Furthermore, it can be seen that the positive effects are spreading from urban areas to rural areas. The number of foreign visitors to Japan visiting regional areas other than the three major metropolitan areas of Tokyo, Osaka, and Nagoya, is increasing year by year, reaching 18.4 million in 2019 (3.83 million in 2012). Especially since 2016, the regional areas have been driving the increase in the number of foreign visitors to Japan. Also, at the Rugby World Cup 2019 Japan, the impact of foreign visitors to Japan on the regional economy was very clear, and the number of foreign guests from participating countries during the tournament increased significantly in the rural areas compared to the previous year. By the way, unit consumption of foreign tourists participating in the Rugby World Cup Japan was 2.4 times that of non-participants (i.e. ordinary tourists)

However, since the spread of COVID-19, the movement of people around the world has been restricted, and the tourism industry in Japan has been hit hard. In Japan, the national emergency was lifted on May 25th, and domestic long-distance travel using airplanes and trains has gradually picked up. However, as of July 13th, Japan has prohibited tourists from 129 countries and regions entering the country as result of the pandemic.

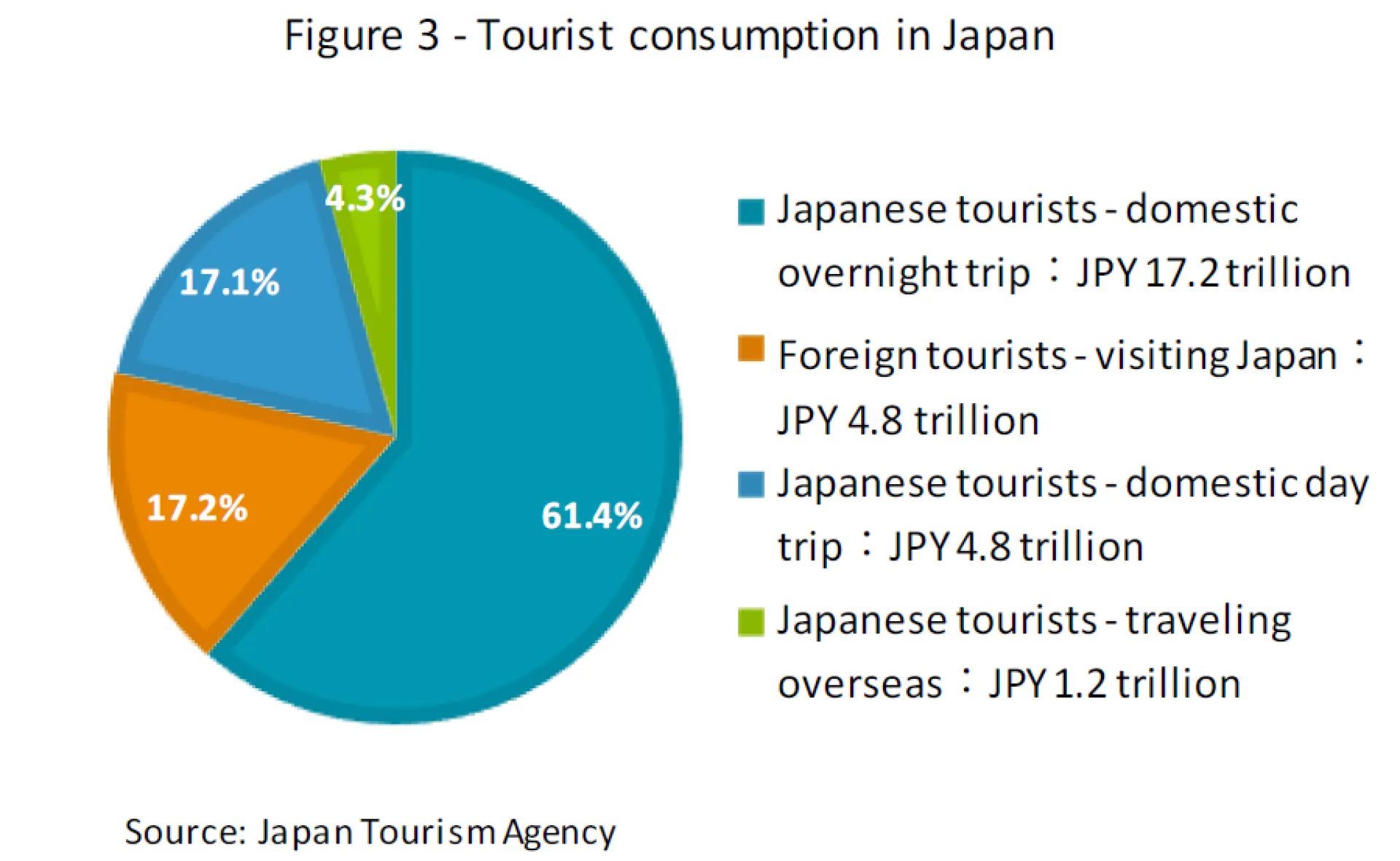

The impact of COVID-19 on tourism-related industries will be summarized here. According to the Japan Tourism Agency, internal tourism consumption in Japan was JPY 28 trillion (approximately USD 260 billion) in 2019, of which JPY 22 trillion (78.5%) came from domestic travel by Japanese tourists and JPY 4.8 trillion (17.2%) from foreign tourists (Figure 3). From this, it is clear that the greater economic impact is from the self- restraint of domestic travel by Japanese tourists. Since the national emergency was lifted, the number of COVID-19 cases has diminished, but it has not hit zero. It is difficult to expect a rapid recovery of domestic travel under such circumstances. Considering the above, it is quite natural to think that it will take several years for domestic tourism-related industries to return to pre-COVID-19 levels, including inbound tourism. Especially for 2020, as the public and private sectors continue to take preventive measures against COVID- 19, we don’t expect the domestic tourism industry to recover significantly.

