Trends in wage increases observed in Japanese companies

Japanese companies are increasingly moving towards higher wages in line with the high level of inflation and the economic recovery from COVID-19, which lagged behind other developed countries. According to the Ministry of Health, Labour and Welfare's Monthly Survey of Labour Statistics, nominal wages are rising due to special salaries and lump-sum payments in response to the price hikes, but they are not catching up with price increases, and real wage growth remains negative. During “Shunto” (annual wage negotiations between labour unions and companies every spring), the labour unions at many companies requested significant rises, and the outcome of this year is a bit different from the usual year, especially in the LEs such as Toyota Motor Corporation, which has agreed with its labour union to accept the wage increase request, which is the highest level in the last 20 years. Toyota’s new CEO, Koji Sato, made a decision at the first negotiation to fully admit the request from the union, and this decision is a strong message for the industry. The government has also appealed to companies to raise wages above the rate of inflation, and social momentum is steadily growing.

Small and medium-sized enterprises have little room for wage increases

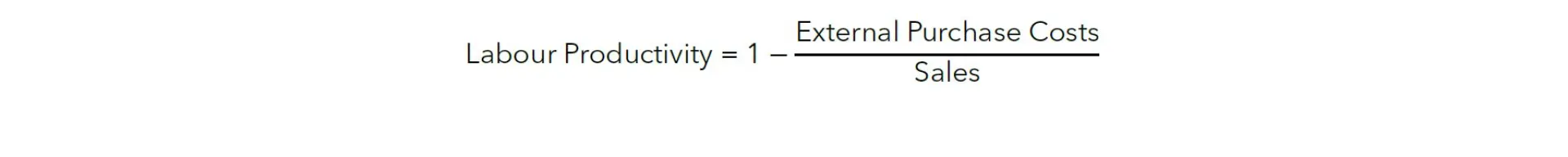

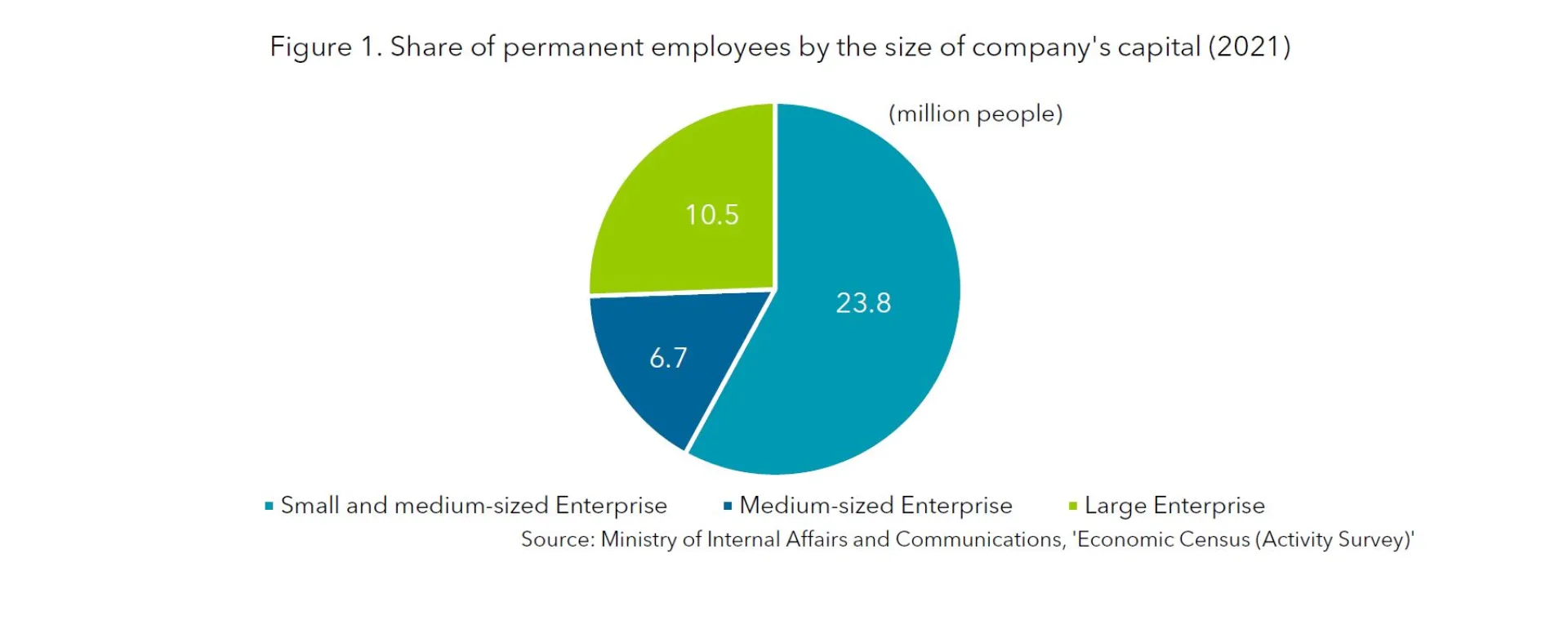

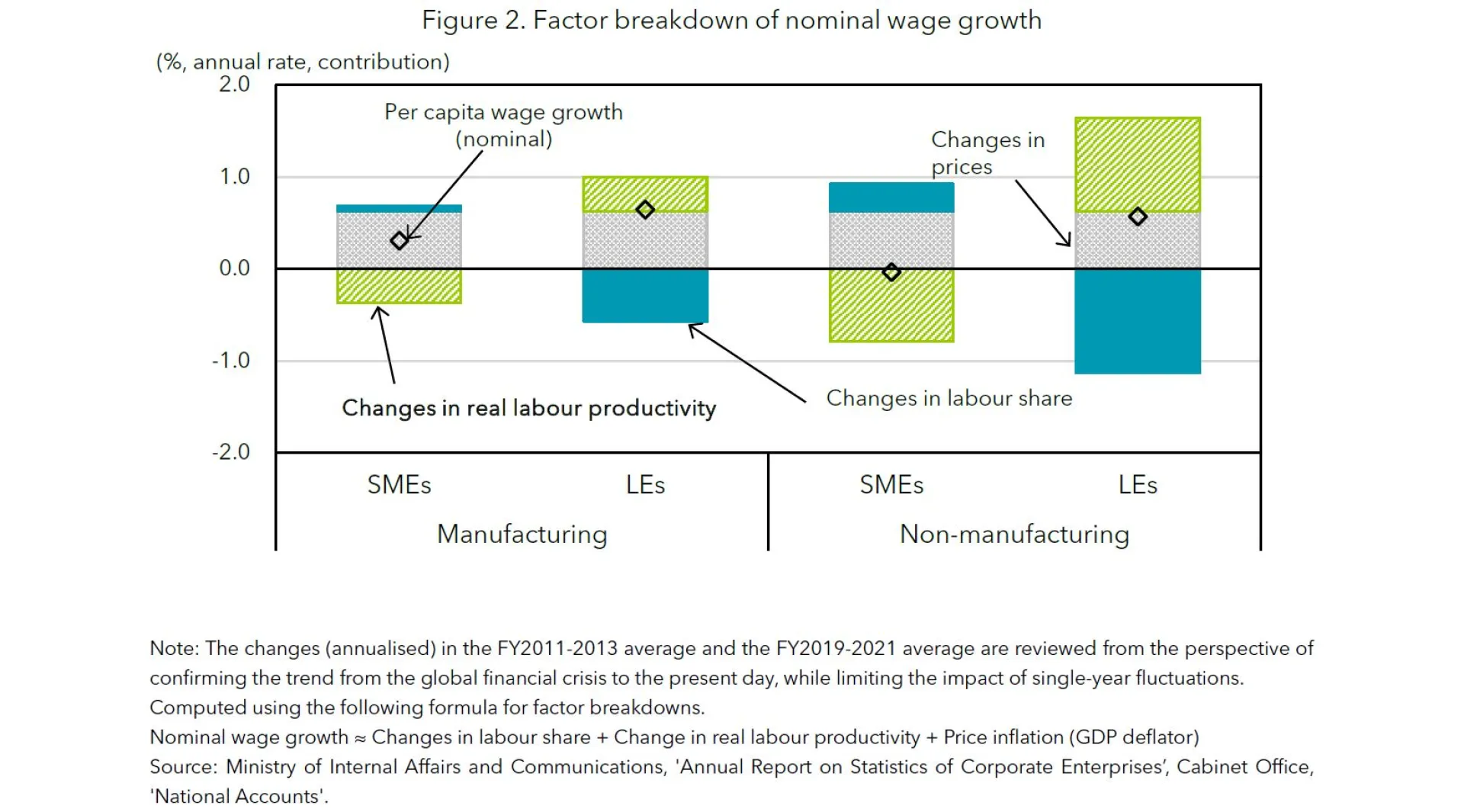

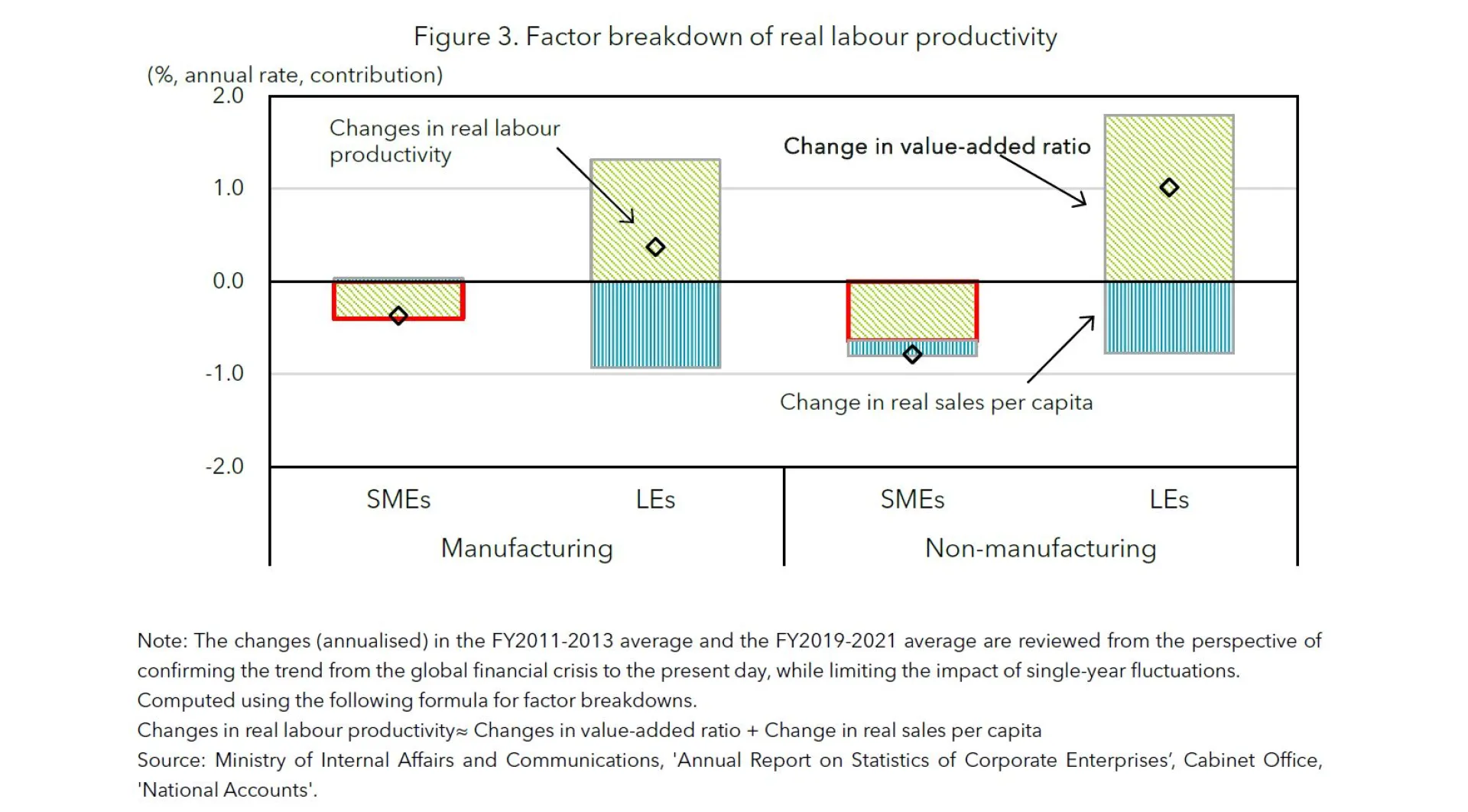

While labour unions’ demands for higher wages have been fully accepted by many LEs, the situation in SMEs appears to be different. SMEs, defined as companies with capital of less than JPY 100 million (approximately USD 750 to 800 thousand), account for 58.1% of Japan's share of employment and have a significant influence on wages in Japan (Fig. 1). A comparison of the 2011-2013 period, which includes the beginning of Abenomics, and the average for the most recent three years, 2019-2021, shows that the wage increase rate for both manufacturing and non-manufacturing industries was lower for SMEs than for LEs, with the non-manufacturing sector displaying a negative rate of wage growth (Fig. 2). Among the three components: (a) change in labour share, (b) change in labour productivity or value-added per capita and (c) change in price, (b) was the largest negative contributor for SMEs in the non-manufacturing sector. A further breakdown of the labour productivity into sales per capita and change in the value-added ratio (value added per sales) shows that the value-added ratio significantly impacts the difference in the labour productivity between LEs and SMEs. The labour productivity can be represented in the following formula.

