SuMi's Coffee Break Column

From April 2023 the newly appointed Governor, Kazuo Ueda, will take the reins of the Bank of Japan's (BOJ) monetary policy, replacing the long standing Governor Kuroda, who has held the role since 2013. In a somewhat surprise move in December last year, to improve the functionality of the bond market the BOJ expanded the volatility of the 10-year Japan Governmental Bond (JGB) interest rate, which is subject to the Yield Curve Control (YCC) policy. While the side effects of Japan’s monetary easing framework have long been pointed out, since this change the market has been speculating about the possibility of various revisions to the YCC and the negative interest rate policy when the BOJ comes under new management. This column introduces a discussion on the exit strategy of ETF (exchange-traded fund) purchases, which has received little attention among the BOJ's monetary easing policies.

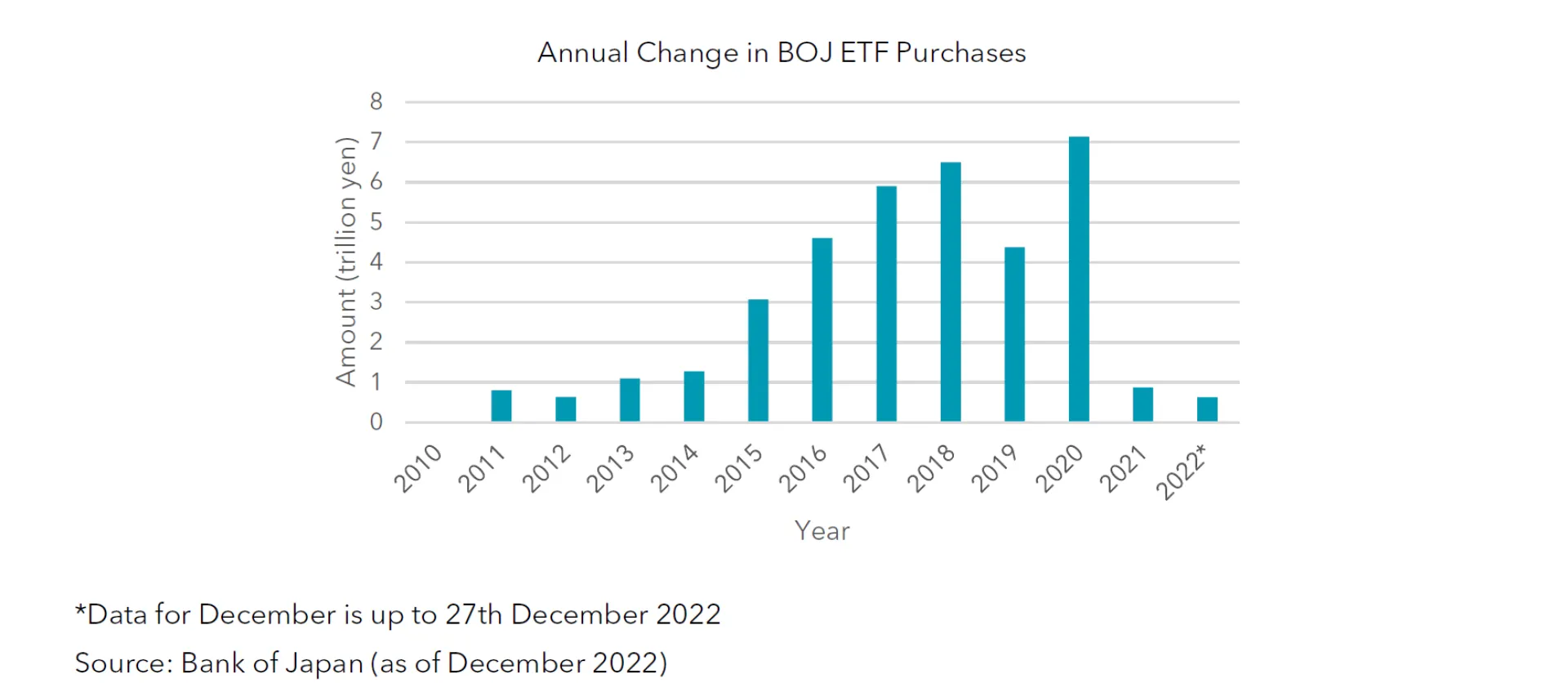

The BOJ's ETF purchases began in October 2010 as an "extraordinary and exceptional" measure during the term of Governor Shirakawa, Kuroda's predecessor. Since then, under Kuroda, who positioned ETF purchases as part of the framework for a large-scale monetary easing program, the amount of assets has continued to grow. To date, the Bank has purchased approximately 37 trillion yen in Japanese equity ETFs. During this period, the market has been on an upward trend. The market value has expanded to approximately 50 trillion yen (as of December 2022, as calculated by NLI Research Institute), equivalent to about 7% of the TOPIX market capitalization. At one time, the BOJ's ETF purchases were noted as a support for the market, as the BOJ would purchase ETFs when the market fell by a certain degree, but now they are less likely to appear in the news as additional purchases have largely been abandoned.

As monetary easing moves toward a correction, selling or otherwise dealing with ETFs will, at some point, become an inevitability. It is no longer justifiable for the BOJ to continue to hold ETFs, which unlike JGBs have no maturity. So, when and to whom should they be sold? If the BOJ were to sell 1 trillion yen per year in the market, it would take 50 years. There is a proposal to mitigate the market impact through corporate share buy-backs after exchanging it for shares in kind. In the past, the Banks' Shareholdings Purchase Corporation has sold some of the shares it purchased from banks and other financial institutions by tendering them for corporate share buy-backs [1]. However, not all companies need to buy back their shares, and investors who will hold the shares through ETFs must be found. In this case, the new buyers would be institutional or individual investors. While institutional investors will have their own particular needs, the expansion of the NISA (Nippon Individual Savings Account: Japan's new tax exemption scheme for investment by individuals) has potential and transferring them to individuals may be easier for the BOJ, which can target those looking to build and utilise personal assets.