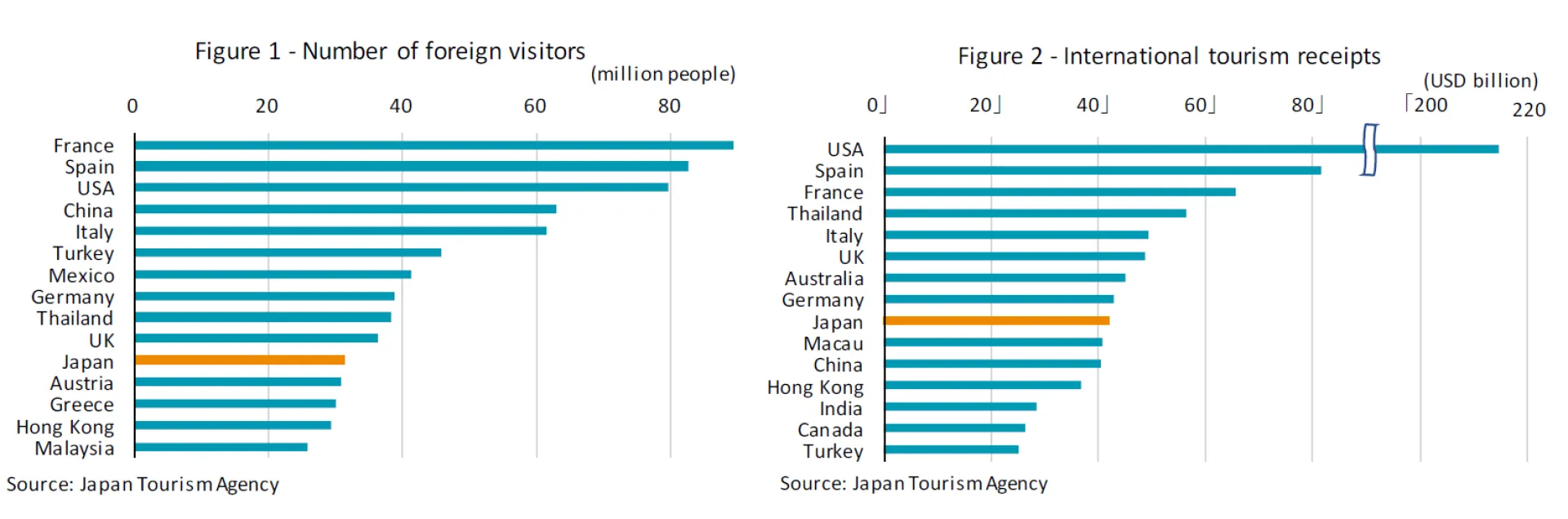

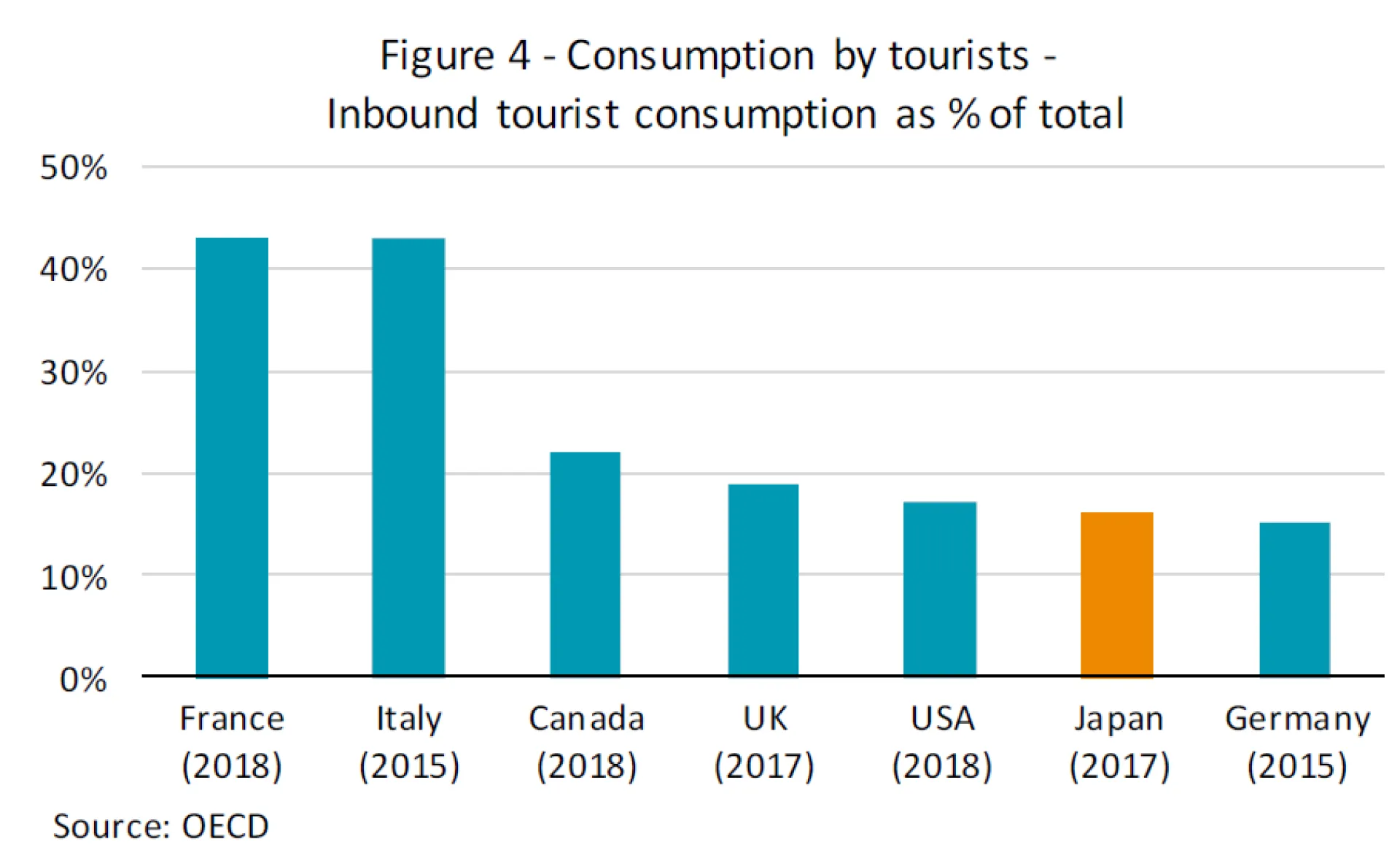

Although the tourism-related industry faces a difficult situation, when considering future recovery, two features should support the industry: "Japan has a low inbound rate compared to advanced tourism countries" and "we can anticipate large-scale government stimulus measures".

First of all, the number of inbound tourists has increased sharply since 2012, but as mentioned above, it is still small compared to domestic travel by Japanese tourists. Also, the proportion of inbound tourist consumption to total in Japan is small compared to other advanced nations (Figure 4). When COVID-19 subsides, we expect countries to restore domestic travel first. Although we expect every country to suffer from low inbound tourism for the time being, Japan, which has had relatively low inbound dependence, can make up for it on its own. It is domestic travel that will fill the void, and there is also the likelihood of it being an alternative to overseas travel. According to the 2017 Travel and Tourism Satellite Account, Japanese spend JPY 2.9 trillion on overseas travel. Furthermore, if you include domestic consumption (JPY 1.2 trillion) pre- and post-international travel, the total will be JPY 4.1 trillion. The key is in diverting these funds to domestic travel expenditure.