To increase labour productivity, it is required to lower external purchase costs, such as materials, logistics and outsourcing costs, or to increase sales. Most of the external purchase costs are variable costs, which closely link to sales, and thus purchase/sales price is more important than the amount of sales. While SMEs hesitated to increase their sales price, the higher external purchase costs caused by global inflation and the Japanese Yen’s depreciation have lowered labour productivity (Fig. 3).

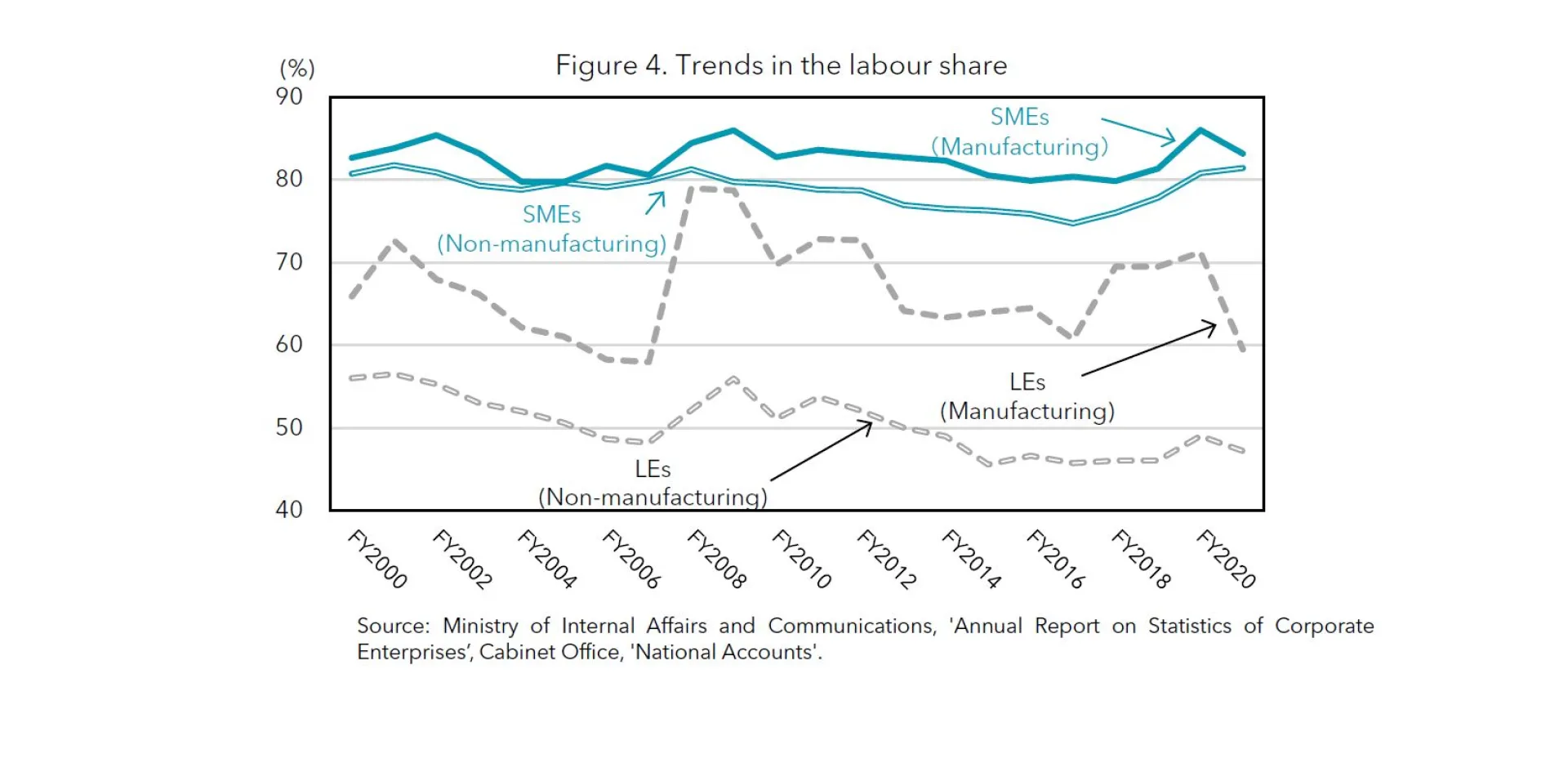

Additionally other differences were found in the change in the labour share (labour costs per value added) between LEs and SMEs. While the labour share fell in LEs, it remains high or even rising in SMEs. In SMEs, the labour share increased because the amount of value added decreased more than that of labour costs. In other words, the labour share of SMEs rose because value added fell more than during the normal phase of economic expansion due to a lack of price pass-through. In addition to the fact that SMEs originally had less room to increase their labour costs due to their higher labour share compared to LEs, they have further lost their capacity to raise labour costs due to the increase in labour share over the last decade (Fig. 4).

