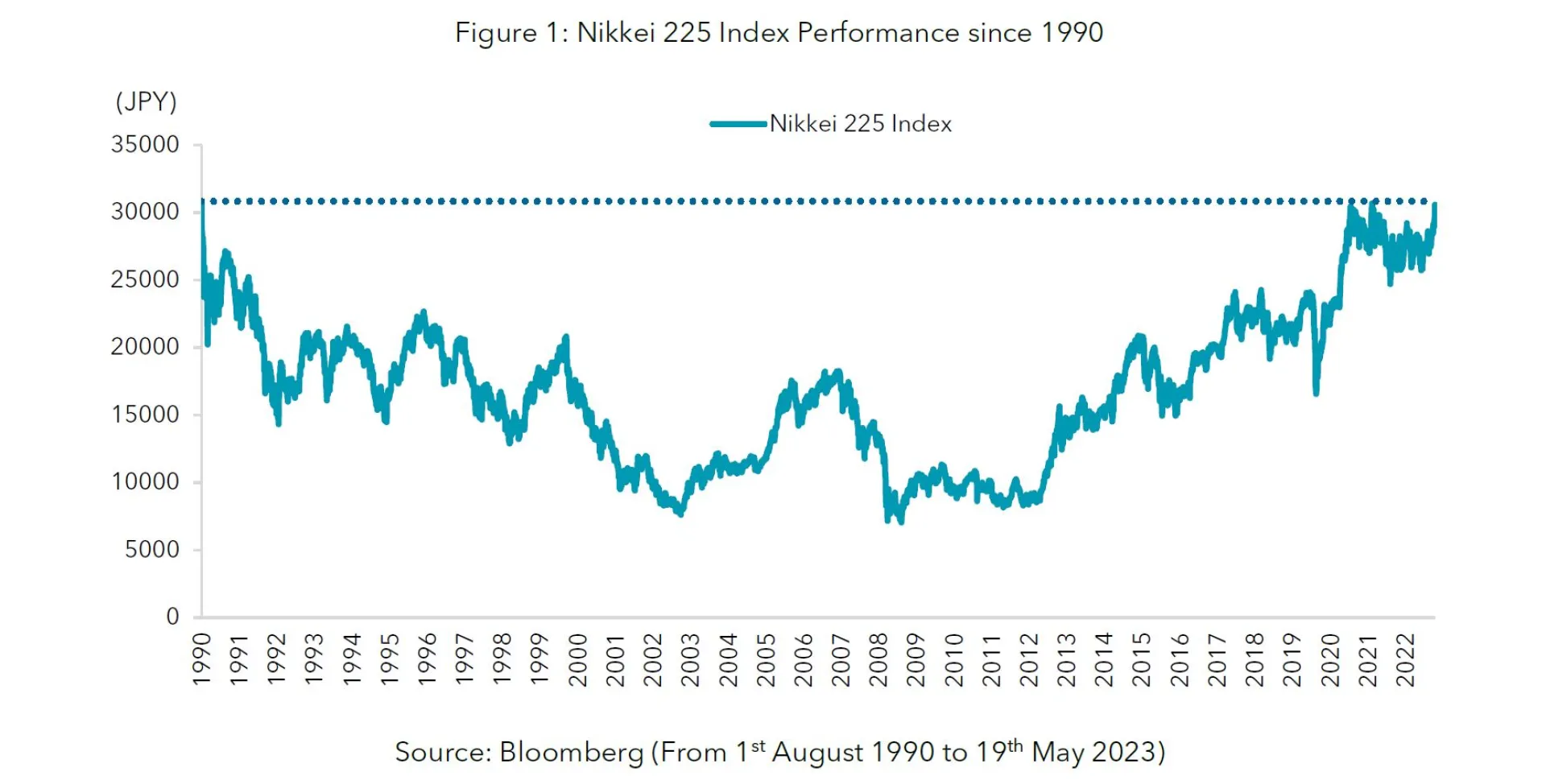

Japan’s Nikkei 225 index recently reached its highest level since August 1990 on the back of foreign buying and locally driven corporate governance improvements. As such investors’ views on Japanese equities have been changing. In this article, we would like to introduce the three reasons the Nikkei 225 index has jumped up recently.

1. Tokyo Stock Exchange (TSE) urges companies to improve capital efficiency, gradually attracting the interest of foreign investors

- TSE encourages listed companies to raise awareness of their capital cost as well as share prices and promote their efforts for sustainable corporate value enhancement.