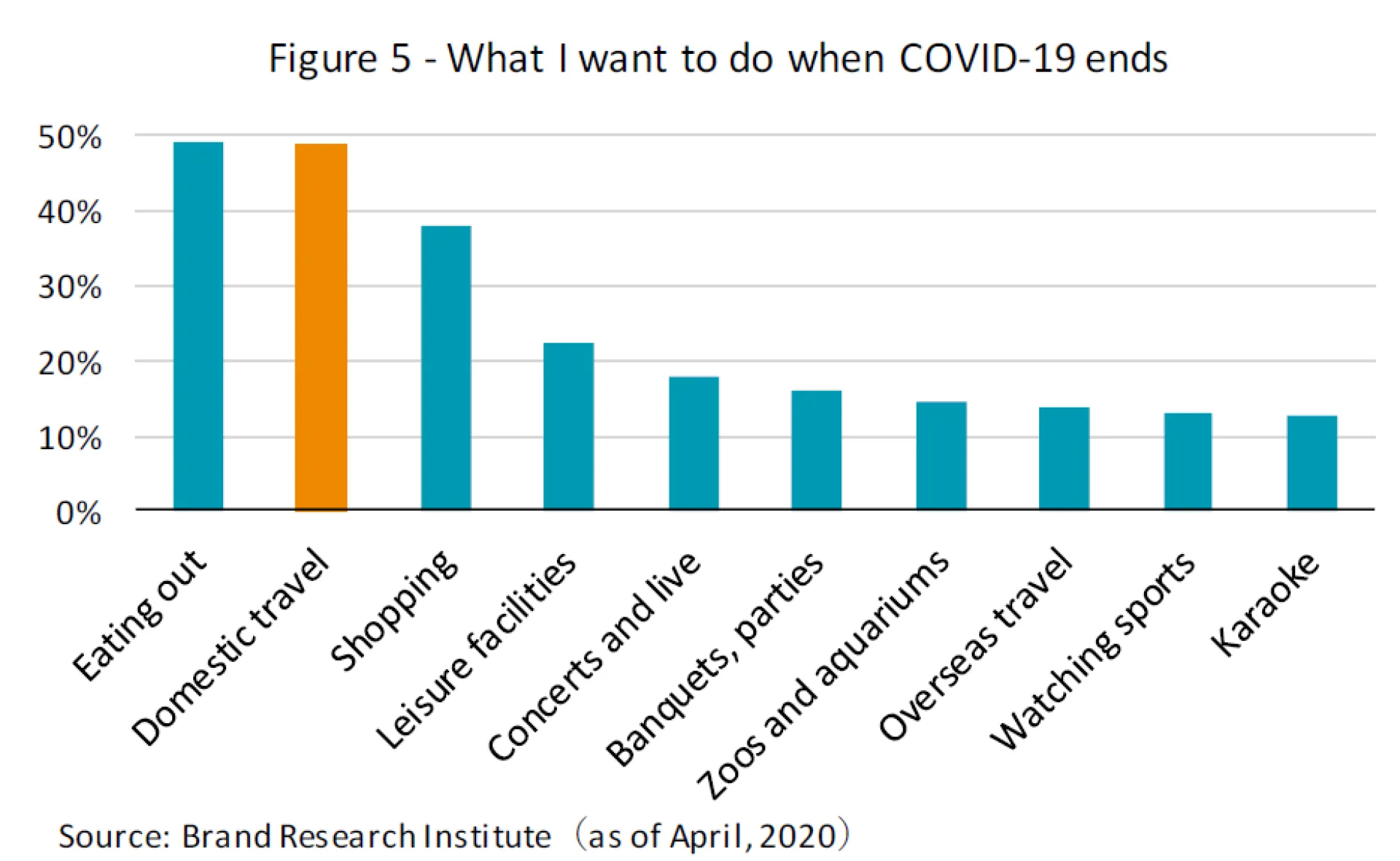

The second factor supporting the recovery of the tourism industry is government policy. The Japanese government introduced the “Go To Campaign” of JPY 1.7 trillion in the first supplementary budget for fiscal 2020, which was passed in April, as a measure to stimulate demand in the tourism and restaurant industries among others. As part of this campaign is the "Go To Travel Campaign" which subsidizes an amount equivalent to up to half of the travel fare. A budget of JPY 1.4 trillion was allocated to the "Go To Travel Campaign". This is a huge budget of over JPY 10,000 per person even if simply divided by the total Japanese population. This type of large-scale government support for the tourism industry cannot be found in other countries. The "Go To Travel Campaign" is due to launch on July 22nd. In addition, we believe that part of the special fixed-amount benefit (i.e. government handout) of JPY 100,000 per citizen, which was provided as part of the economic measures against COVID-19, could be spent on domestic travel. According to the questionnaire, "What I want to do when COVID-19 ends", the top item was eating out followed by domestic travel. Thus, it is highly possible that a portion of the benefits will go to domestic travel (Figure 5).

It should take several years for the domestic tourism industry to return to pre-COVID-19 levels. However, compared to other countries, Japan's tourism industry should recover more quickly. On the other hand, we believe that it is necessary to further stimulate domestic travel demand, while inbound tourism demand cannot be expected for the time being under COVID-19.

