1. Japan has become an Advanced Nation in Vaccinations

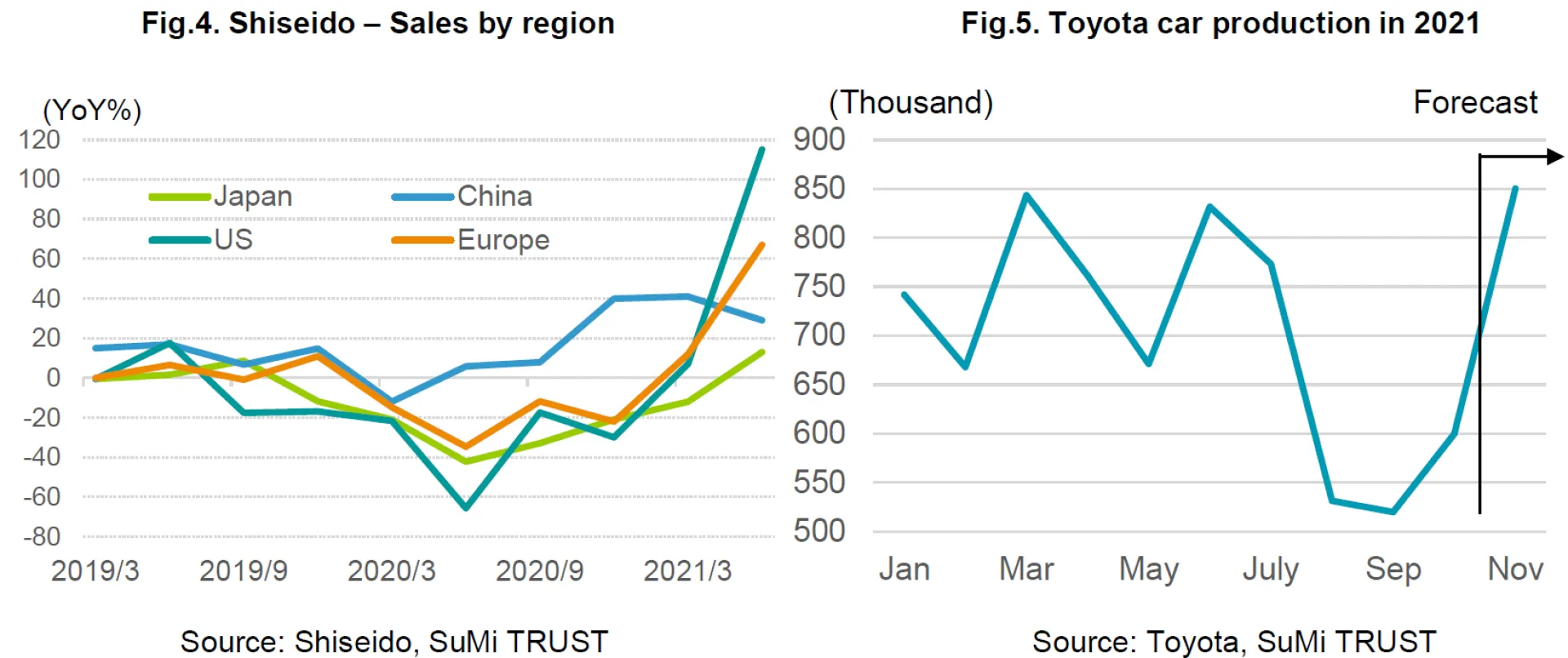

Vaccination in Japan had been lagged behind as compared with the major countries. However, after the Japanese government had taken various measures, vaccinations progressed at a stretch since June. As of 1st June, Japan's fully-vaccinated rate (i.e. population who received two doses) was only 3%. But as of 13th October, it had skyrocketed to 66%, surpassing that of the United States (Figure 1). Japan has become among the highly vaccinated countries. Japan approved the Moderna and AstraZeneca vaccines on 21st May in addition to the Pfizer vaccine, and expanded the scope of coverage who could administer the vaccine (In addition to doctors and nurses, dentists, paramedics and clinical laboratory technicians were included.) It opened large-scale vaccination centers to enable mass inoculation, and also started vaccinations at workplaces. As a result, bottlenecks were removed at once. On 1st October, former Vaccine Minister Kono acknowledged that the vaccination rate would eventually reach about 80% of the total population. As of 13th October, Japan's vaccination rate (i.e. those with at least one vaccination) had risen to 75%, and it is expected that all those who wish to be vaccinated will have been inoculated by November. Considering typical Japanese mentality, peer pressure is stronger than a sense of rebellion against the vaccine, and thus it is expected that the vaccination rate will be higher among nations.

