Impact of the Comprehensive Economic Measures to Create a Future of Security and Growth

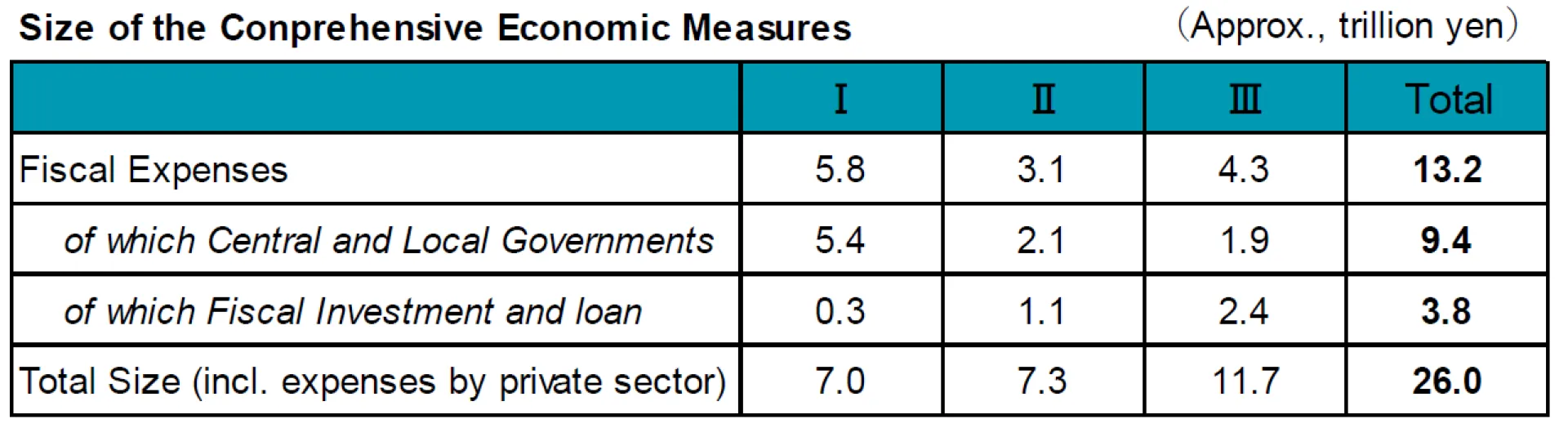

On December 5th, 2019, the Abe Cabinet announced the launch of a large-scale economic stimulus package (“Comprehensive Economic Measures to Create a Future of Security and Growth”), the first time since August 2016 that the Japanese government has taken such action. The three pillars of the package are as follows: I) Restoration and Reconstruction from Natural Disasters and Ensuring Safety and Security, II) Intensive Support for Those Striving to Overcome Economic Downside Risks, and III) Investing for a Future, Maintaining/Enhancing Economic Vitality Beyond the 2020 Tokyo Olympics and Paralympics. The total fiscal outlay of the package is said to be JPY 13.2 trillion(of which JPY 9.4 trillion is from the central and local governments, and the remainder from the fiscal investment and loan program). Including outlays from the private sector, the total package comes to JPY 26 trillion (USD 236 billion). The last economic stimulus package(“Economic Measures for Realizing Investment for the Future”) was JPY 28.1 trillion (of which JPY 13.5 trillion was in the form of fiscal expenditures). Thus the latest package is similar in scale to that of 2016. The Cabinet Office estimates that the stimulus will add JPY 7.6 trillion to aggregate demand and push up real GDP by 1.4% by around FY 2021.

Whilst the Bank of Japan’s monetary stimulus has begun to show signs of its limits, the government countered with its large-scale fiscal measure to alleviate economic downside risk caused in part by the October 2019 consumption tax hike and Sino-US trade frictions. By averting an economic recession, Shinzo Abe may now seek a record 4th term as prime minister after his current term expires at the end of September 2021.

Of the 3 Arrows of Abenomics (Monetary policy, Fiscal policy and Growth strategy), there was hitherto a skew towards monetary policy. But going forward, we believe that fiscal policy will become the main tool. The role of monetary policy will be to sustain fiscal policy and control the rise in interest rates. It will thus be used more as a supportive tool to fiscal policy.

