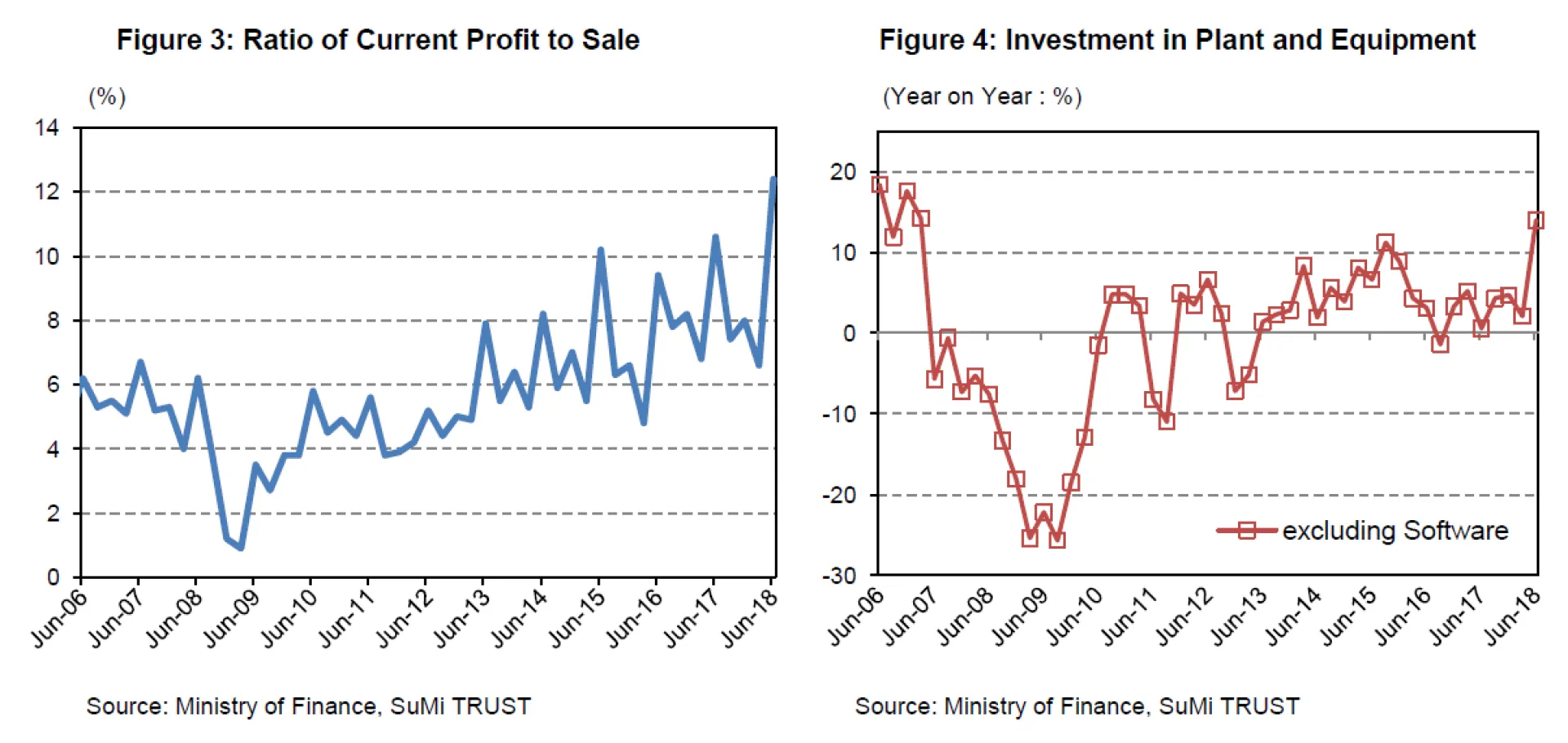

On the earnings front, according to 2018 Q2 corporate statistics, ordinary profits grew by double digits year on year in both the manufacturing and non-manufacturing sectors (Figure 3). Total capital expenditure including software was up 12.8% year on year, and excluding software, it was up 14.0% (Figure 4), which were the highest numbers seen since before the 2008 financial crisis (2007 Q1; excludes financials and insurance). Individual consumption also grew by 2.8% in 2018 Q2, in spite of the negative figure in the previous term. Compared to last year, scheduled wages increased approximately 1% due to the labour shortage, and fringe benefits increased, raising total cash earnings. Thus, we expect that individual consumption will keep growing slowly thanks to this positive income environment.