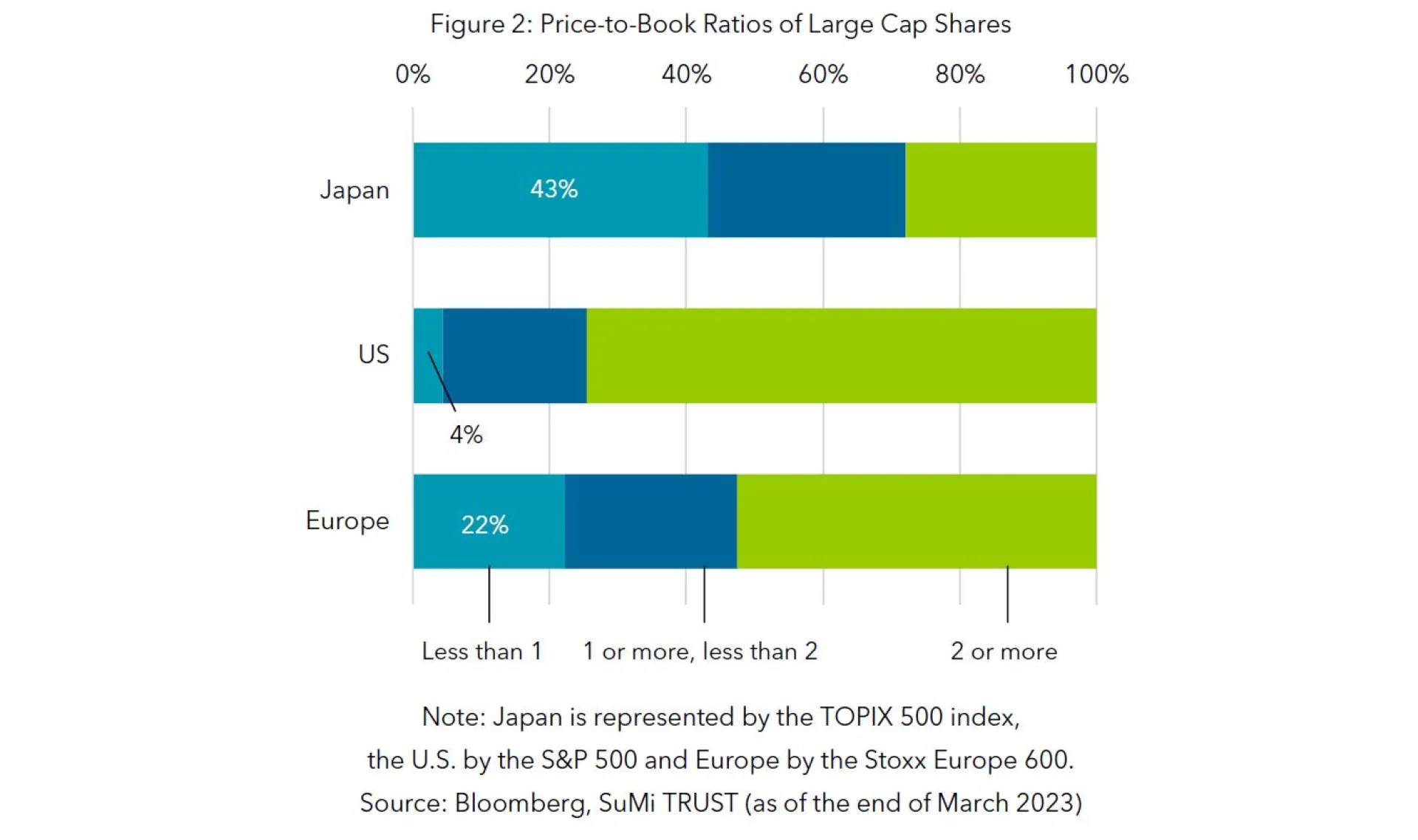

- Specifically, TSE strongly urges companies with P/B ratios below 1.0 to disclose their detailed plans and progress in increasing corporate value.

- The Japanese companies pay little attention to P/B ratio in comparison to their American and European counterparts: only 4% of U.S. S&P 500 companies and 22% of European STOXX 600 companies are traded below P/B ratios 1x, while 43% of TOPIX 500 companies are [Figure 2].

- There is likely to be a widespread move to announce plans to improve ROE and P/B ratios through increases in dividends, share buybacks, and capital expenditures for better capital efficiency at earnings announcements and shareholder meetings.

