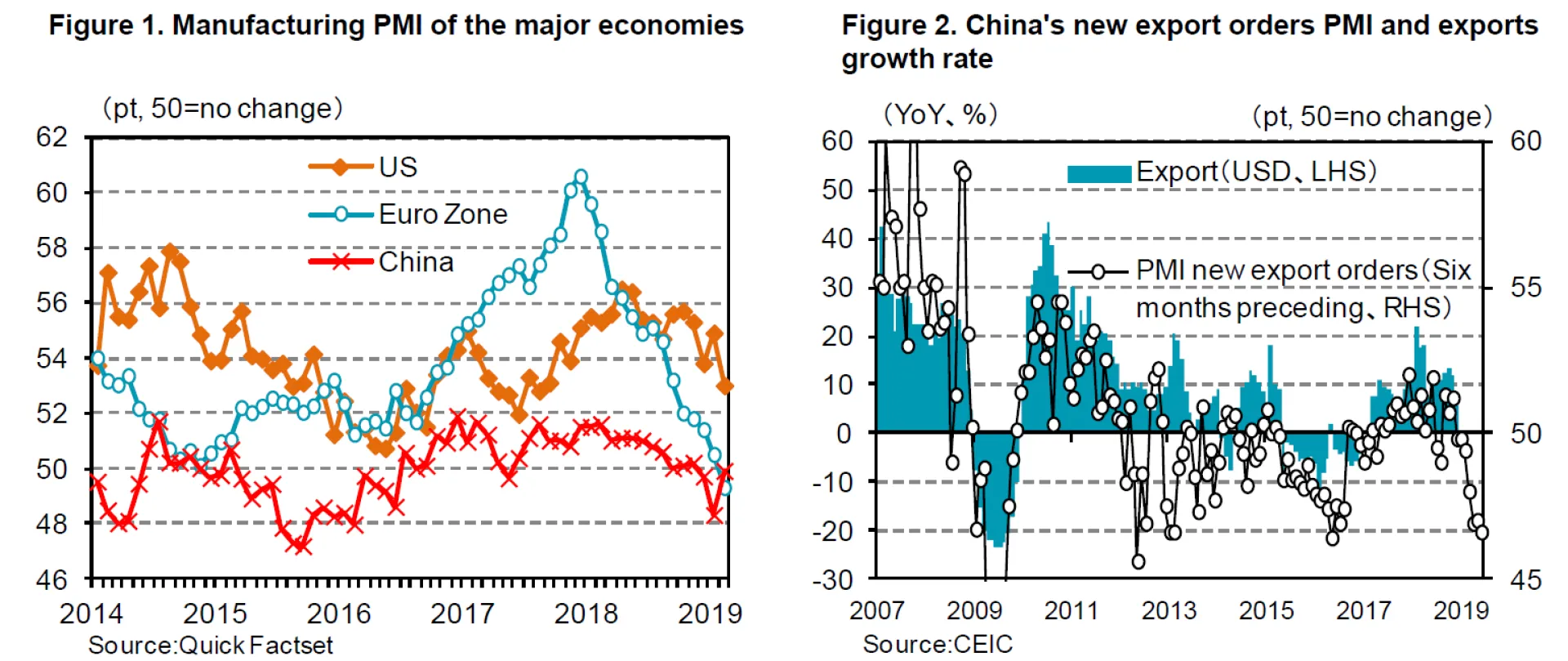

In addition, when viewing the manufacturing PMI, economic slowdown in the Euro zone has also become noticeable. The IMF cited Italy's financial problems and delays in responding to new environmental regulations in Germany's auto industry as factors. But given the relatively high dependence on Germany's exports to China, we believe that the effects of China’s economic slowdown has only just begun to emerge.

As for our outlook on the overseas economies, China's growth rate will continue to decline unless its government pushes through its structural reform policy. In the US, whose economy has remained firm, the annual growth rate over the past year was 3%, which is much higher than the potential growth rate of around 2%. But the impact of rate hikes so far is expected to slow down the growth rate. We expect the global economy to avoid a slowdown throughout fiscal 2019, assuming that the US economy will maintain its current strength, and that China will implement accommodative measures such as large scale fiscal spending and interest rate cuts should the economy rapidly deteriorate. Although we think that a global recession can be avoided, the slowdown in growth is inevitable. Exports from Japan are also unlikely to grow, and the YoY increase from 6.4% in FY 2017 to 1.9% in FY 2018, will further erode to 1.6% in FY 2019.

