This integration has resulted in the balance of assets under management reaching 60 trillion-yen size*, making us one of the largest asset managers in Japan and Asia.

When the economic and market environment changes dramatically, SMTAM has development capabilities to create products that meet the needs of each and every client and investment management capabilities thereof, as well as a business network expanding into every part of the globe and support capabilities to carefully assist business partners who deal in our products, and leveraging all of these strengths, SMTAM will do our utmost to contribute to long-term asset formation of our clients and the development of society. *Total amount of the balance of assets under management (fair value basis) as of the end of August 2018.

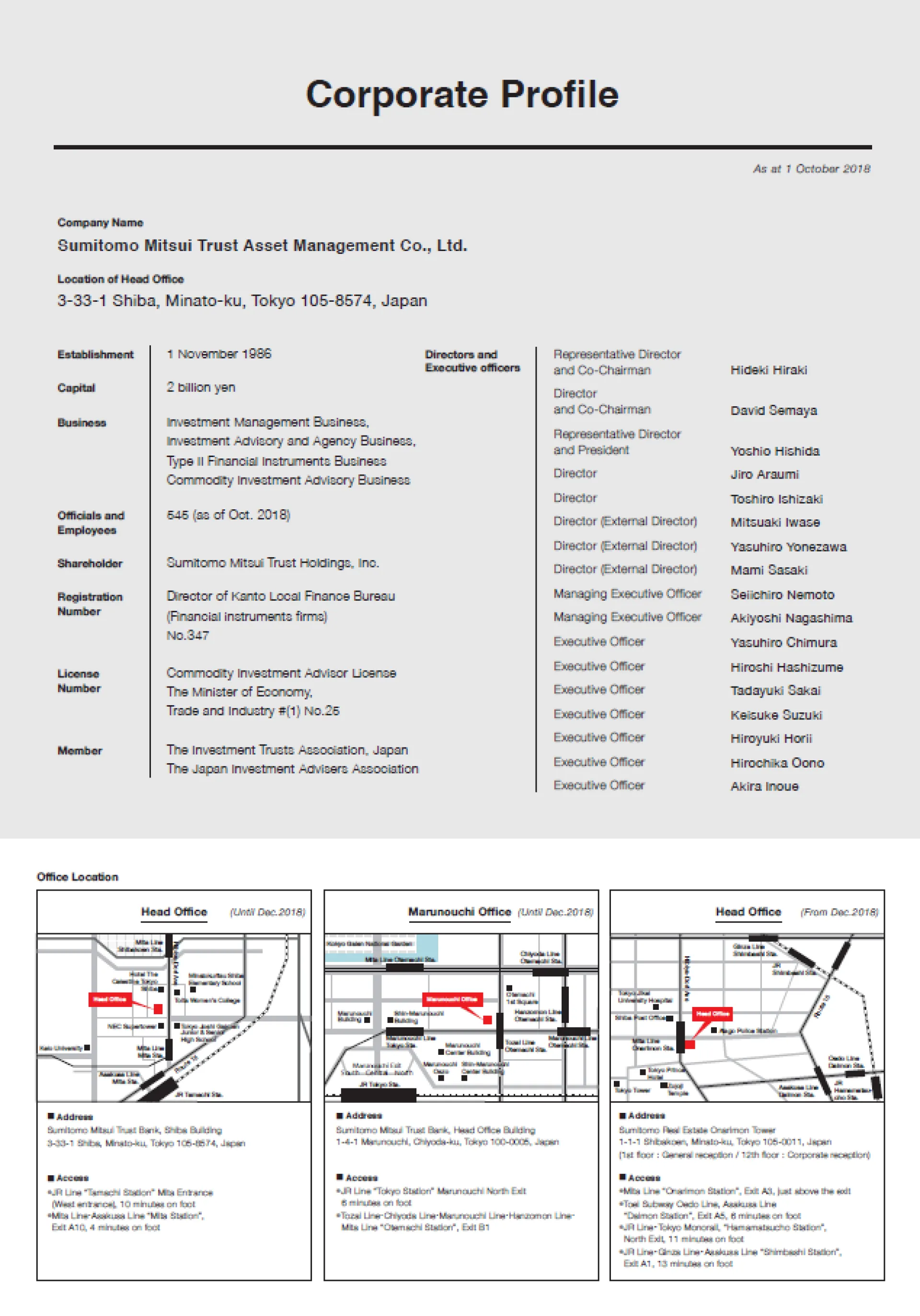

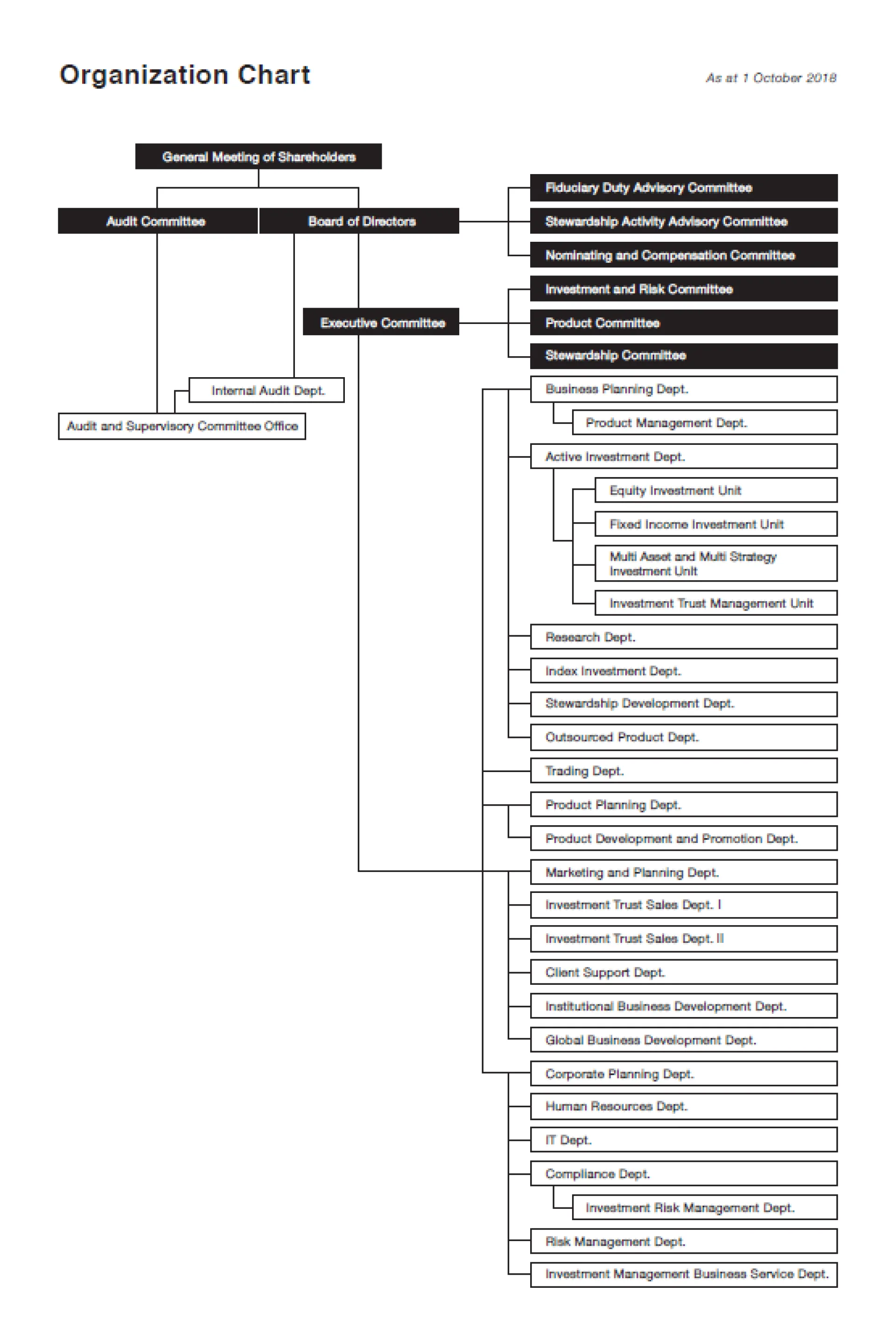

The overview of SMTAM after the integration is as follows.

We would greatly appreciate your continued support.

1. Overview of SMTAM after the integration

As shown in Corporate Profile and Organization Chart in the appendix.

2.Notification to Beneficiaries

(1)Necessary procedures for beneficiaries

No particular procedures are needed for beneficiaries along with this integration.

(2)Regarding names of funds

There are no changes in names of funds accompanied by this integration.

(3)Net Asset Value Column in The Nikkei

There are no changes in placement position, published company names, published name of each fund.

(4)Homepage

There are no changes in address(http://www.smtam.jp/)

(5)Information Desk By Telephone

There is no change in the telephone number for the Information Desk.

Call Center: 0120-668-001 (Service Hours::Business day 9:00 a.m. – 5:00 p.m.)