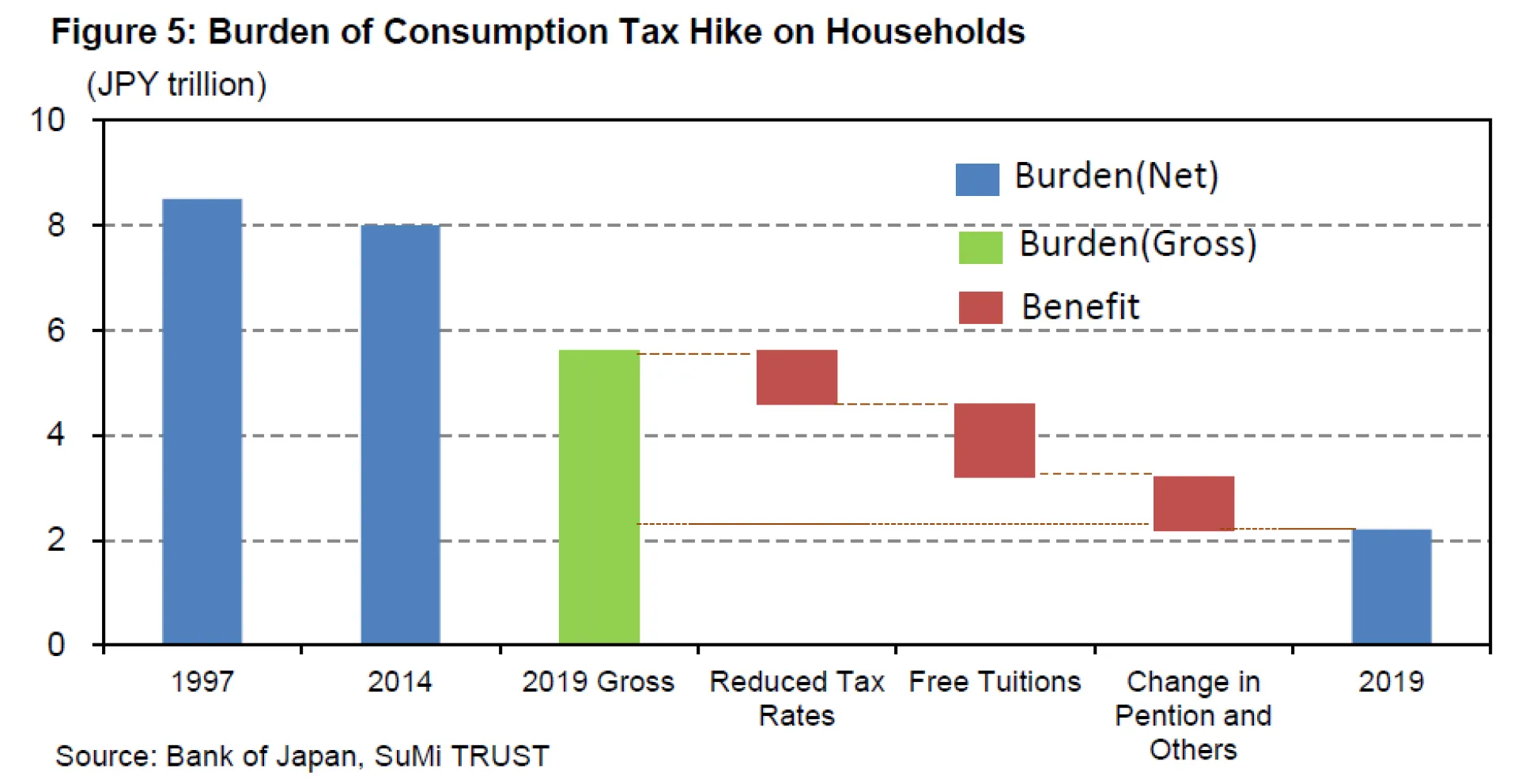

Next, we would like to highlight the consumption tax hike as well as its impact on the Japanese economy. Prime Minister Abe won the Liberal Democratic Party presidential election and he will continue his role until autumn 2021, which means the Japanese economy may continue to recover due to political stability. Although there were some delays before, Abe finally announced that he would implement the consumption tax hike as planned. The 2% tax hike (raising the tax from 8% to 10%) was announced during the administrative term of 2013, and it was planned to be implemented in April 2017. However, this implementation was delayed for 2.5 years due to the economic crisis, a total delay of six years from the original planned implementation. Looking back on previous consumption tax hikes, the 2% increase in 1997 saw a tax increase of JPY 5.2 trillion and placed a net JPY 8.5 trillion burden on households, and in 2014, the 3% increase saw a tax burden of gross JPY 8.2 trillion and net JPY 8.0 trillion on households, based on a trial calculation. According to the BOJ’s calculation, the impact from the next hike is expected to be gross JPY 5.6 trillion and net JPY 2.2 trillion, benefitting from mitigation measures such as reduced tax rates as well as free tuition (Figure 5). Therefore, other government policies are as important as tax hikes in terms of economic impacts, and we believe the influence of the next hike will be limited.