The fiscal stimulus should be received favorably by the stock market. When reflecting on past large-scale fiscal measures, the stock market had risen 30% on average over the subsequent 12 months. Market sentiment should improve as the measure serves to support the economy. We believe that the construction sector will be a direct beneficiary of the stimulus plan. Major construction companies such as TAISEI (1801), OBAYASHI (1802), KAJIMA (1812) and SHIMIZU (1803) are relatively inexpensive from a valuation perspective including the P/E ratio, and their share prices are expected to improve. In addition, since 5G investment is an economic theme, the number of 5G base stations are expected to increase significantly. We also like the prospects for electrical equipment construction companies, COMSYS Holdings (1721) and KYOWA EXEO (1951). Moreover, as this fiscal measure is focused on improving productivity by using ICT and digital technology, capital should flow into IT service stocks. We like the stocks of the long-established Nomura Research Institute (4307), ITOCHU Techno-Solutions (4739), which has an advantage in 5G technology, and the highly profitable OBIC (4684). We forecast the Nikkei 225 to touch 27,000 by year end. USD-JPY (dollar-yen) should gradually rise in a risk-on market. Long-term JGB yields should trade in a narrow range around the 0% level as the Bank of Japan will exercise its yield curve control when rates begin to nudge higher.

Measures to Implement: The Three Pillars

I. Restoration and Reconstruction from Natural Disasters and Ensuring Safety and Security

1. Acceleration of Restoration and Reconstruction from Natural Disasters

e.g. Restoration (including improvement) of the damaged infrastructure including rivers, roads and ports

2. Strong Promotion of Disaster Prevention, Mitigation and Building National Resilience

(i) Steady Implementation of “Three Years’ Emergency Measures (from FY2018 to

(ii) Further Strengthening National Resilience Projects, focusing on Flood Control Measures

e.g. Improving river channels and levees, Preventing measures against flood including developing rainwater storage facility, Promoting to lay power lines underground

3. Securing Safety and Security of the People

e.g. Developing shared information platform for disaster management

II. Intensive Support to Those Striving to Overcome Economic Downside Risks

1. Developing an Environment for Enhancing Productivity of SMEs

e.g. Subsidies for investment in ICT and digital technologies, etc.

2. Facilitation of the Businesses by the Companies Developing Overseas Operations

e.g. Support for developing new foreign market by SMEs

3. Making Agriculture, Forestry and Fisheries a Growth Industry and Enhancing its Exporting Capacity

e.g. Implementation of “smart agriculture” technology, Development of processed food production facilities for export

4. Further Promotion of Regional Revitalization

e.g. Promotion of matching between local businesses and managerial talents from urban areas

5. Support for the “Employment Ice Age” Generation.

e.g. Establishing specialized contact at public job placement offices, Hiring those from this generation in government service sector

III. Investing for a Future, Maintaining/Enhancing Economic Vitality Beyond the 2020 Tokyo Olympics and Paralympics

1. Promoting Innovation and Social Implementation of Technologies toward Realizing Society 5.0 and SDGs

e.g. Developing “post 5G” technologies, Accelerating safe and reliable 5G investment

2. Investing in Human Capital for those Playing Important Roles in Society 5.0 and Creating Environment Suitable for Child Rearing

e.g. Realizing an environment where every pupil/student in compulsory education is equipped with and utilize his/her computer until FY2023

3. Infrastructure Development for the Era of 60 million Inbound Tourists

e.g. Capacity enhancement of capital area airport

4. Improvement of Infrastructure to Support Productivity Enhancement

e.g. Development of highways, hub ports, etc. partially through fiscal investment and loan scheme

5. Supporting Private Consumption in a Seamless Manner

e.g. Continuing point reward program for cashless payment at small and medium size retail stores until June 2020, and Initiating a new point granting program using Tax Number Card (“My number Card”) from September 2020

6. Promotion of Corporate Governance Reform, etc.