Prospects for wage increases

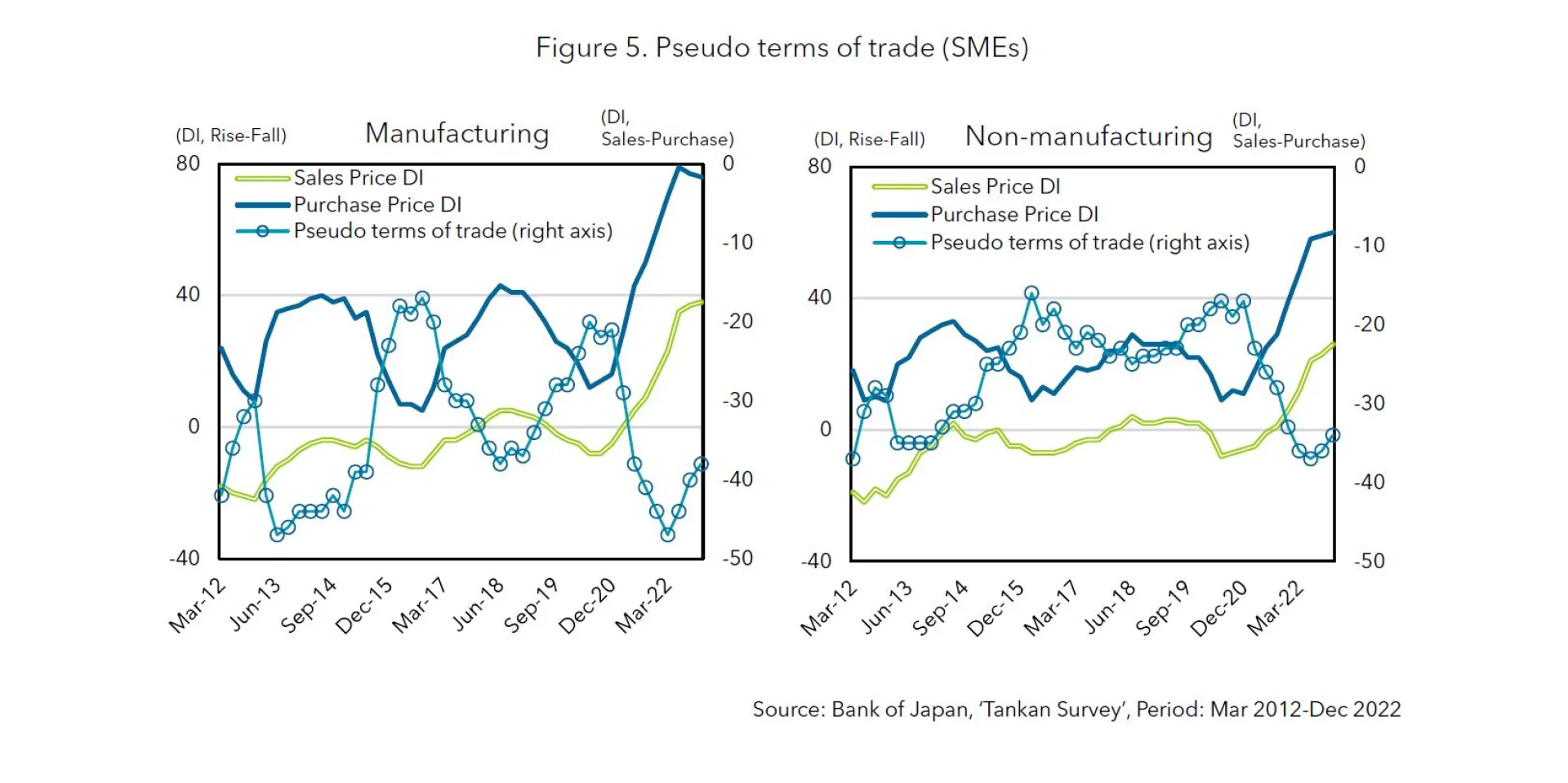

Although SMEs were facing challenges to raise wages, the environment is changing. The pseudo terms of trade (sales price DI – purchase price DI) has bottomed out in early 2022 and it is continuously improving (Fig. 5).

