

Figure 1 shows the spread return between the Russell/Nomura Value Index and the Russell/Nomura Growth Index. In 2021, a large value reversal occurred in the first quarter. This was due to a reversal of the strong growth market of the previous year, amid expectations of the normalisation of the economy after the pandemic. After an absence of significant trends since the second quarter, a strong value outperformance began in December 2021. This was mainly due to rising interest rates in the US, based on expectations of monetary tightening. Figure 2 shows the spread return between the Russell/Nomura Large Cap and Russell/Nomura Small Cap Index. There was no significant trend in terms of size in 2021, but large-cap stocks have gradually outperformed since the fourth quarter of 2021.

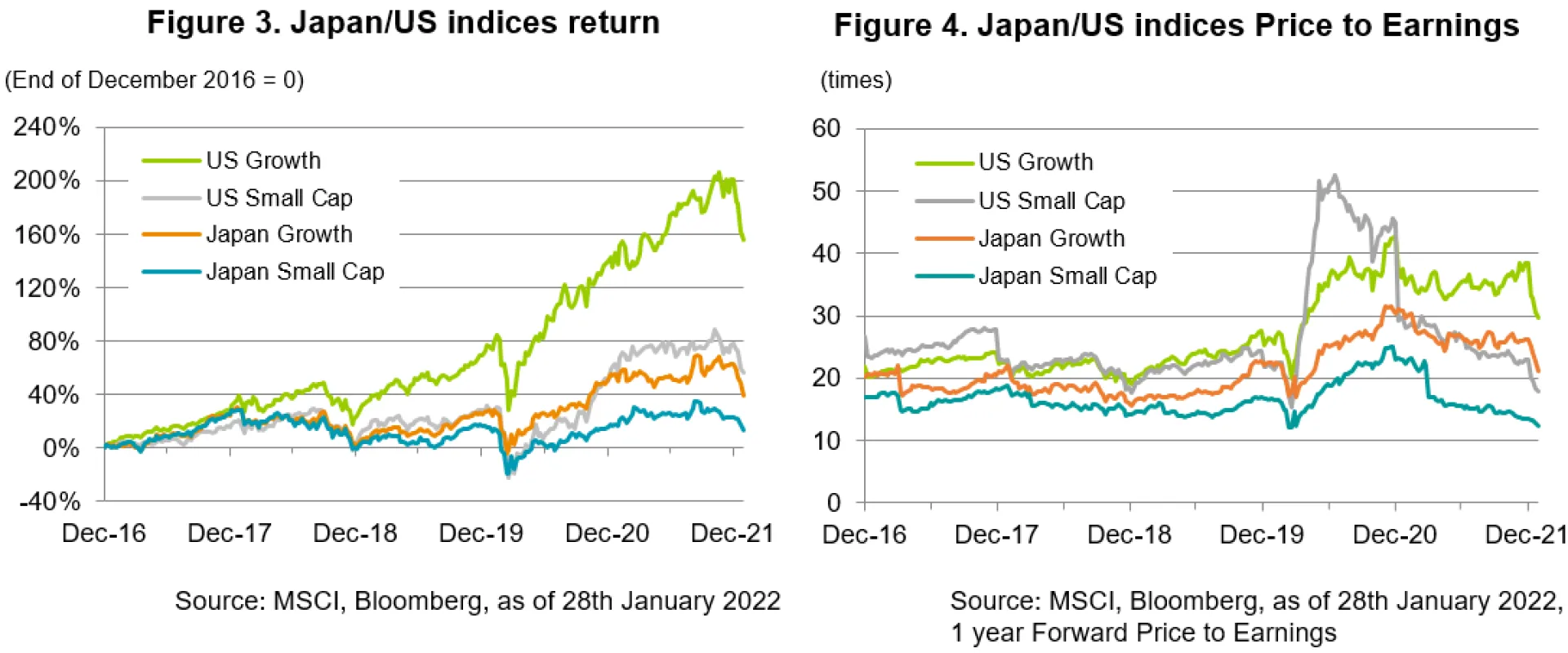

Figure 3 shows the five-year returns of the US and Japanese growth and small-cap indices. It can be seen that the US index has risen significantly over the past five years on the back of relatively high earnings growth, and that a correction is now underway. Japanese stocks, on the other hand, have not risen as much and have already corrected to some extent. A comparison of valuations (Figure 4) also shows that the Japanese growth and small-cap indices are less overheated than their US counterparts and have already corrected to near their five-year average.