To summarize, our outlook on the Japanese economy remains positive as we believe gradual recovery will continue, supported by the two pillars of domestic demand: namely capital expenditure and personal consumption. Should the current recovery continue, we believe that the consumption tax hike of October 2019 will go ahead as scheduled. In this scenario, we forecast that real GDP will grow by 1.2% in FY 2018, and by 0.8% in FY 2019 with the slowdown due to the higher consumption tax, which we consider quite bullish.

2. Market Review

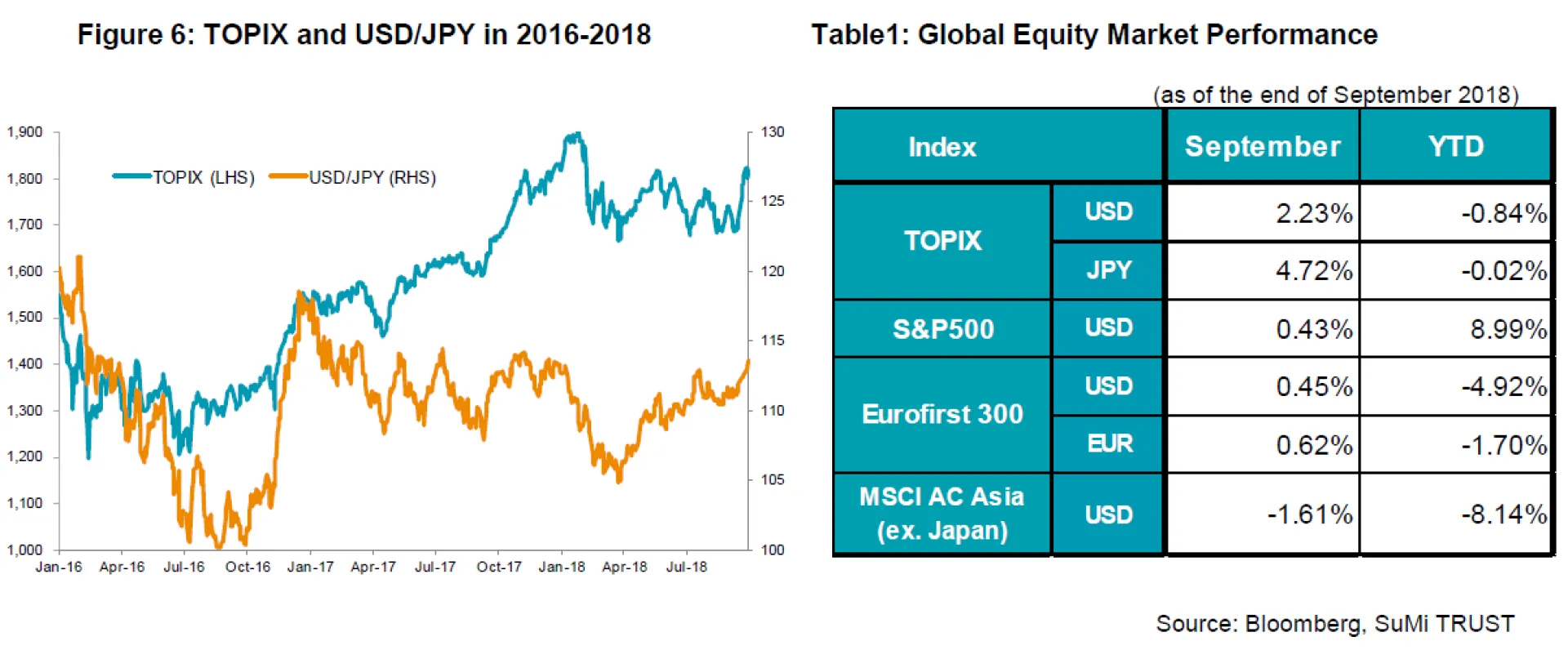

In September, the Japanese equity market rallied, outperforming its major global peers and recovering all its losses of 2018. The TOPIX closed +4.72% on the month before. Investor sentiment improved significantly, as concerns over the escalation of trade frictions between the US and China temporarily receded following the announcement of the third round of US tariffs on Chinese goods. Another major driver of the upswing was a weaker yen amid higher US yields, boosting expectations for upward earnings revisions among exporters. US stocks recording all-time highs also provided a tailwind for the market. The impact of the natural disasters that hit Japan has been limited. In terms of sectors, resource-related stocks drove gains on rising crude prices, whilst semiconductors lagged amid concerns about their earnings outlook.