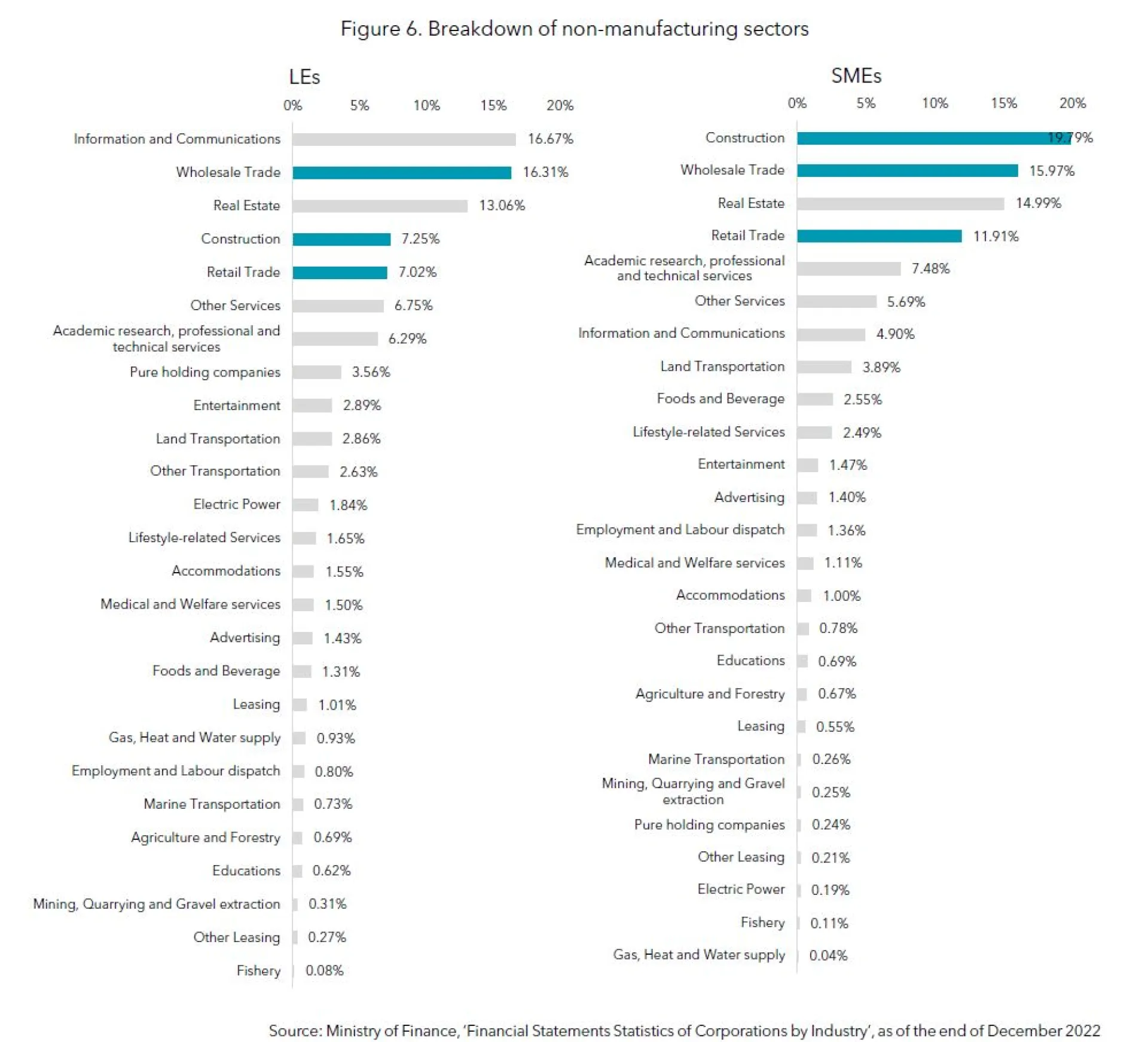

Moreover, SMEs in the non-manufacturing sector, where real labour productivity has declined the most, include many firms in the three sectors that are negatively impacted by price hikes: construction, wholesale, and retail (Fig. 6). While many industries are recovering from the stagnation caused by COVID-19, the increase in costs has taken away the capacity for wage increases, particularly in the construction industry, where material prices have risen significantly. However, price