2. The Government will gradually relax restrictions

Although the state of emergency was lifted as of the end of September, not all restrictions has been removed at once. The government plans to relax the restrictions gradually. For example, in Tokyo, for the time being, restaurants that have been certified as having proper infection control measures will be allowed to open until 9 pm, and alcoholic beverages may be served until 8 pm. On the other hand, uncertified restaurants may stay open until 8 pm, and alcoholic beverages are not allowed to serve. Regardless of the certification, the number of guests in a group is limited to 4 people.

The government plans to implement full-scale relaxation of restrictions in November when all applicants for the vaccine will have been inoculated. The relaxation measures are targeted to those who have been vaccinated and have a PCR test negative certificate within 72 hours. The government would digitise vaccination certificates by the end of the year, and there would likely be App on smartphones. Reduced restrictions include (1) relaxation of measures for certified restaurants including business hours, number of customers and serving alcoholic beverages, (2) participation of vaccinated people at events, (3) face-to-face classes and sports/club activities at universities, (4) long-distance business trips and promotion of travel. It is worth noting that even should COVID-19 cases rise again in the future, it is unlikely that restrictions will be tightened unless the number of seriously ill or deaths rise markedly.

In October, Merck, a German pharmaceutical giant, announced that Molnupiravir, a new oral treatment for COVID-19, is effective in reducing the risk of hospitalisation and death at risk of aggravation by about 50%. It is expected that authorisation for emergency use will be applied to the US Food and Drug Administration (FDA) soon. In Japan, the Ministry of Health, Labor and Welfare is proceeding with procurement discussions so that it can be approved under a special case by the end of the year. In addition, Shionogi, a major Japanese pharmaceutical firm, is applying for the approval of the new oral therapeutic drug by the end of 2021, and is expected to produce enough dosage for 1 million people by March 2022. The day when we choose to coexist with COVID-19 is coming closer.

3. Economic Normalization

As mentioned above, we believe that economic normalisation will progress in stages, but not everything will return to the pre-COVID days. For example, working from home will take root in society as a result of COVID-19. Based on this, the beneficiaries of normalisation will vary depending on industries and individual companies. In addition to industries that will directly benefit from government subsidies, such as tourism, we are monitoring carefully the change in the industries, which may benefit indirectly, such as cosmetics.