Various experts have proposed the idea of transferring ETFs to individuals, and one of BOJ’s alumni who was involved in the planning of the ETF purchases has proposed a plan to restrict the sale of ETFs for a certain period while transferring them at a discount. The purpose is to mitigate the impact on the stock market and to promote investment by transferring ETFs at a discount. Such a move is not unprecedented. In 1998, the Hong Kong Monetary Authority (HKMA), made a large-scale purchase equivalent to about 6% of the market capitalization of the Hong Kong Stock Exchange [2]. The purchased shares were converted into ETFs, some of which were sold to corporations and individuals at a discount. However, there is a balancing act to consider when discounting as an incentive to purchase. If the range is too small, there won’t be enough demand, but if it’s too large, a bear ETF, which profit can be made from falling stock prices, can be purchased simultaneously, allowing risk-free arbitrage. An effective way to side step such issues, is provide incentives at point of sale rather than when purchased at a discount.

Jesper Koll, the former Chief Economist at JP Morgan Japan and Merrill Lynch Japan, suggests offering “individuals an inheritance tax break to get them to buy” as an incentive. Although Mr. Koll does not provide specifics, reducing the inheritance tax assessed value of ETFs transferred from the BOJ from their market value could for example, capture the needs of wealthy individuals who invest in real estate to save on taxes. In addition, to benefit from an inheritance tax reduction, the ETFs would continue to be held until the time of inheritance to the next generation. Thus it would diversify the timing of sales even without having to place restrictions.

Involving tax benefits as part of the BOJ’s ETF exit strategy would prove to be a complicated solution. However, when considering modifying long-standing monetary easing, it is imperative to do so while mitigating the impact on the market. Such a measure, while quite out of the ordinary, should not be overlooked.

Governor Ueda has these and many other decisions to contend with as he enters the BOJ from the position of a relative outsider. However, as an academic whose approach seems to be careful analysis, it seems unlikely he will rush into any changes in the short-term. I will be keeping a keen eye on how he approaches the role in the coming months.

[1] 464.1 billion was disposed of by applying for share buybacks in 2019/4-2020/3 before the COVID-19 pandemic. (syobun2019.pdf (bspc.jp) – Japanese only)

[2] HKMA is selling at a 5.25% discount.

(野村資本市場研究所|香港政府による上場投資信託(ETF)の組成 (PDF) (nicmr.com) – Japanese only)