Initiatives to improve corporate governance

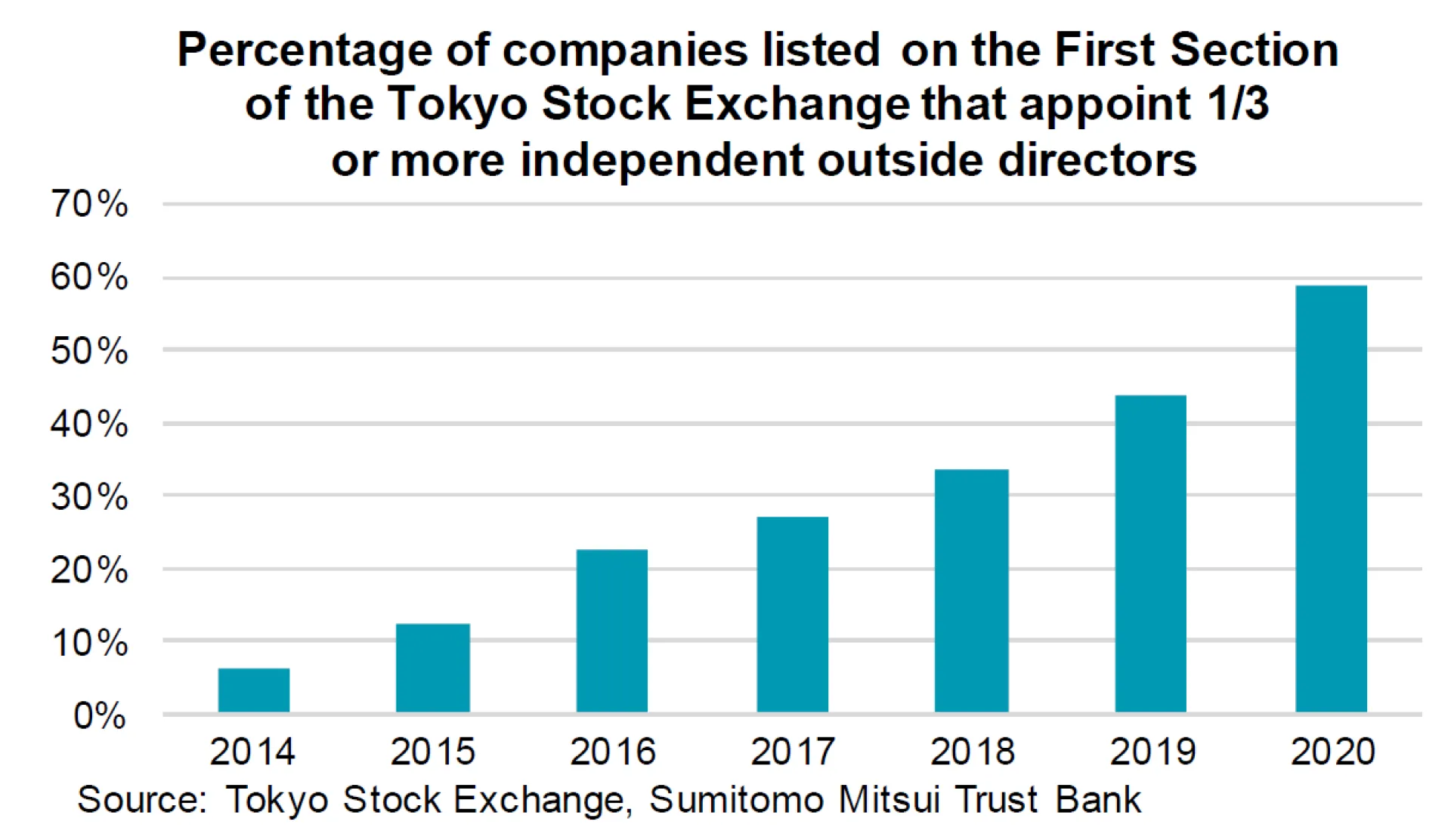

Initiatives to improve the corporate governance of Japanese companies began as part of Abenomics, and are still in effect at this moment. As part of the initiative, the inclusion of outside members to the Board of Directors has been proceeding for a long time, and the trend has been accelerating as seen at this year’s AGM’s. There have been cases where women and foreigners are added as members to diversify the Board. For example, half of the Tokyo Stock Exchange member companies have a Board composition where independent, outside directors account for over 1/3 of the Board Directors (In the First Section of the Tokyo Stock Exchange, where mainly large companies are listed, companies where more than 1/3 of their directors are outside members constitute 58.9% of total).