3.Outlook for personal consumption

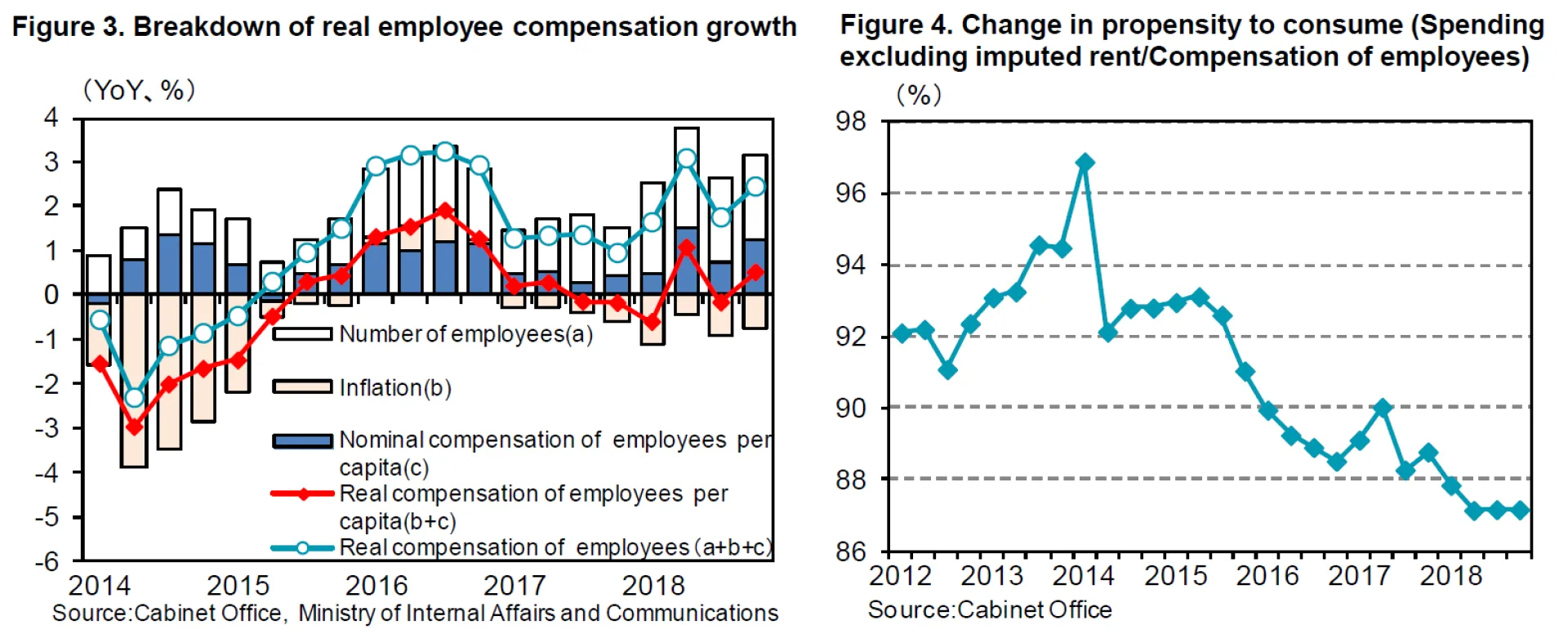

The environment for consumption is generally good. Looking at the breakdown of real employment compensation from the perspective of the household income (Figure 3), price increases have depressed real income since 2017 (b in Figure 3) Wage growth has not been stable (b + c in Figure 3), but due to the higher number of employees (a in Figure 3), real total employee compensation has continued to grow steadily by 2-3% over the previous year.

The consumption propensity as seen by the ratio of household consumption to employee compensation excluding imputed rent has stopped declining although at a low level (Figure 4), indicating that a positive cycle from corporate earnings to household income, and household income to consumption has continued.

We forecast that the unemployment rate should remain tight in the mid-2% range, and that the labor market equilibrium to remain unchanged throughout FY 2019, and that household income should increase due to both higher wages per employee and the number of employees, which in turn should continue to increase consumption. There will be last minute demand followed by a reactionary decline before and after the October 2019 consumption tax hike, but personal consumption will continue to increase over the period up to FY 2019.