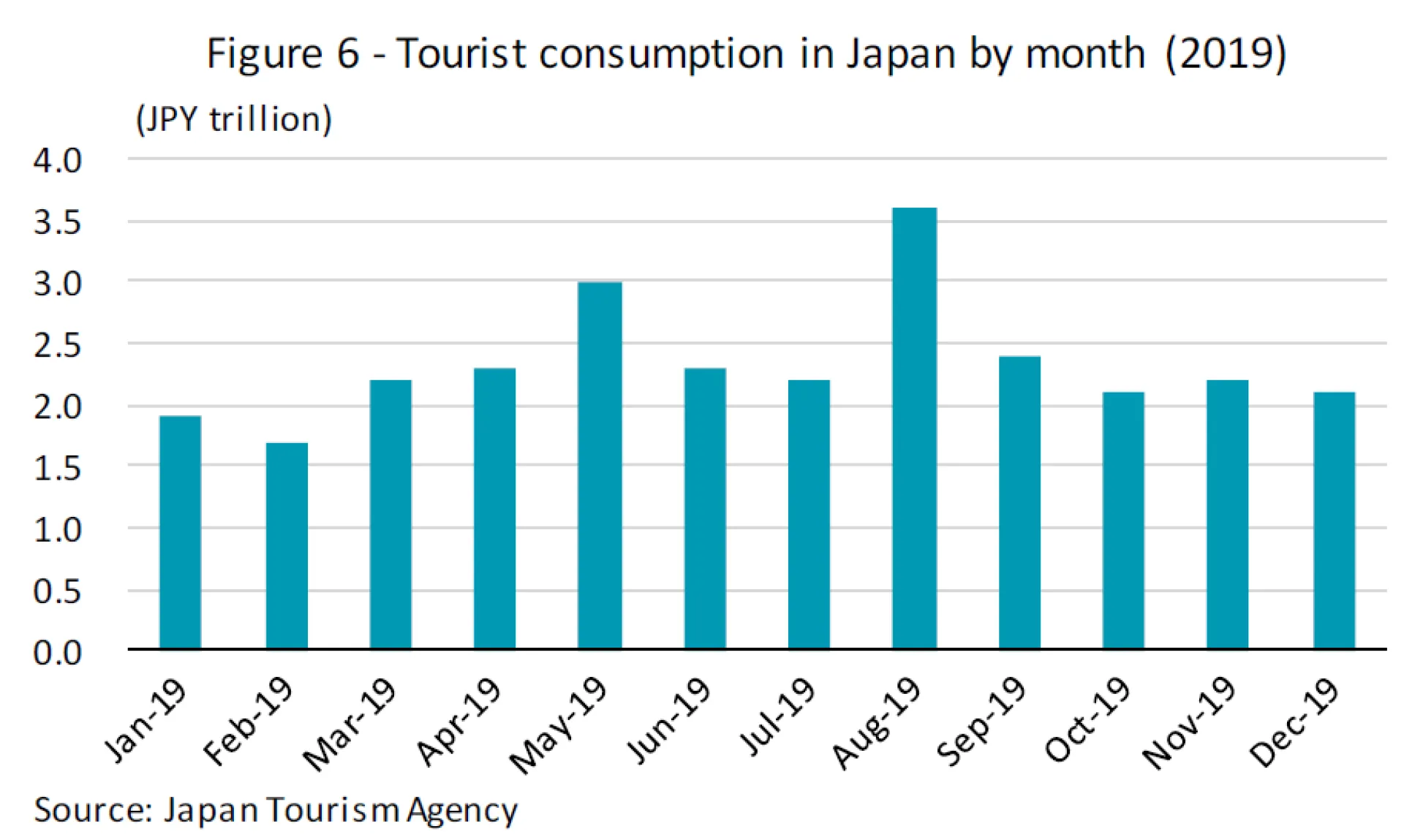

In June, the Japanese government urged companies to promote vacations and to spread out the timing of holidays as a means to reinvigorate travel demand while preventing the spread of COVID-19. In Japan, travel is concentrated in May, which has consecutive holidays, and in August, which coincides with summer holidays. Thus, congestion and shortage of accommodation facilities at tourist spots is anticipated and will pose problems. According to a 2019 survey by the Japan Tourism Agency, domestic travel consumption was notably high at JPY 3.6 trillion in August and JPY 3 trillion in May (Figure 6). If demand is spread out, it will be possible to find new demand for those who have avoided travel due to congestion. With worries over COVID-19 yet to subside, such government-led efforts are required.