The reason why this number has been increasing is because, under the 2018 revision of the “Corporate Governance Code”, which applies to all TSE-listed companies, the Exchange recommended that listed companies appoint 1/3 of their directors externally. The 1/3 threshold is also critical as some institutional investors argue that if the ratio of independent outside directors is less than one-third, a counter opposition vote to proposals may be exercised, particularly in the election of top management officials.

The proportion of companies that appoint female directors also increased, exceeding 30% (2019: 28.7% → 2020: 33.6%). On the other hand, the number of foreign directors has been slightly lower (2019: 6.7% → 2020: 6.1%).

The number of companies that have implemented a stock-based compensation system for directors is 1,406 (up 250 from the previous year), which constitutes 37.6% of all listed companies. The introduction of not only stock compensation, but linking the medium-term management plan with the executive compensation system is becoming apparent. For example, Shizuoka Bank has changed its annual bonus KPI from non-consolidated to consolidated net income to emphasize consolidated performance based on the medium-term management plan.

There are also cases where the Compensation Advisory Committee is actively involved in identifying issues in the current compensation system and in reviewing future direction. At Yamato Holdings, the Advisory Committee deliberated on the issues and direction regarding the executive compensation system and revised the compensation system to raise the performance-linked ratio. This is because, in addition to motivating the achievement of performance and sustainable growth, it also sets a remuneration level that contributes to the acquisition and retention of high quality human resources. Also, the company has introduced a stock compensation system that incorporates KPIs including ESG indicators in line with the medium-term management plan, and has established a framework for evaluating ESG-friendly management.