2. Foreign Investors Return to Japanese Stocks

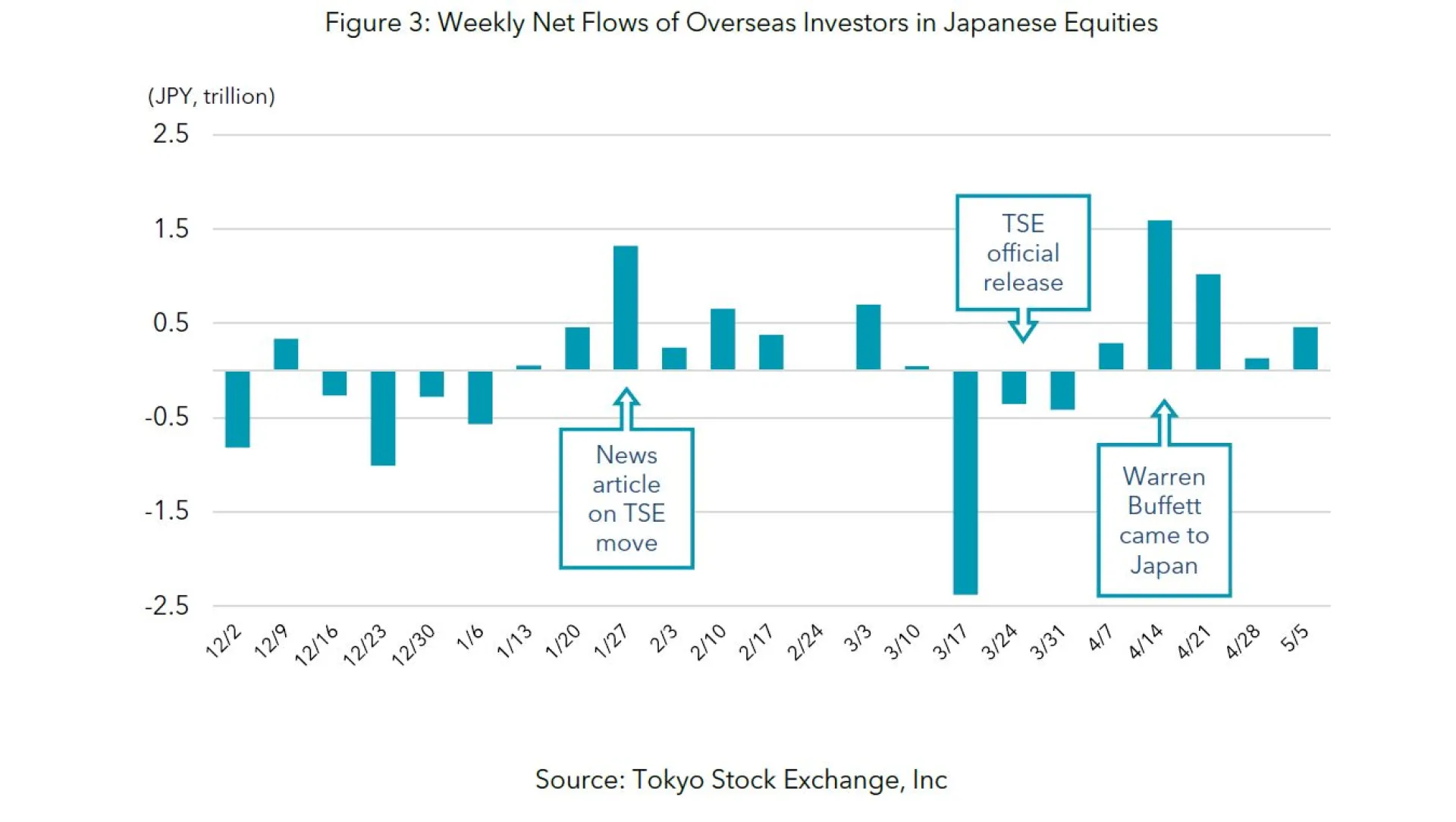

- Foreign investors are returning to Japanese equities, given an additional boost by Warren Buffett's announcements on 11 April about his additional investment in Japanese equities.

- The Nikkei 225 index rose for eight consecutive business days thereafter, the index’s longest consecutive gain since March 2022, which may be a sign that overseas investors are reassessing Japanese equities [Figure 3].

- It is thought that investors' expectations of change in Japanese companies’ capital efficiency are rising, which may lead to a revaluation of Japanese stocks as a whole in the future.

3. Relatively Strong Macroeconomic Performance

- According to our Chief Strategist Hiroyuki Ueno, Japan is likely to avoid the liquidity problems recently seen in the US as Japanese financial institutions have a stable funding base and are well capitalised.