levels have gradually started to fall since the second half of 2022, and the price hikes of the past few years are coming to a halt (Fig. 7).

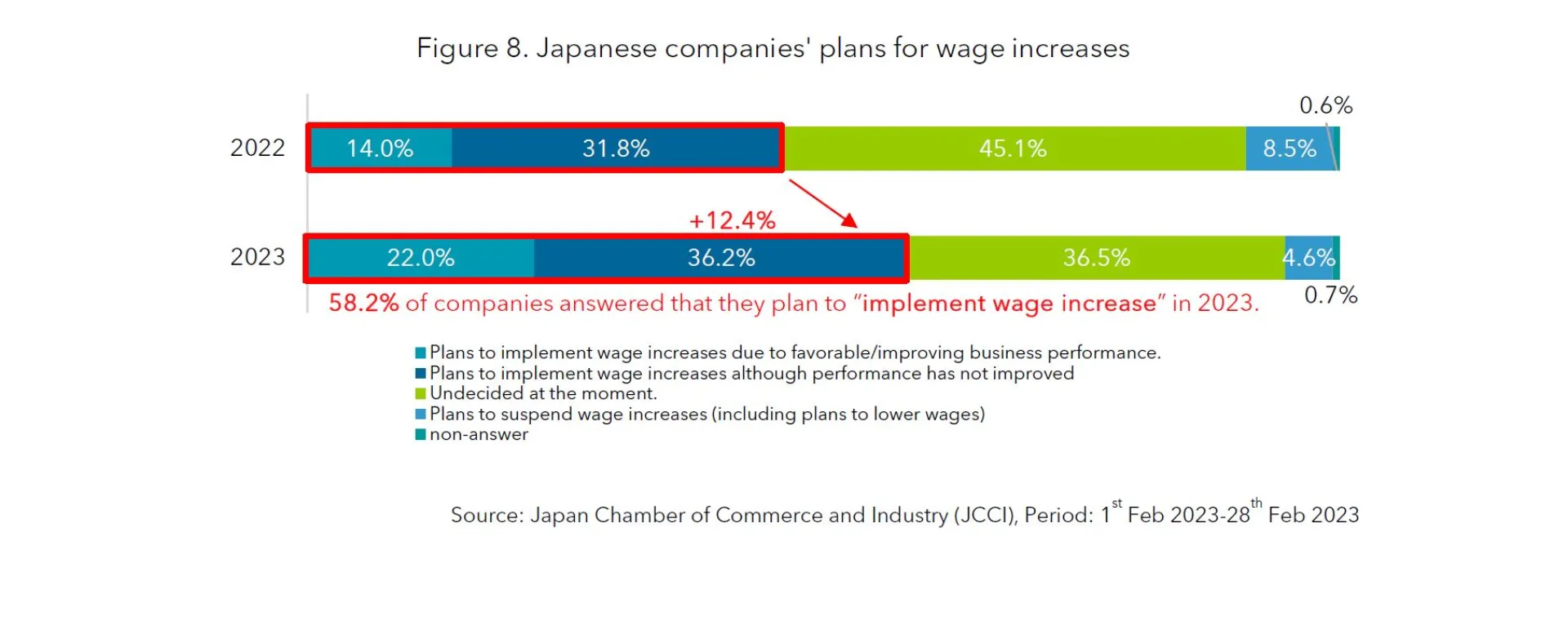

The labour shortage also pushes the SMEs to increase their wages. According to the results of a survey on wage increases among SMEs by the Japan Chamber of Commerce and Industry, 64.3% of SMEs answered that they are facing labour shortages, and 66.3% of SMEs have increased the wage/proposed wage for recruiting in order to attract employees.