4.Outlook for capital expenditures

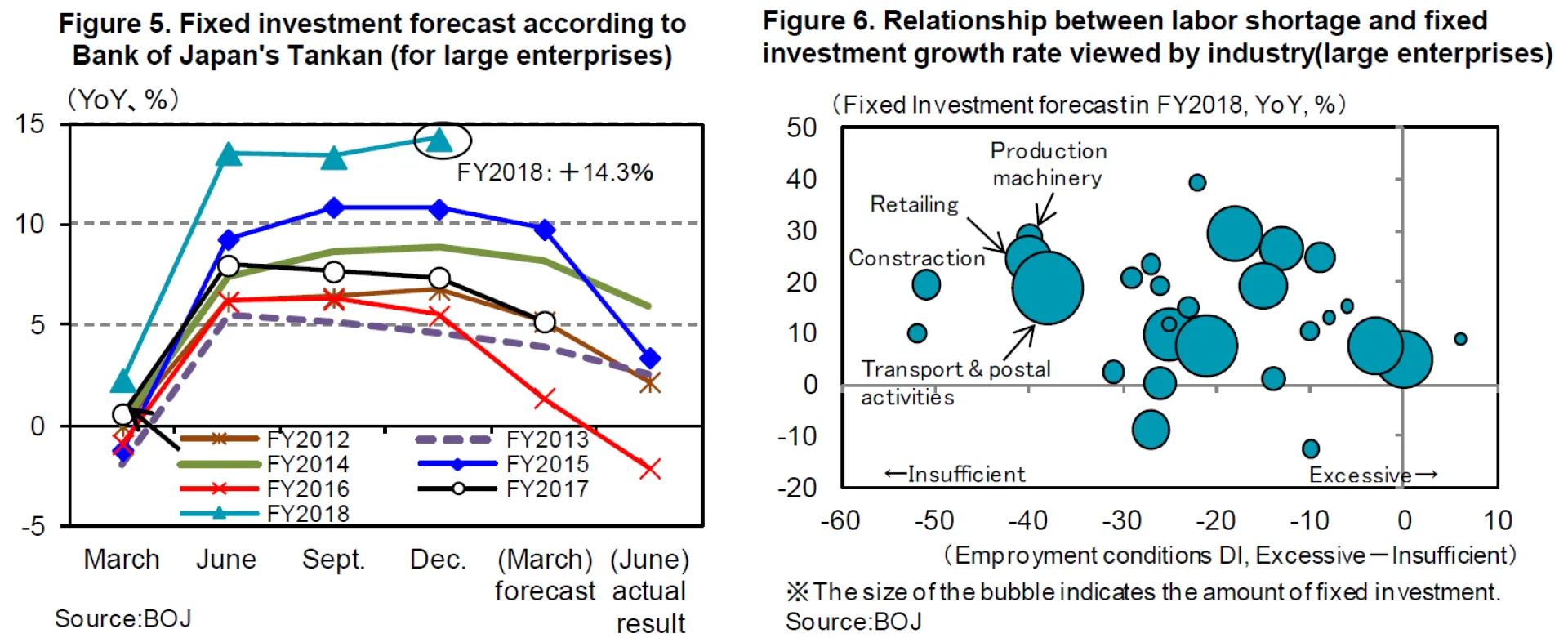

The environment for capital expenditures is also favorable at the moment. As of December 2018, the fixed investment forecast for large enterprises in the BOJ Tankan sees a rise of 14.3% YoY, the highest growth rate in recent years (Figure 5). Looking at the fixed investment forecast for large enterprises by industry and in conjunction with the employment conditions DI, we see a trend for increased fixed investment in sectors with a high degree of labor shortage, such as transport, postal services and retail (Figure 6). While cash flow is abundant, the cautious stance on capital expenditures has not changed significantly, but we can see that capital expenditure has increased as a response to labor shortages. It is also expected that capital expenditure growth should continue until FY 2019 on the premise that the labor shortage will not change.

5. Economic Outlook - Summary

Summarizing the above, we expect that a recession in Japan in FY 2019 should be averted, together with the overseas economies. Personal consumption and capital expenditures will support the economy, although it will lose its strength mainly due to the slowdown in export growth. Our basic view is that the growth of the entire economy should be moderate and close to the lower limit of the potential growth rate range of 0.5% in FY2018 and 0.6% in FY2019.

6.Capital expenditures related stocks

We are focusing on the trend for increased investments in automation of production as well as logistics equipment. We believe this to be a long term global trend and will focus on stocks which should benefit from such equipment investment as labor supply remains tight and demand stays steady. For example, Keyence (6861 JP) boosts the productivity for its customers by introducing more efficient production facilities. Daifuku (6383 JP) produces machines which sort goods in the warehouse, and optimizes transport to achieve a more efficient delivery in e-commerce. In addition, we are also following Nomura Research Institute (4303 JP) and NTT Data (9613 JP) which should reap the benefits of expanding information system investments with the aim of improving labor efficiency and costs as well as promoting work style reform.