Features of this year's shareholders’ meetings under COVID-19

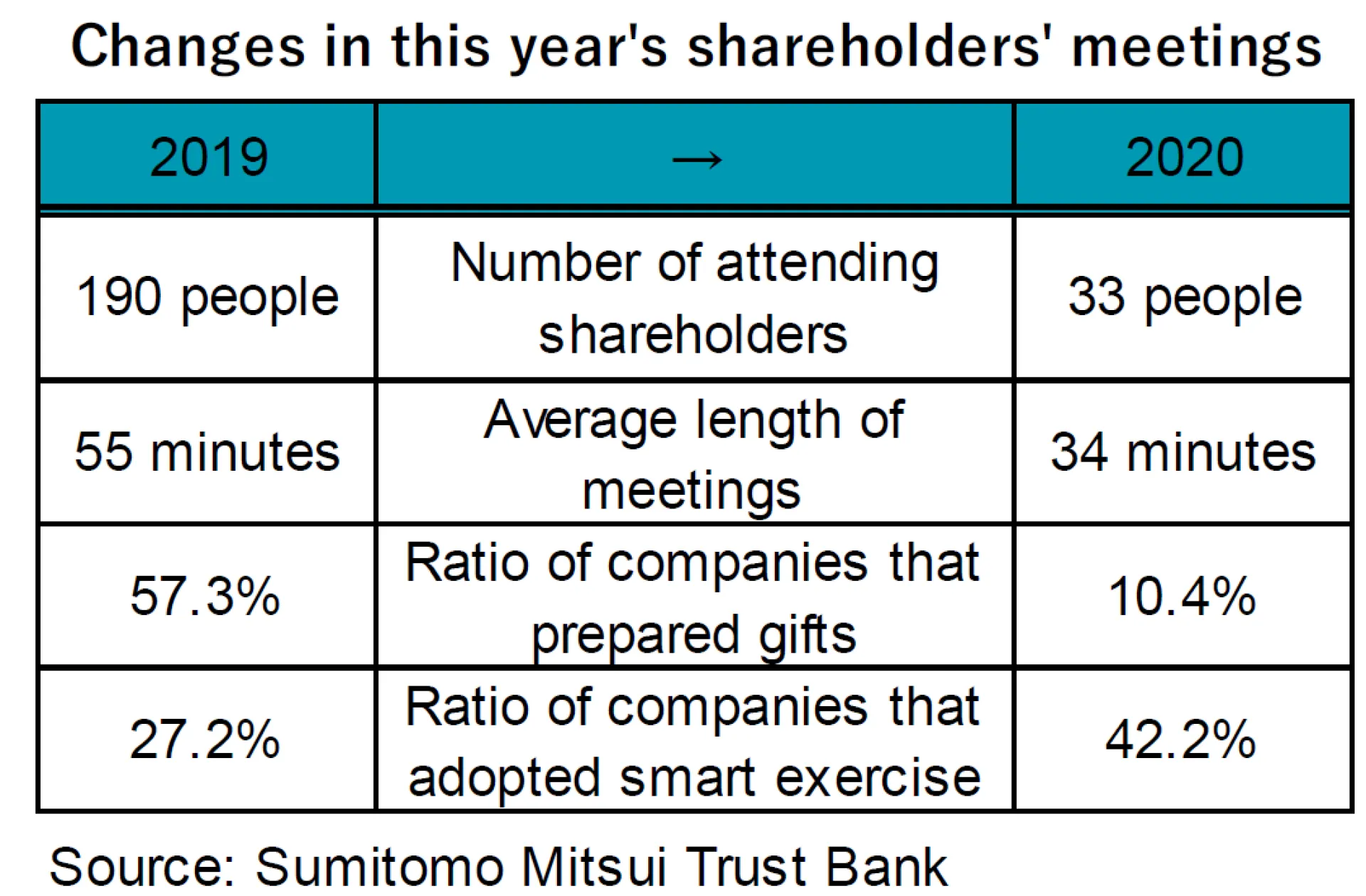

A major feature of this year's shareholders' meetings was the change in format because of the difficulty to hold the meetings in a physically gathered form due to the spread of the COVID-19 infection. According to Sumitomo Mitsui Trust Bank, the average number of attendees in 2020 was 33 people, a sharp decrease from 190 people last year, when results of the shareholders' meetings of the 926 client companies that held the AGM in June were aggregated. Many companies have stopped the practice of giving gifts, have reduced the number of venue seats, and have called on shareholders to refrain from attending. The average meeting time fell from 55 minutes last year to just 34 minutes. More than 60% of companies omitted some reporting items, and more than 30% of the companies limited the number of questions to one per person.

In addition, at this year’s shareholders’ meetings, we saw some new methodologies of exercising voting rights (e.g. Smart exercise: a method that allows you to easily exercise your voting rights by reading the QR code on the voting form using your smartphone). Adoption of smart exercise increased by 61.2% from the previous year, in which the adoption rate was 42.2% overall. As a rule, the higher the number of voting shareholders, the higher the adoption rate.

Also, the introduction of hybrid virtual AGMs has been notable in order to maintain dialogue with shareholders who do not attend the meetings. It should be noted that it is difficult to conduct virtual-only AGMs in Japan without a venue due to legal restrictions. The introduction of the hybrid virtual AGMs will not only mitigate COVID-19 issues, but also provide access to AGMs to many shareholders who are unable to visit the venue, such as shareholders in remote areas and overseas.

The number of companies that held a hybrid virtual AGM in the June was about 100 companies, although it varied according to industry and the number of shareholders. About 60% are in the information/communications, services, and electrical equipment industries. 79.5% of shareholders participated via the internet. Companies that are considering virtual AGMs for the next year accounted for 38.3% of all companies, including those that implemented it this year, and is expected to increase as a new form of channel for dialogue with shareholders.

Regarding the timing of the AGMs, due to the delay in audits from the impact of COVID-19, 56 companies have postponed the AGM dates* to July and onwards which goes against the provisions of the Articles of Incorporation. Companies whose year-end dividends are not decided by the board of directors, will decide on the dividend at the AGM in June in order to maintain the dividend record date (dividend payment to shareholders at the end of March), and submit audit and business reports at extended meetings after June.

*For companies whose fiscal year end is March, the record date of the AGM is set on March 31 in the articles of incorporation. The base date system requires exercise of rights within 3 months of the date (Article 124 of the Company Act).

Matters to be considered for the shareholders' meetings from next year

As matters to be considered for the shareholders' meetings from next year, we believe the following practices will become permanent: (1) abolishing the practice of giving gifts, (2) shortening the time required for the shareholders' meeting, (3) introduction of the exercise of voting rights via the internet, (4) restrictions on the number of seats at the venue, (5) limiting shareholders' meetings where all related people meet, and (6) limiting speeches where possible.

In addition, measures to be considered in the future are as follows: (1) efforts to enhance dialogue with shareholders (live distribution, virtual shareholders’ meetings), (2) review of the shareholders' meeting schedule (holding the shareholders' meeting over a period of 3 months or more to alleviate the overcrowded schedule for the settlement of accounts and audits and to secure a period of review by shareholders), (3) Secure flexible management (by changing the articles of incorporation that allows dividends to be decided by a resolution of the board of directors).