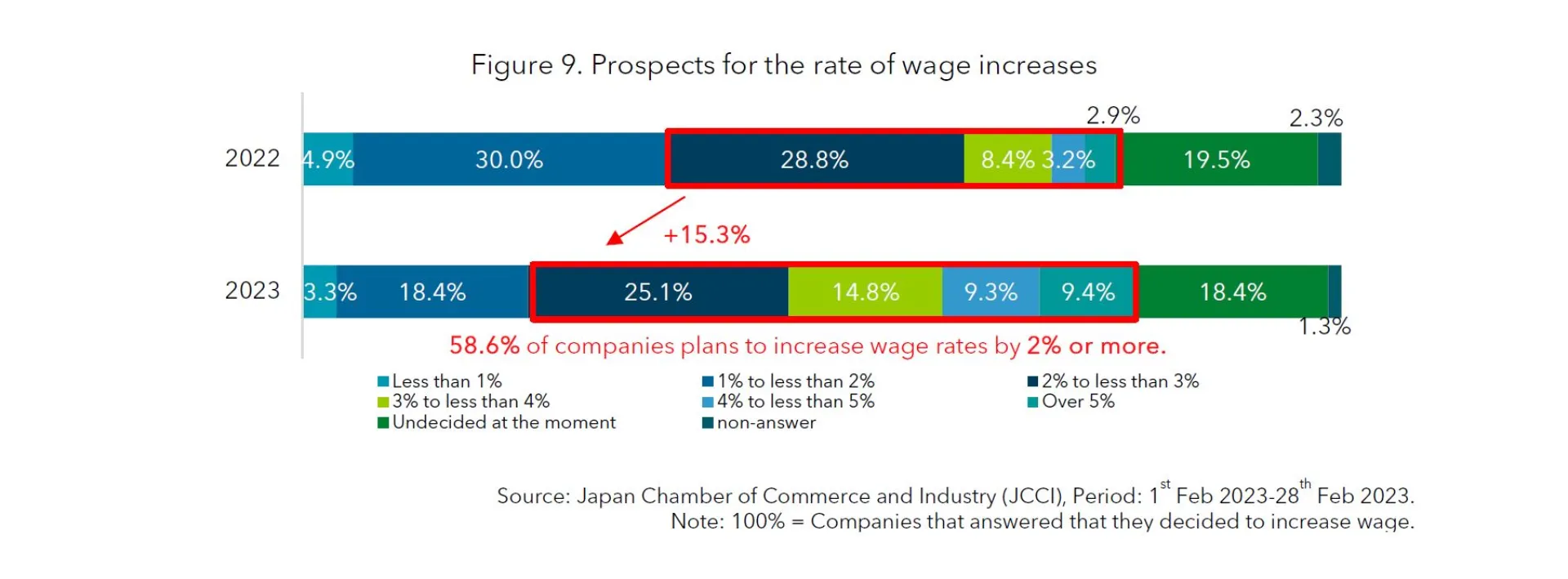

In the same survey, 58.2% of SMEs answered that they have decided to increase their wages, which is 12.4% points larger than the last year (Fig. 8). Out of the SMEs that have decided to increase wages, 58.6% will increase wages more than 2.0% and 18.7% will increase wages more than 4.0% (Fig. 9).

The government is also supporting SMEs that increase wages. Tax reduction is one of the major measures. A maximum of 40% of the amount increase in payroll will be deducted from the corporate tax. The government also encourages SMEs to pass on prices. At the end of last year, the government announced the names of 13 companies that refused to discuss with their subcontractors about reflecting cost increases, such as raw fuel and labour costs, in their transaction prices. Furthermore, in February, the government announced a plan to investigate subcontractors to check whether their suppliers agreed to negotiations and to what extent they were able to pass on costs to prices, and if the LEs' actions were unfair, the government would issue documented warnings to the companies. In this way, the government aims to stabilise the management of SMEs and help them raise wages and invest in growth.

Sustainable wage increases are the key factor for Japan to get on the path to tackle deflationary pressure. More and more LEs, which have more capacity to increase wages, have aggressively decided to increase wages taking inflation pressure into account, while many of the SMEs are struggling to increase wages. In the meantime, the SMEs are under pressure to increase wages to retain employees due to labour shortages. As the global inflation pressure weakens, SMEs will have more room for wage increases. We expect that not only the LEs but also SMEs will contribute to creating a virtuous cycle of economic growth by increasing wages sustainably.

Figures 1 to 5 and related descriptions are quoted from a report published by The Research Department of Sumitomo Mitsui Trust Bank. Click here to read it. (Only in Japanese)