- Domestic wage increases above the rate of inflation are expected to stimulate economic growth while inflationary pressures are expected to ease throughout the second half of 2023 due to the Japanese government policy to help with the utility bill burden.

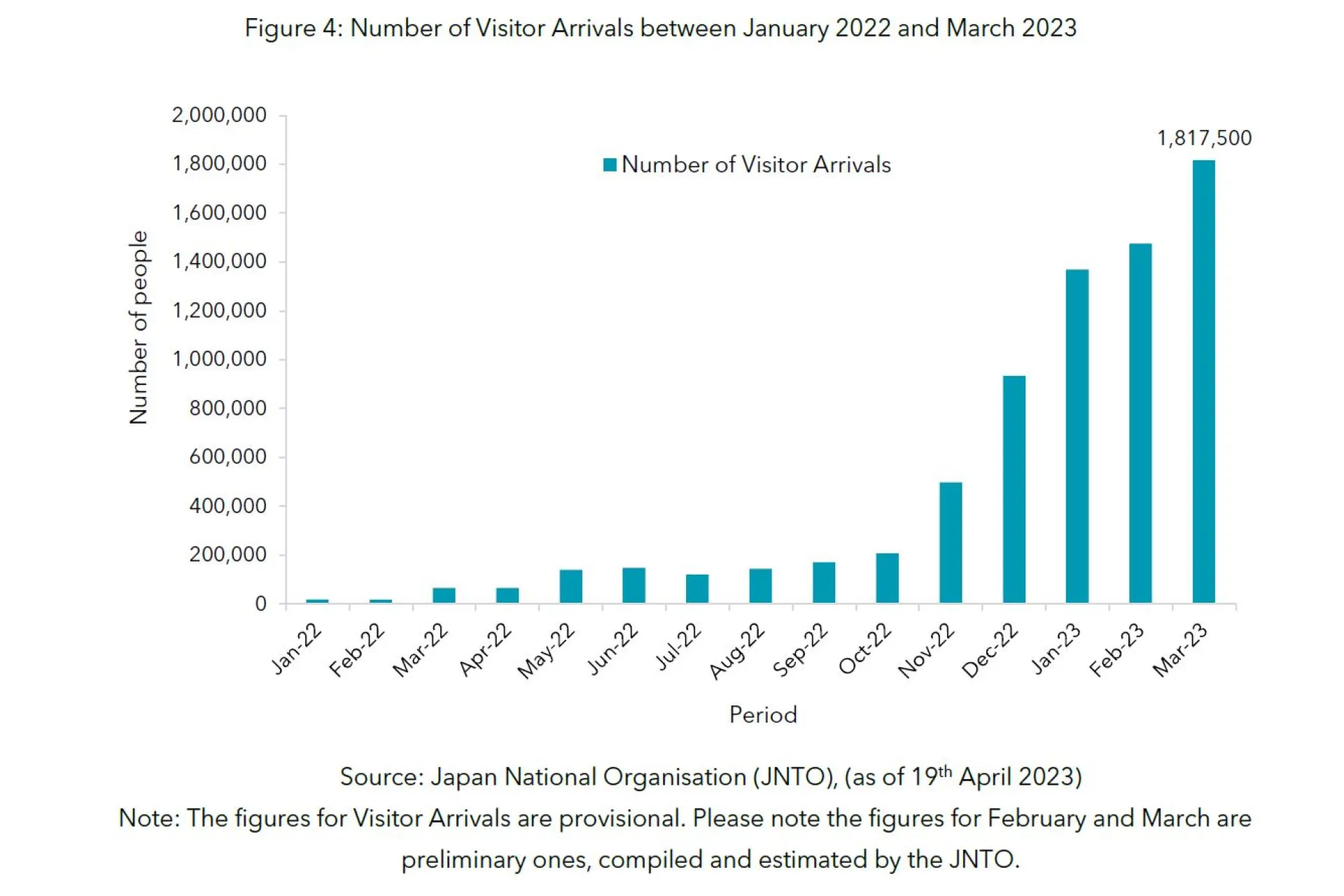

- Katsunori Ogawa, the Chief Portfolio Manager of our Sakigake High Alpha strategy also sees the Japanese economy experiencing a rapid recovery in inbound tourism, with numbers rising to 1.8 million in March, 66% of the 2019 level before lockdowns brought international tourism in Japan to a standstill [Figure 4].

Overall, Japanese equities stand in a strong position and offer great sources of return for overseas investors.