2. Mr Marui’s View on the Japanese Small Cap Market

We asked Mr Marui, Chief Portfolio Manager of the Japan Small Cap Strategy, about the outlook for the small cap market.

How do you see the recent sell-off in the markets?

Since early December, the Japanese equity market has been in a situation where value stocks have outperformed and growth stocks have been heavily sold. The biggest factor has been the impact of the global sell-off in hyper growth stocks due to rising US interest rates. In addition, there were 32 IPOs in Japan in December, which had a negative impact on the supply and demand balance of stocks particularly for retail investors. Looking at the small-cap growth stocks, which have been sold the most, there has been no deterioration in earnings revisions; the share price decline has simply been caused by valuation corrections. In terms of capital flows, although I obviously don't know everything perfectly, there may have been some redemptions in other companies' Japanese small and mid-cap funds. I do think that some of the all-cap managers who had shifted to small-caps are moving their money back into large-caps, and I would say that even in the small-caps there is money coming into value stocks. Retail investors play a large part in the small-cap market and many of them are margin traders in Japan, so I think they are facing margin calls and are being forced to sell their stocks as the market falls.

How do you see the market moving ahead?

There were a number of times in the past when markets fell and growth stocks collapsed in the short term, such as the Livedoor-scandal in 2006 when investors’ confidence in the small cap market was lost due to a case of accounting fraud at Livedoor, a rising star company; the global financial crisis in 2008 and the period when trade tensions between the US and China heated up in recent years. But I feel this time there has been a more rapid shift than during those periods. As the shift has occurred so rapidly, I think growth stocks will settle down at some point and rebound, but I don‘t have the sense that their valuation will revert to what they were before the sell-off. This is because I do not believe the situation will return to what it was in the past, when the excess money from monetary easing went into hyper growth stocks. Some smaller companies will be forced to rethink their growth strategies as they will no longer be able to raise funds easily by leveraging their high valuation.

Even if the growth stocks are on the rebound, value stocks may continue to be favoured by the market for a while (possibly in 2022). However, if the rise in interest rates does not turn out to be a bad one, or if interest rates rise moderately while the economy recovers, I think growth stocks and small and mid-cap stocks will eventually be bought, rather than value stocks alone. I believe the market will then become less binary between value and growth and favour companies that are able to change and grow their earnings, regardless of whether they are value or growth stocks.

How do you plan to manage your portfolio going forward?

There is no top-down shift to value in the portfolio in response to the current market environment. We do not believe that a market where only value is being bought will last for long, but it may take some time for growth stocks to be bought again. In the meantime, we believe that the fundamentals at the company level remain sound and that solid corporate earnings growth can be expected. Rather than being swayed by short-term market movements, we will continue to look for small-cap stocks that have the potential to grow with their own drivers over the medium to long term.

How do you plan to select stocks going forward?

My view remains the same: new technologies and services will change business practices and social structure over the next few years. The change was accelerated by the pandemic, and I do not anticipate a reversal of this trend. I think we are going to see more companies across a wide range of sectors that are not just providers of new technology, but also companies that can use that technology to successfully transform their own businesses and services. In the former case, there are still many companies which are providing new technology and services in my research coverage including IPO and pre-IPO names, and this area will remain one of my focuses. With regard to the latter, once the COVID situation has settled down, I believe companies using new technology to transform themselves will emerge in a wider range of industries, so I will be researching from a broad perspective and will continue to invest in stocks regardless of which sector they belong to or whether they are value or growth stocks.

Another trend I am watching is the new Prime Minister Kishida's advocacy of New Capitalism, which is changing the axis of corporate evaluation from shareholder capitalism to stakeholder capitalism. Japanese companies have always managed their businesses in a stakeholder-oriented manner, so the impact of this change will not be significant in Japan. However, I believe companies will enhance non-financial information disclosure such as ESG information, which will become important for corporate analysis, and I would like to make effective use of this information in my stock selection. I have been evaluating non-financial information qualitatively within the framework of corporate analysis, and I believe that continuing to do so will enable me to discover many investment opportunities.