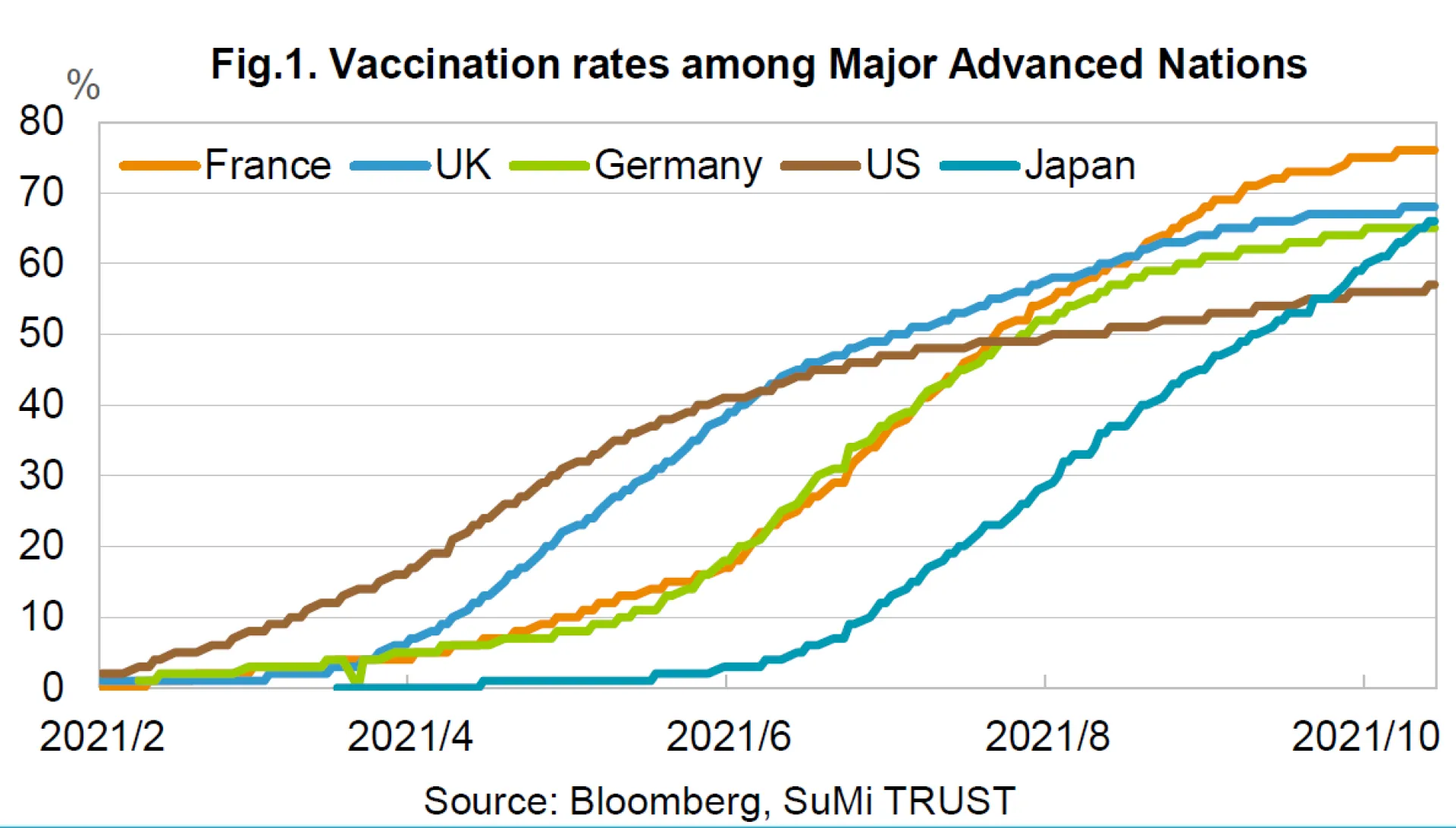

In 2020, the value of cosmetics shipments fell significantly compared to the previous year under COVID-19, dropping to the same level as in 2014. The decline in cosmetics shipments was comparable in value to the decline in cosmetics purchases by foreign visitors to Japan, suggesting that the decline in consumption by foreign visitors to Japan had a significant impact (Figure 2). A breakdown of cosmetics shipments by product category shows a decline mainly in makeup products such as lipsticks and eye makeup, suggesting that telework and voluntary restraint from going out had a significant impact on makeup products. Especially, demand for lipsticks decreased significantly, as people wore masks when going out (Figure 3). However, as economic activities are gradually normalising worldwide, there are some positive signs.

Figure 4 summarises the sales trend of Shiseido, a leading Japanese cosmetics manufacturer, by region. In 2020, global sales fell sharply, but in 2021, we see a sales recovery across the region, but its momentum is different. Japan, where was under a state of emergency until the end of September, has been slow to recover compared to other regions. As the number of people going out has been increasing, further recovery is expected. In addition, we believe that some users may switch brands at this point, and hence the strategy of each cosmetic company will affect future market share.

It may take some time before foreign visitors come back to Japan. They had been key drivers of cosmetics manufacturers' growth before COVID-19. On the other hand, cross-border e-commerce (Japanese products are sold to overseas consumers through mail-order sites) is expanding, and sales at duty-free shops are showing high growth. Traveling to Hainan Island is further gaining popularity among Chinese tourists as it has been difficult for them to travel overseas. Many Japanese companies (Shiseido, Pola and Kao included) have expanded into duty-free shops in Hainan to capture this business. Hainan Island is a warm weather resort, and the Chinese government wants to develop it as a "shopping paradise" to replace Hong Kong. Tourists can buy most of standard cosmetics in Hainan Island. Hainan Island is also accessible to people who have not been able to go abroad before, and there is still a lot of room for growth for business. Japanese brands, especially whose skin care products have long been popular, should adjust their strategies in order to meet the needs of current consumers even before the restrictions on movement are lifted and tourists from overseas come back again. Corporate strategies are being tested to see how they can respond through a variety of channels.

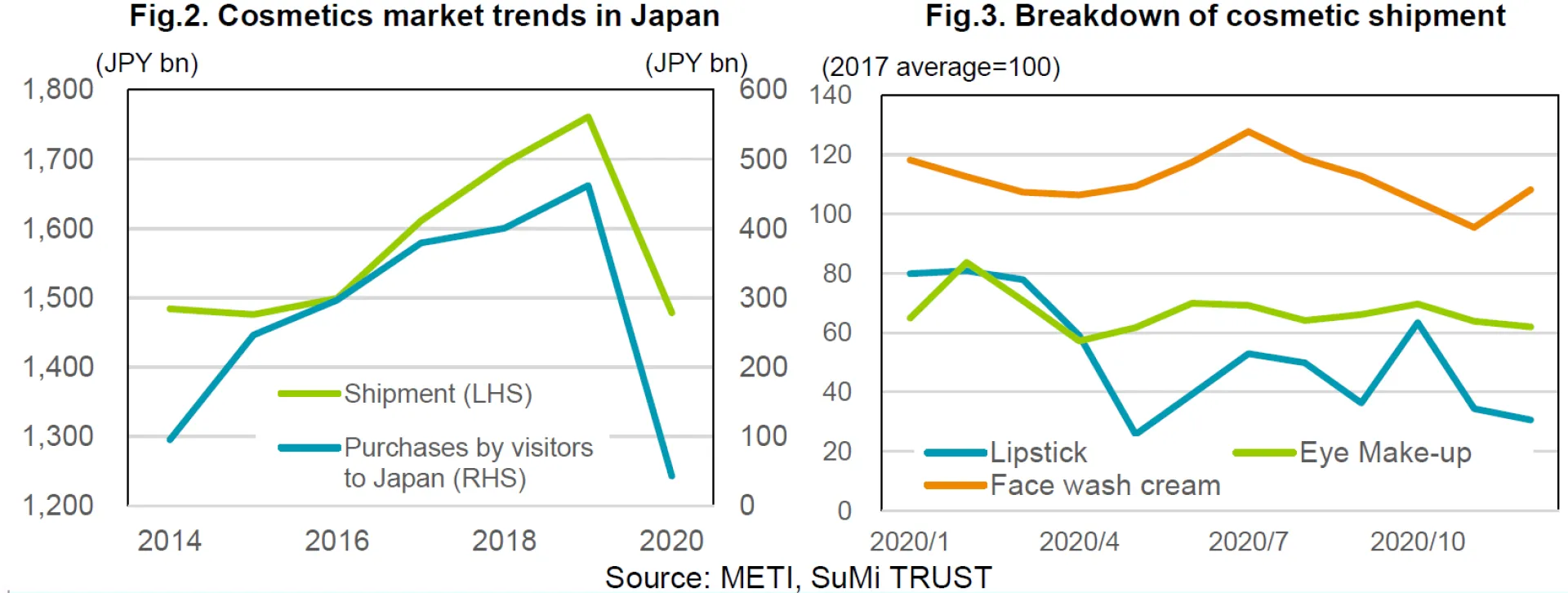

In addition, the automobile industry was forced to cut production from August to September due to higher COVID- 19 cases in Southeast Asia. For example, Toyota has been forced to drastically reduce production since August, but it expects production to recover to about 850,000 units in November due to the easing of restrictions on COVID-19 in Southeast Asia (Figure 5). In addition to the shortage of semiconductors, the closure of factories in Southeast Asia has made it difficult to procure auto parts, forcing automakers to cut back production. Specifically, the distribution of wiring harnesses (assembled wires for cars) was stagnant due to a decline in the operating rate of Sumitomo Electric's plant in Vietnam. Also, the distribution of semiconductors for cars was stagnant due to a decline in the operating rate of Malaysian plants of STMicro and Infineon, the major automotive semiconductor manufacturers. The production of wire harnesses is difficult to automate with machines and has relied on low cost labor in Vietnam. In addition, even if alternative production methods were to be used for automotive semiconductors, it would take a considerable amount of time to set up a new production line for these extremely precise components. It would not be possible to significantly increase production capacity immediately. In addition to the existing tight supply-demand situation for semiconductors, the concentration of production bases of automotive semiconductors in Malaysia led to a great deal of confusion in production.

Currently, the supply of semiconductors is still tight, but COVID-19 cases in Southeast Asia have peaked and production has resumed. Automobile demand itself is not declining, so we expect a recovery in production toward the end of the fiscal year. In predicting the future of the stock market, I will pay close attention to the normalisation of economies both in Japan and abroad.